A CAUTIONARY buyer mood continues to impact the grazing property market across the eastern seaboard.

In this week’s property review, agribusiness and rural valuation experts in Queensland, New South Wales and Victoria share their perspectives on the state of the market, on a region-by-region basis.

New South Wales

James Skuthorp oversees Dubbo and the Central West for valuers PRP. He said across most of the state, the property market had stabilised with buyer caution now apparent.

“After a decade of unbroken farmland value growth, buyers have become more considered in their purchasing decisions following significant shifts in the operating environment,” he said.

James Skuthorp PRP

Mr Skuthorp said across the wider part of New South Wales, late 2022 to early 2023 appears to have been the market peak, with a large increase in the number of sales supported by strong sale results.

“2023 was a vastly different year for Australian agriculture as drier conditions, falling commodity prices, sustained high cost of key farm inputs and sustained high interest rates contributed to a cooling-off in demand for farmland which in turn had a softening effect on property values,” he said.

Mr Skuthorp said for many rural enterprises, the significant drop in cattle prices proved to be the strongest headwind on cash flow.

“This was compounded by the factors mentioned previously and made it more challenging for potential buyers to secure funds.”

Mr Skuthorp said with the key drivers of farmland values set to remain in a holding pattern in 2024, it was likely the market will see a plateau in values.

“The ongoing reduction in confidence in rural grazing properties in the Central West, Far West, Riverina, New England and North West compared to 2022 is most evidently expressed by the recent collapse in the cattle market,” he said.

“Current market prices for beef are returning closer to levels more typical of long-term averages, particularly since seasonal conditions improved from November 2023, however we are not seeing a shift in increased buyer activity for rural grazing property to date.”

Mr Skuthorp said several factors were contributing to the caution.

“The recent collapse in cattle prices is still fresh, global supply issues have created inflationary headwinds which has resulted in higher operating costs, and producers continue to experience a higher interest rate environment.”

Victoria

Larry Harden is a senior valuer and partner at PRP Geelong and Warrnambool in Victoria, and Mount Gambier in South Australia.

Larry Harden PRP

He said the grazing property market in Western Victoria was experiencing a period of adjustment.

“It is a notable shift from the rapid growth and high activity that began in 2015 and continued until early 2023, to a more subdued environment in 2024.”

Mr Harden said higher interest rates, softer beef prices, rising input costs and a dry autumn had combined to slow market activity and reduce property values.

“Buyers are more selective, and transactions are increasingly influenced by local dynamics and if operational efficiencies can be achieved by purchasing adjoining or nearby land.”

He outlined some of the key factors that have influenced the property market:

- The higher interest rate environment has increased the cost of borrowing, impacting on a farmer’s ability to finance new purchases, expand operations or spend capital to improve infrastructure on existing holdings.

- Softer beef commodity prices on the back of a downturn in the beef industry. The Eastern Young Cattle Indicator peaked at 1154c/kg carcase weight in January 2022 but fell sharply to 358c/kg by September 2023. Currently the EYCI is at 672c/kg, which is still slightly below the long-term average, but trending upwards.

- Increased costs for inputs such as feed, fuel, fertiliser and labour have resulted in higher production costs impacting on farmers’ bottom line.

- Dry conditions for the first six months of 2024. Many parts of Western Victoria have experienced a ‘green drought’ where good rainfall was received in January and minimal falls from January through to June. This has resulted in a late autumn break and reduced autumn/winter pasture production. As a result, additional fodder was purchased by many farmers placing further pressure on cashflows, as prices for fodder increased due to demand.

Mr Harden said market trends observed through the first half of 2024 included:

- The previous property boom saw an influx of buyers (including established operators) seeking to diversify into alternative agricultural pursuits to spread risk. However, due to the current market conditions and micro and macro-economic influences, buyers have become cautious. Transactions are now more likely to involve neighbouring property owners who can leverage managerial efficiencies by acquiring adjacent or nearby land.

- A softening in value for grazing land with property values on a gradual decline since early 2023. This reflects the reduced demand and increased market pressure from higher interest rates, higher input costs and lower commodity prices.

- Longer selling periods. Properties are generally taking longer to sell unless vendors adjust their expectations to align with the current market conditions. The slower market is characterised by fewer transactions and longer negotiation and selling periods for due diligence and securing of finance, with financing becoming tighter.

Mr Harden said while the overall grazing market had cooled, there were still pockets of activity in some areas, particularly where local conditions or specific buyer interests create opportunities.

“This is currently being observed in areas suitable for agroforestry where a number of both grazing and dairy properties have been sold to companies which are converting the acquired land into hardwood and softwood plantations.”

Mr Harden said this trend was primarily driven by the additional value generated through the production of carbon credits, which have become an attractive incentive in the current market.

“The demand for carbon credits has surged as companies and governments seek to meet environmental and sustainability targets, making the establishment of plantations on former grazing land a financially viable and strategic investment for these forestry enterprises,” he said.

Queensland

Well known valuer Roger Hill is the North Queensland regional director at Preston Rowe Paterson.

Roger Hill, PRP

He said the recent fluctuations in the cattle market had served to change the due diligence process among Queensland cattle property purchasers.

“The recent recovery in the cattle market has been good for bringing buyers back into the property market, but with a more considered and prudent approach to their pricing process,” he said.

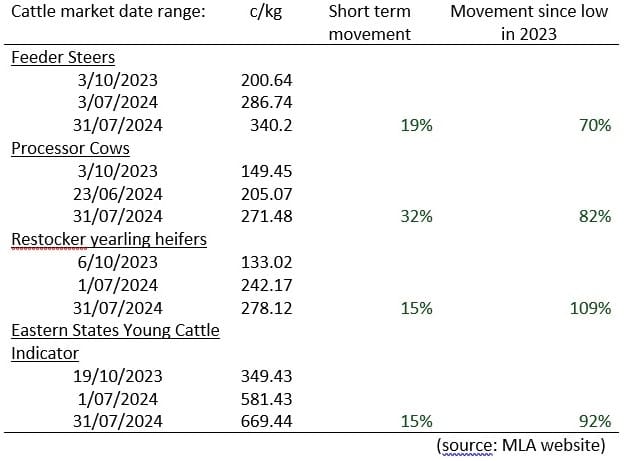

Mr Hill notes cattle market movements in the recent month and year have had a positive influence on buyer interest.

The table below reviews the MLA data for the short (last month) and longer (since about October/November last year) price movements.

Difference between breeding and finishing/backgrounding country

Despite positive cattle market movements, over the last year Mr Hill has witnessed a split in the property market due diligence process – between breeding and backgrounding country.

“For backgrounding and finishing country, buyers are still talking rough property value gauges of dollars per hectare or beast area values. In these market areas there is strong demand for country and market conditions are akin to a sellers’ market,” he said.

“The market is showing confidence in this section of the supply chain to be profitable at existing (and potentially slightly higher) property value parameters.”

Mr Hill said in the last 12 months, market conditions had changed for breeding country.

Mr Hill said in the last 12 months, market conditions had changed for breeding country.

“Buyers are doing their figures, running stock flows, cashflow and capital development budgets,” he said.

“Yes, these processes are being followed in backgrounding country, however in forest breeding country, buyers appear to be more stringent in their approach and matter of fact, rather than accepting of rule of thumb guides,” he said.

According to Mr Hill, the combination of higher operating costs, higher interest bills and lower (or fluctuating) cattle prices are foremost in buyers’ minds.

He believes the northern breeding cattle property market segment is well and truly in the buyers’ favour.

“Simply talking of a price per hectare or beast area is helpful as a value proposition, however if there is a property market sentiment change in the wind, then operating cost profiles and cash flow returns are under the spotlight in trying business conditions.”

Mr Hill said there was only a certain amount of debt and net return that an enterprise can service.

In recent months, in line with the cattle market recovery, he said there were signs of stronger demand for backgrounding country.

“In some districts, value parameters are similar to 2023, while those towards the north and north-western areas of Queensland are showing signs of demand slightly pushing prices up.”

Mr Hill said there are some private deals being negotiated off market, however no properties were being listed and offered to the open market.

“Market conditions are tight due to strong demand. In the forest breeding segment, there are eight stations on the market in the north at present.”

“For sure, there is good market interest, yet the calculations are really being done at these operating margins,” he said.

Brennan Leggett PRP

When it comes to North Queensland’s coastal grazing property markets, PRP valuer and analyst Brennan Leggett reports Bowen, Ingham, Tully and Innisfail have remained relatively stable throughout 2024.

“There are signs of some strengthening in land values primarily on the back of commodity price performance and a levelling in interest rate rises,” Mr Leggett said.