- Bitcoin jumps to a new all-time high of $109,588 on Monday.

- Bitcoin open interest crosses $71 billion as crypto market heats up for Trump’s inauguration.

- Bitcoin volatility climbs to 73%, and bullish sentiment suggests traders expect short-term market swings, positioning for the upside.

- Higher demand for upside leverage supports gains in Bitcoin price, BTC enters price discovery.

Bitcoin (BTC) rallies to a new all-time high of $109,588 on Monday as crypto traders anticipate gains in the sector with the upcoming inauguration of President-elect Donald Trump. Derivatives traders position themselves for an upside in BTC, and experts predict short-term price turbulence, followed by steadier movements beyond next week.

Bitcoin climbs to $109,588, new milestone

Bitcoin has flipped the $100,000 milestone to support and rallied to a new peak on Monday, January 20. President-elect Donald Trump’s inauguration is the biggest catalyst, followed by the positive sentiment among traders and the return of interest from institutional investors.

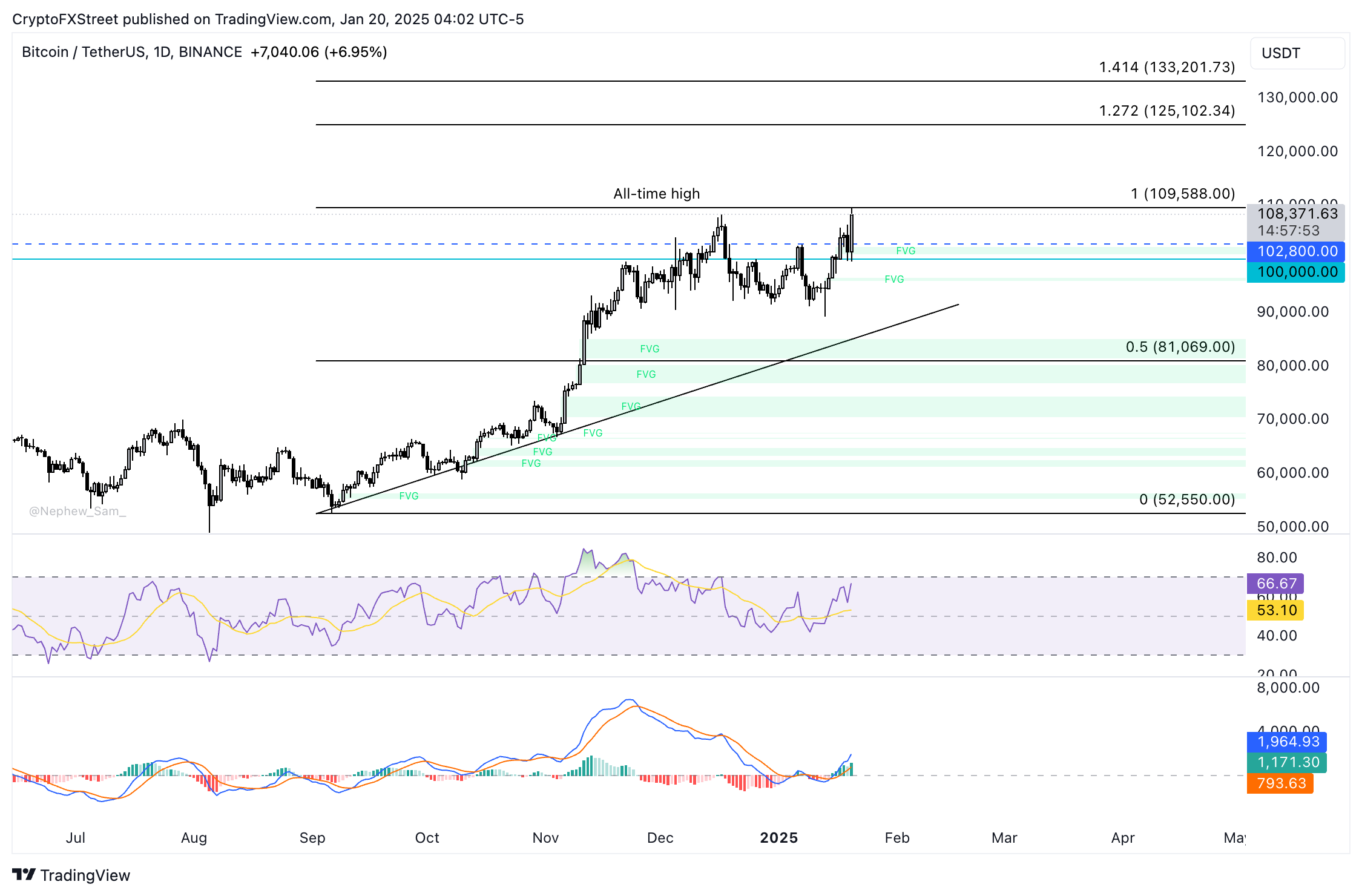

Technical indicators Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) support a thesis of further gains in Bitcoin price. RSI reads 66 and is sloping upwards while MACD flashes consecutive green histogram bars, both signalling strong bullish momentum.

BTC/USDT daily price chart

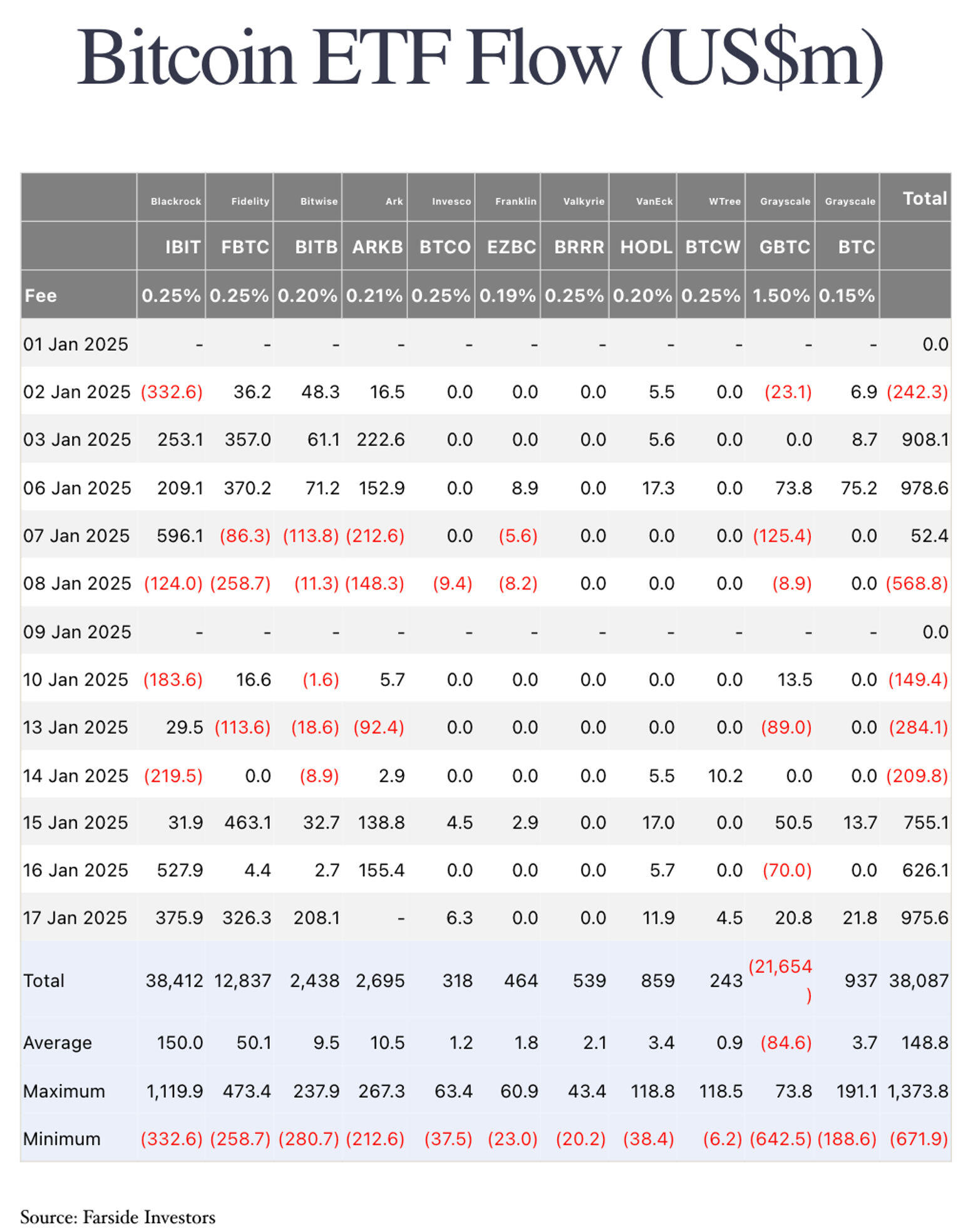

Data from Farside investors shows a return of institutional interest to Bitcoin with a streak of inflows to US-based spot Bitcoin Exchange Traded Funds (ETFs) last week.

Bitcoin ETF flows as seen on Farside investors

Coinglass data shows that Bitcoin Open Interest (OI) has climbed to $71.21 billion, and options volume nearly doubled to $4.49 billion early on Monday.

Dr. Sean Deason, Head of Research at Derive.xyz told FXStreet in an exclusive interview:

“The crypto market is heating up for Trump’s inauguration tomorrow, with signs of increased volatility and bullish sentiment across major assets like Bitcoin and Ethereum. BTC’s at-the-money (ATM) 1 DTE implied volatility (IV) has risen sharply, climbing from 35% yesterday to 83.5% today.

The surge reflects heightened expectations for market swings in the immediate aftermath of the inauguration. Meanwhile, the 7-day ATM IV has risen more modestly, from 62.2% to 73.3%, suggesting traders anticipate short-term price turbulence but steadier movement beyond the next week.”

Deason notes that the buildup in short-term Bitcoin volatility is indicative of the growing uncertainty among traders hours ahead of Donald Trump’s inauguration. BTC’s 7-day skew turned positive, signaling that calls are now trading at a premium to puts. There is an increased demand for upside leverage, as traders position for a bullish market response.

Deason said:

“Over the past 24 hours, approximately 54% of BTC premiums were spent on buying calls. This suggests traders are positioning for upside potential, while 32.4% of premiums were from calls sold, possibly reflecting an effort to capitalize on perceived overpricing in the market.