Investors felt that their gains had been taken away overnight by the government’s actions. However, the question remains: have gold investors truly been deprived of their profits?

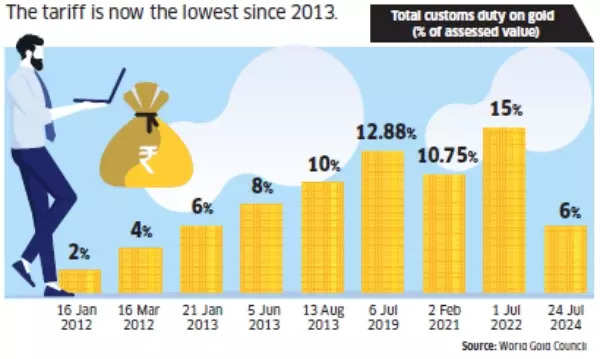

An ET report quotes Kavita Chacko, Research Head, India, World Gold Council, saying, “This is the sharpest reduction on record and the lowest since June 2013.” Although the duty cut led to a significant decline in gold prices, as well as gold bond and ETF prices, the impact on various gold bonds differed, with some experiencing only a slight 1-3% decrease.

Factors such as time remaining until bond maturity, trading volumes, and the premium at which the bond was trading before the Budget influenced the extent of the impact.

Mrin Agarwal, Founder Director, Finsafe India, asserts, “The impact of the duty cut on the value of gold has been overstated.”

The Indian government’s decision to reduce import duty on gold is not a random move but a part of its policy framework to manage the country’s current account deficit and protect the rupee, says the ET report. The recent cut was aimed at curbing the rising smuggling of gold into India, which had become more attractive due to the previous duty hikes making it expensive to buy the yellow metal through legal channels.

Gold customs duty

Chacko said, “The customs duty reduction will make gold imports via unofficial channels less (or even non-) profitable.”

Additionally, the duty cut was intended to boost India’s exports of gems and jewellery, which had been experiencing a slowdown due to weak global demand.

Chirag Mehta, CIO, Quantum AMC, was quoted as saying, “India is a price taker in gold. The prevailing elevated duty structure— widening the differential between global and domestic gold prices—was distorting the market significantly.” The duties were previously raised to control gold imports when India’s trade deficit was high, but the situation is not as severe now.

It is crucial to consider the import duty reduction in the context of the past 12 years. During this period, the import duty on gold has steadily increased from 2% in January 2012 to 15% in July 2022, with only one reduction in between. Duty hikes have been significantly more common than cuts, and each hike has resulted in an increase in the domestic value of gold, as well as the traded value of gold ETFs and SGBs.

While investors have experienced a loss due to the recent cut, they have also benefited from previous duty hikes. Primeinvestor.in points out that when the first SGB was introduced in November 2015, the import duty on gold was 10%. This was subsequently raised to 12.8% in July 2019, reduced to 10.75% in February 2021, and then increased again to 15% in July 2022. These two hikes boosted domestic gold prices, enabling investors to obtain higher values for their SGBs and gold ETFs. Additionally, two tranches of SGBs have been redeemed at those elevated prices when the 15% import duty was in effect.

Also Check | New Tax Regime 2023 vs 2024 After Budget: How Much Income Tax Will Salaried Taxpayers Save?

For investors who needed to sell their holdings to cover expenses, this drop is significant. Investors in Sovereign Gold Bonds (SGBs) feel particularly affected by this cut, with some believing that the government deliberately reduced the import duty to lower its payout to investors of SGBs maturing in the coming months. However, this is a misinterpretation, as the cut affects investors in all gold instruments equally, not just SGBs, according to Agarwal.

Moreover, the savings the government will make on its outgo on SGB redemptions will be minimal, as noted by Primeinvestor.

While investors worry that future duty changes will continue to impact gold investments, those who hold for longer periods may recover some of the losses.

“If you hang on to your SGBs till maturity, the loss from the customs duty cut can be made up by other factors that spike global gold prices or weaken the rupee,” argues the Primeinvestor note.

In fact, the precious metal has already regained some of its lost value. Customs duty is only a minor factor influencing local gold prices, with other variables such as international gold prices, demand-supply of gold, and rupee-dollar exchange rate having a more significant impact, as pointed out by Agarwal. International gold prices are influenced by factors like the strength of the dollar, geopolitical tensions, inflation, and central bank purchases, among others.

Experts maintain that gold remains a compelling investment option, regardless of any duty changes. Mehta asserts, “Gold retains its defining characteristics as a portfolio diversifier, store of value and source of liquidity. It will continue to offer stability when other risk assets decline.”