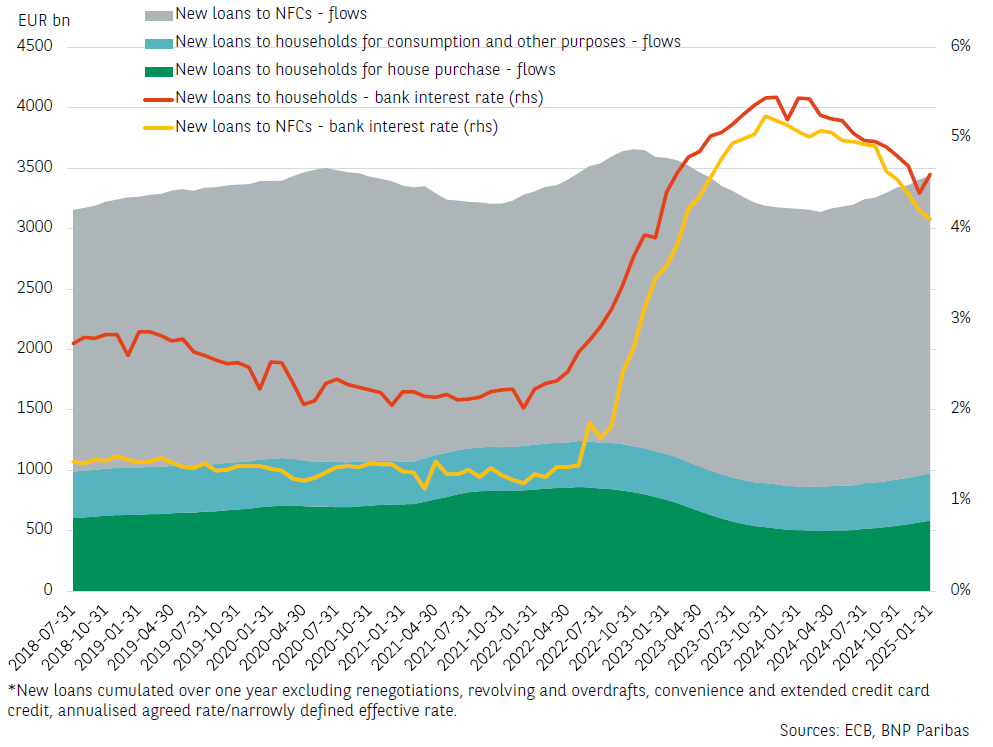

Against a backdrop of falling interest rates[1], new banking loans (excluding renegotiations) to households[2] and to non-financial corporations (NFCs) in the Eurozone continued to accelerate in January 2025. Cumulated over one year, new loans[3] to the non-financial private sector (NFPS) increased by 8.6% year-on-year, after 7.4% in December 2024, to EUR 3,437 bn.

Eurozone: New banking loans continue their recovery

This is the fifth consecutive month of increase, following sixteen months of decline between May 2023 and August 2024. This increase in new loans was largely driven by loans to households for house purchase, which rose by 15.7% year-on-year in January 2025 (compared with 7.9% for loans to households for consumption and other purposes and 7.2% for loans to NFCs). The high year-on-year rise in new loans for house purchase is due in particular to a favourable base effect, since they had fallen by 33.2% a year earlier and are now simply returning to their historical level. France and Croatia are the only two countries in the Eurozone[4] where the upturn in new monthly loans for house purchase has not yet been enough to halt the cumulated over one year decline (-8.3% and -4.3% respectively in January 2025).