Reserve assets in an Economic Union

Reserve assets of a currency union, the euro area, have a different meaning than reserve assets of an economic union, the European Union. In the euro area, the single monetary policy requires the availability of information for the main BOP and IIP variables, including reserve assets, that affect monetary and foreign exchange conditions for the currency union as a whole. The reserve assets of the euro area consist of the Eurosystem’s reserve assets, i.e. the ECB’s reserve assets and the reserve assets held by the central banks of the participating Member States (see European Union Balance of Payments and International Investment Position statistical sources and methods). Reserve assets shown in the balance of payments and IIP of the euro area include those foreign currency (i.e. non-euro) highly liquid and marketable assets that are under the effective control of the relevant monetary authority and that are claims vis-à-vis non-residents. These claims are reserve assets in addition to monetary gold, SDRs and the IMF reserve position. The concept of reserve assets at EU level is less meaningful; reserve assets of a union other than a currency union are the sum of the total of the national reserves. In the EU, these include reserve assets denominated in euro and/or other claims that are vis-à-vis other EU Member States. Reserves that are held vis-à-vis other EU Member States would have to be excluded from reserve assets and included under other external assets (other investment or portfolio investment) before compilation of the EU IIP. The feasibility to obtain/estimate detailed information for the compilation of an EU IIP that includes reserve assets according to sound methodological requirements is currently being examined by Eurostat. In the meantime, the EU (net) IIP is published excluding reserve assets and thus cannot be compared to the sum of national IIPs. Also, the calculation of a net IIP (assets – liabilities) without reserve assets would give a wrong picture of describing the EU as being a net creditor or net debtor vis-à-vis the Rest-of-the-World (for further information see Section on Data Sources below).

When countries are quoted with national IIP data in the article below, these IIP data include national reserve assets.

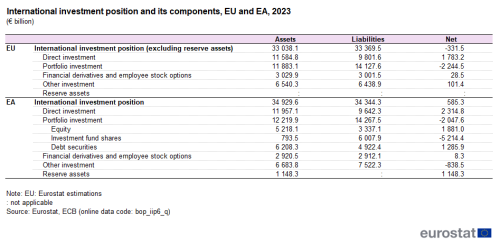

Without reserve assets, the EU is a net borrower of financial funds

Without accounting for reserve assets (see Table 1), the net international investment position of the EU amounted to –€331.5 billion in 2023, mainly caused by a negative net position of –€2 244.5 billion in portfolio investment. Without reserve assets, the net international investment position of the euro area also recorded negative value of

–€562.9 billion. In relative terms, the estimated net IIP (excluding reserve assets) of the EU measured as a share of GDP was –2.0 % in 2023, while for the euro area it was –3.9 %. The regular net IIP of the euro area including reserve assets, recorded a positive value of €585.3 billion, which in relative terms corresponds to 4.1 % of GDP.

Source: Eurostat, ECB (bop_iip6_q)

Looking at national net IIPs, the United States showed the highest international indebtedness in 2023 with a net IIP of

–€17 890 billion and can be therefore considered as the top global net debtor economy in the world (see Figure 1). Japan on the contrary was the global top net lender economy to the world with a net IIP of 3 111 billion. With France, Spain, Ireland and Greece, four EU countries were among the top 10 net borrowers, while other European countries like Germany, Norway, the Netherlands and Switzerland were among the top ten net lenders to the world. This comparison clearly displays a very heterogeneous situation at national level concerning net international surplus or debt within Europe and the EU[1].

Source: IMF, ECB, Eurostat (bop_iip6_q)

EU is a net lender in direct investment

In contrast to the overall negative net investment position (excluding reserve assets) with the rest of the world, the EU is a significant net lender regarding direct investment to the rest of the world. Based upon Eurostat estimations, EU aggregated net assets in direct investment outside the EU amounted to €1 783.2 billion in 2023. The positive net position in direct investment resulted from considerably higher values of external direct investment assets (€11 584.8 billion) compared to figures for external direct investment liabilities (€9 801.6 billion).

Table 2 shows that in 2023, the Netherlands recorded the highest net position of €659.0 billion in direct investment vis-à-vis extra EU, ahead of Germany (€469.1 billion) and France (€337.1 billion). These three countries were also among the most significant direct investors vis-à-vis rest of the world (including also other EU countries), another one being Luxembourg with a net direct investment position with the rest of the world amounting to €915.3 billion in 2023. On the other hand, Poland and Spain were the largest recipients of direct investment from the rest of the world with a negative net position of –€269.6 billion and –€246.0 v, respectively, followed by Czechia (–€133.4 billion) and Portugal (–€116.0 billion).

Source: Eurostat (bop_iip6_q)

Regarding the direct investment relationships of EU countries vis-à-vis partner countries, Luxembourg published an outstanding direct investment net position with the United Kingdom (€177.6 billion), the Netherlands with Switzerland (€249.8 billion), and Germany (€250.1 billion) and France (€159.0 billion) with the United States. Large net recipients of direct investment from the United States were Ireland (-€246.0 billion) and the Netherlands (-€176.8 billion).

The EU is a significant net issuer of portfolio investment

Residents of the EU recorded outstanding portfolio investment assets in 2023 of €11 883 billion and outstanding portfolio investment liabilities of €14 127.6 billion. According to the net deficit of –€2 244.5 billion, the EU is a significant net issuer of portfolio investment. As shown in Table 3, considerably high values for assets and liabilities in portfolio investment towards the rest of the world were recorded by Luxembourg (€5 307.7 billion and €6 458.9 billion) and Ireland (€4 420.8 billion and €5 248.3 billion), because funds are raised predominantly through the issuance of investment fund shares in these two countries. Among all EU countries, Germany was in 2023 the largest net investor in foreign portfolio investment assets, recording a net surplus of €680.0 billion vis-à-vis the rest of the world, while the highest net deficits were reported by France (–€1 221.3 billion) and Luxembourg (–€1 151.2 billion).

Source: Eurostat (bop_iip6_q)

Other Investment Assets and Liabilities nearly equal at EU Level in 2023

The IIP component other investment[2] for the EU recorded a slightly positive net position of €101.4 billion in 2023. This is a change in sign compared with the previous year (-€256.5 billion).

Table 4 shows that in 2023 the highest positive net assets concerning other investment of all EU countries with the rest of the world were again recorded by Germany (€909.3 billion) followed by Ireland (€330.1 billion) and the Netherlands (€274.1 billion), while Italy (–€715.6 billion), Greece

(–€438.5 billion) and Spain (–€381.4 billion) displayed the largest net liabilities with the rest of the world.

Source: Eurostat (bop_iip6_q)

Regarding economic activity outside the EU, France showed a high net lending position of other investment versus Japan (€176.7 billion) and was a significant net borrower vis-à-vis the United Kingdom (–€223.9 billion). Moreover, Belgium exhibited a large net borrowing position with Russia (-€132.9 billion) and Germany with the United Kingdom (–€55.5 billion).

Germany and the Netherlands are the biggest EU creditor nations

National IIP data for each EU country can be analysed by examining their (net) exposure in financial assets and liabilities with the rest of the world (including intra-EU exposure). Economies with a positive net IIP are characterised by higher positions in financial assets vis-à-vis abroad than financial liabilities and are consequently considered as net lenders or creditors. In the EU, Germany and the Netherlands had the highest net IIP values vis-à-vis the rest of the world in 2023. National IIPs, of course, include reserve assets.

Figure 2 shows that Germany displayed a positive net IIP of €2 900.1 billion (€2 749.8 billion in 2022) and that the corresponding value for the Netherlands was €742.6 billion (€706.8 billion in 2022). The highest outstanding positions in assets and liabilities abroad, respectively, were reported by Germany, Luxembourg, the Netherlands, France and Ireland due to their status as financial centres. Furthermore, Norway reported high net lending positions with €1 359.7 billion in 2023.

Source: Eurostat (bop_iip6_q)

In the EU, France, Spain and Ireland show currently the highest net liabilities vis-à-vis abroad

Economies with higher positions in financial liabilities abroad than financial assets have a negative net IIP and are considered as net borrowers or debtors. As shown in Figure 2, the top net borrowing economies in the EU in absolute terms in 2023 were France with a negative net IIP of –€824.5 billion (–€692.1 billion in 2022), Spain with –€771.4 billion (–€802.4 billion in 2022) and Ireland with –€534.2 billion (–€606.8 billion in 2022).

Within the framework of a reinforced European economic governance after the financial and economic crisis, the European Commission has developed a set of scoreboard indicators to identify harmful macroeconomic imbalances. The net IIP as a percentage of GDP is one of the indicators included in the Macroeconomic imbalances procedure (MIP) for early warnings and national values are carefully monitored on an annual basis. The indicative threshold applied for benchmarking negative net IIPs is 35 % of GDP. Additionally, an indicator on net IIP excluding non–defaultable instruments as a share of GDP (calculated as net IIP excluding net direct investment and portfolio investment equity) has been introduced as one of auxiliary indicators.

Source: Eurostat (bop_iip6_q)

Other measures that can be used as indicators for financial stability analysis are gross and net external debt. The main difference between IIP and external debt is the absence of all equity and investment fund shares components, financial derivatives and gold bullion in the latter. Thus, gross external debt includes all debt liabilities of an economy, while net external debt (also taking into account all debt instruments) is calculated as liabilities minus assets. It has the opposite sign from net IIP (which is calculated as assets minus liabilities). For more information, see Data sources, section Interpreting external debt.

Since net external debt is calculated in a different way than net IIP, values for both measures may differ considerably. As can be seen from Table 5, countries exhibiting the highest net external debt as percentage of GDP are Greece (126.3 %), Finland (59.8 %), Cyprus (57.4 %), and Portugal (53.8 %). On the other side, Luxembourg and Malta recorded by far the largest negative net external debt (assets higher than liabilities), both in absolute terms and as a share of GDP, reflecting their specific position as financial centres.

Source data for tables and graphs

Data sources

Statistics about the IIP are based on position (or stock) data which relate to the framework of balance of payments statistics. The main methodological reference is the Sixth Edition of the Balance of Payments and International Investment Position Manual (BPM6) of the International Monetary Fund (IMF). An updated version of BPM6 as well as the 2008 System of National Accounts (2008 SNA) is planned for mid-2025 partly in response to significant economic developments, including an increased role for globalisation, rising innovation, digitalization and interconnectedness of financial and trade markets.

The transmission of IIP data to Eurostat is covered by Regulation (EC) No 184/2005 of the European Parliament and of the Council of 12 January 2005 on Community statistics concerning balance of payments, international trade in services and foreign direct investment. Data requirements according to the BPM6 manual are included in Commission Regulation (EU) No 555/2012 of 22 June 2012 and Commission Regulation (EU) No 1013/2016 of 8 June 2016 as an amendment to the above.

Estimate of IIP of the EU

The international investment position is an indicator of an economy’s external exposure in financial assets and liabilities to the rest of the world. It contributes to monetary policy analysis and foreign exchange rate policies. Given that the EU is not a homogeneous currency union (unlike the euro area), the EU IIP has been treated only with minor attention in the past. There has been, however, increasing demand for an IIP of the European Union for the purpose of financial stability analysis of the whole European Union. In contrast, the euro area IIP is very relevant for analysis benefitting the monetary policy of the European Central Bank.

The compilation of the IIP for the EU requires a geographical breakdown of position data. All Member States would have to generally disseminate their assets and liabilities[3] held outside the European Union (extra EU). This would require all Member States to send also their positions in reserve assets (as a component of the IIP) vis-à-vis extra-EU to Eurostat. Data requirements applying to Member States not participating in the Monetary Union are for international investment position generally less comprehensive compared with euro area Member States and geographical breakdown. The legal requirement for the dissemination of portfolio investment liabilities remains practically without geographical breakdown (Geo 1, rest of the world)[4], and requires resorting to other data sources[5]while the dissemination of reserve assets is not covered by the above mentioned regulation.

Starting from April 2020, due to better data coverage, Eurostat is able to calculate quarterly international investment position of the EU (excluding reserve assets) and disseminate these series in the public database. Missing national data for portfolio investment liabilities vis-à-vis extra-EU have been calculated as portfolio investment assets vis-à-vis extra EU minus net portfolio investment vis-à-vis rest of the world (i.e. assuming that net intra-EU positions are equal zero). Until now, Eurostat chose, however, not to estimate a geographical breakdown of reserve assets, and decided to disseminate only international investment position excluding reserve assets. Therefore, it should be noted that figures for the EU (IIP excluding reserve assets) are not fully comparable with data for euro area (total IIP). With a geographical breakdown of non-euro area Member States’ data of reserve assets in order to exclude reserve assets held with euro-area Member States, a proper EU IIP including reserve assets could be compiled. The feasibility of this approach is currently being examined by Eurostat.

Interpreting external debt

Two measures in macroeconomic statistics complement IIP statistics – gross and net external debt. Their methodology is covered in the External Debt Statistics – Guide for Compilers and Users (EDS).

Gross external debt represents the total position of an economy in debt liabilities, and comprises the following debt instruments: special drawing rights (SDR) allocations, currency and deposits (including unallocated gold accounts), debt securities at nominal or market value, loans, insurance, pension and standardised guarantee schemes, trade credits and advances, and other accounts payable (EDS, paragraph 2.11). Equity and investment fund shares are excluded from this definition because no payment of principal or interest is required. Likewise the definition excludes financial derivatives and employee stock options.

Eurostat publishes net external debt as positions in debt liabilities minus the respective positions in debt assets[6]. The latter is based on the assumption that for risk-management purposes entities manage their external liabilities and assets in an integrated manner. Consequently, the difference between an economy’s net external debt and net international investment position is the absence of all equity and investment fund shares components, as well as financial derivatives [7] and gold bullion (EDS, paragraph 7.51), as well as the sign convention[8].

Eurostat publishes both gross and net external debt, based on quarterly IIP data for all EU Member States and several European countries, while the World Bank publishes annual data on external debt positions for most countries in the world[9].

Context

The EU is a major player in the global economy not only for international trade in goods and services, but also for financial market operations and direct investment. Statistics on the international investment position provides a complete picture of the EU and its Member States’ external exposure in financial assets and liabilities to the rest of the world. These statistics effectively support financial stability analysis and may be used as a tool to study the international exposure of different parts of the EU’s economy, indicating its comparative advantages and disadvantages with the rest of the world, and calibrating the implied macroeconomic risks for the respective economies.

The financial and economic crisis underlined the importance of developing such economic statistics insofar as improvements in the availability of data on the real and financial economies of the world may have helped policymakers and analysts when the crisis unfolded; for example, if internationally comparable information about financial exposure in specific assets and liabilities had been available earlier.

The European Commission launched new policy proposals in this domain in the aftermath of the financial and economic crisis — aiming at establishing a package of actions designed to stimulate economic recovery, such as the Proposal for a Regulation on the European Fund for Strategic Investments (COM/2015/010), and to launch regular initiatives such as the Macroeconomic imbalances procedure to detect macroeconomic risks in EU Member States, and provide advice for addressing them.

Further details on the European Commission’s initiatives are available from the website of the European Commission’s Directorate-General for Economic and Financial Affairs (DG ECFIN), with a particular interest in recent priorities concerning the European semester.