(Bloomberg) — China’s government bond issuance is expected to jump this month at a time when policymakers are seeking to cool off a relentless demand for debt.

Most Read from Bloomberg

Cinda Securities Co. is projecting net issuance of 1.4 trillion yuan ($195.7 billion) this month, up about 780 billion yuan from July. Huaxi Securities Co. sees sales of around 1.6 trillion yuan to 1.8 trillion in August. Standard Chartered Plc and Societe Generale SA are also predicting an increase.

Rising debt issuance comes at a time when concerns over a slowing economy, expectations for central bank policy easing and a lack of attractive investment alternatives have dragged yields to record lows. Sweeping measures by policymakers to arrest the rally have only had a fleeting effect on the market.

Some analysts expect the supply glut along with recent market interventions by policymakers to create a barrier to further bond gains for now, but they don’t expect yields to rise high enough to hurt the economy.

“The need to support the economy and the emphasis from the recent politburo meeting to accelerate special bond insurance mean local governments will need to follow the policy directions,” said Gary Ng a senior economist at Natixis SA. “Any concentrated issuance will offer tailwinds to supporting bond yields,” but the rise in yields will be limited as higher rates will impact growth.

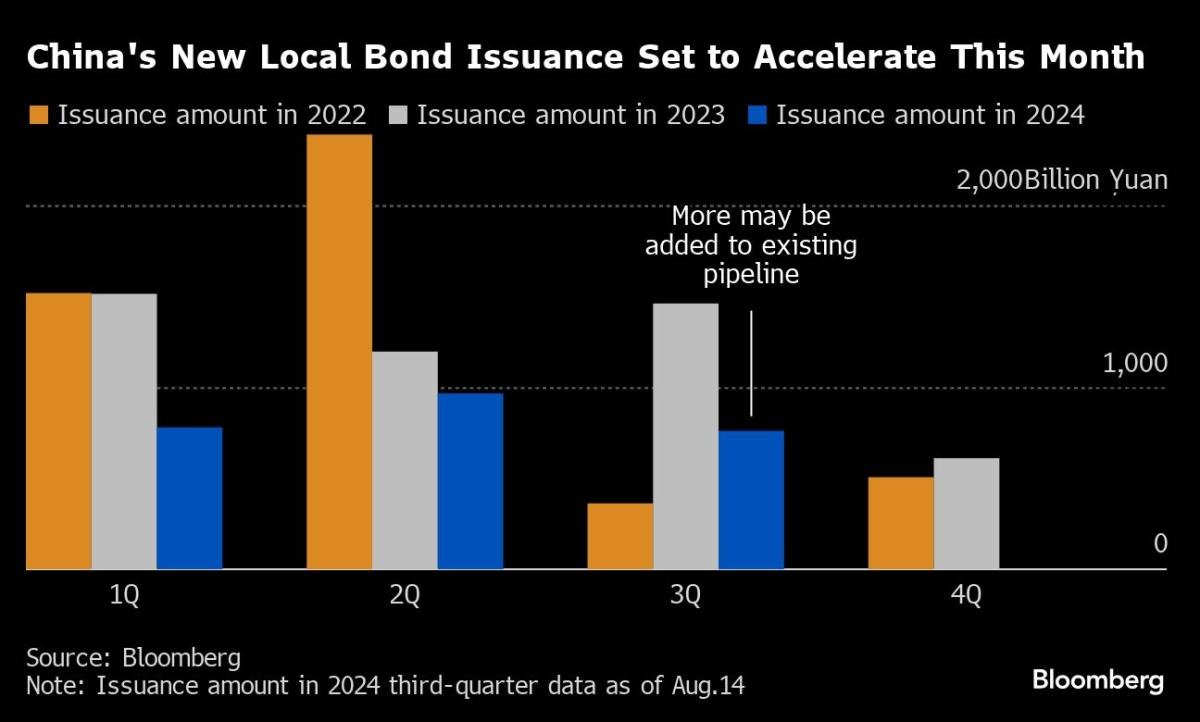

China’s local government bond issuance, excluding that for repaying maturing debt, is expected to reach 760.5 billion yuan in the current quarter, that’s already close to 80% of the total amount sold in the preceding three months, according to data compiled by Bloomberg.

“Local government issuance has lacked notably this year, so they do need to pick up speed,” said Michelle Lam, Greater China economist at Societe Generale. “There is also stronger emphasis from central government to make sure the growth target is met.”

She expects forecasts for a jump in bond sales this month and the PBOC’s window guidance to put an end to the rally at least in the near term. However, “right now the search for safe assets remains entrenched,” Lam said.

Traders in China rushed back into buying bonds after a report showed bank loans to the real economy contracted for the first time in 19 years, underscoring weak domestic demand.

Becky Liu, head of China macro strategy at Standard Chartered said the increase in issuance is unlikely to create a “supply shock.”

“Demand-supply dynamics remain skewed toward the demand side, given still very weak credit growth, especially mortgage loans,” she said.

–With assistance from Jing Zhao.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.