Triple Flag Precious Metals Corp. (NYSE:TFPM – Free Report) – Research analysts at National Bank Financial upped their FY2024 earnings per share estimates for Triple Flag Precious Metals in a report released on Monday, February 10th. National Bank Financial analyst S. Nagle now anticipates that the company will earn $0.57 per share for the year, up from their previous forecast of $0.56. The consensus estimate for Triple Flag Precious Metals’ current full-year earnings is $0.55 per share. National Bank Financial also issued estimates for Triple Flag Precious Metals’ Q4 2024 earnings at $0.18 EPS.

Triple Flag Precious Metals Stock Up 0.7 %

Shares of Triple Flag Precious Metals stock opened at $17.42 on Wednesday. The company has a current ratio of 3.18, a quick ratio of 3.05 and a debt-to-equity ratio of 0.02. The business’s 50 day simple moving average is $15.87 and its 200-day simple moving average is $16.25. The stock has a market capitalization of $3.50 billion, a price-to-earnings ratio of -66.98, a PEG ratio of 0.74 and a beta of -0.08. Triple Flag Precious Metals has a twelve month low of $11.75 and a twelve month high of $18.88.

Institutional Trading of Triple Flag Precious Metals

A number of institutional investors and hedge funds have recently made changes to their positions in TFPM. Farther Finance Advisors LLC raised its position in shares of Triple Flag Precious Metals by 175.6% during the 4th quarter. Farther Finance Advisors LLC now owns 1,896 shares of the company’s stock worth $29,000 after purchasing an additional 1,208 shares during the period. Northwest & Ethical Investments L.P. acquired a new stake in shares of Triple Flag Precious Metals during the 4th quarter worth approximately $45,000. Point72 Asset Management L.P. acquired a new stake in shares of Triple Flag Precious Metals during the 3rd quarter worth approximately $111,000. Drive Wealth Management LLC acquired a new stake in shares of Triple Flag Precious Metals during the 4th quarter worth approximately $175,000. Finally, XTX Topco Ltd acquired a new stake in Triple Flag Precious Metals in the 3rd quarter valued at approximately $220,000. 82.91% of the stock is currently owned by institutional investors and hedge funds.

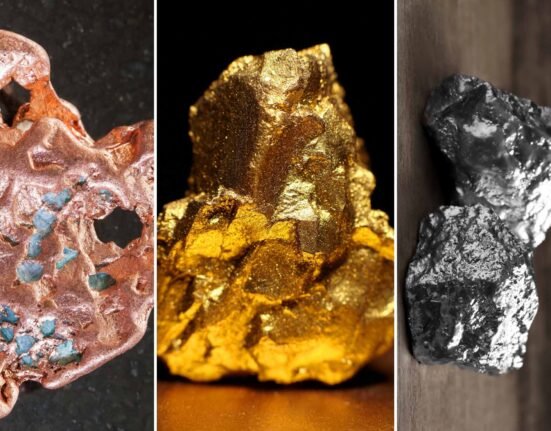

About Triple Flag Precious Metals

Triple Flag Precious Metals Corp., a precious-metals-focused streaming and royalty company, engages in acquiring and managing precious metals, streams, royalties and other mineral interests in Australia, Canada, Colombia, Cote d’Ivoire, Honduras, Mexico, Mongolia, Peru, South Africa, the United States, and internationally.

See Also

Receive News & Ratings for Triple Flag Precious Metals Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Triple Flag Precious Metals and related companies with MarketBeat.com’s FREE daily email newsletter.