London has a new major mining company this week as Anglo American (AAL) demerges Valterra Platinum (VALT), and the secondary listing arrives amid early signs of a recovery for the precious metal price.

A market value of £8bn makes Valterra one of London’s largest pure-play mining companies, just behind Fresnillo (FRES) and Antofagasta (ANTO). Despite its size, Valterra won’t join the FTSE 100 because its primary listing remains overseas, in Johannesburg.

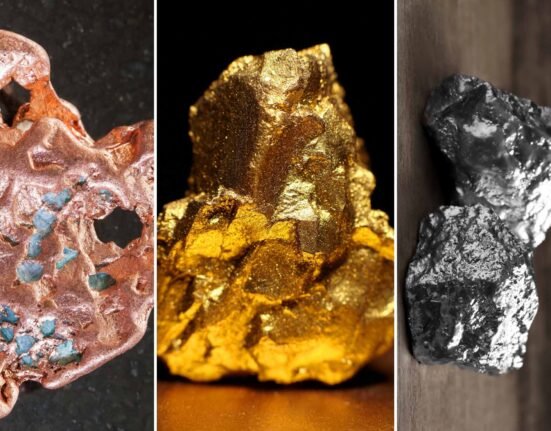

Prices of platinum group metals (PGMs), which refers to platinum, palladium, rhodium and others, have fallen in recent years because of lower demand from the car industry, which uses them for exhaust systems.

Valterra, which has been listed in South Africa until its former name for decades, has largely traded in line with the so-called basket of metals it mines, which includes the above PGMs as well as gold and chrome. In the past year its shares have improved – climbing 20 per cent in a weak PGMs market – as management put in place a serious cost-cutting programme, letting go thousands of workers.

Anglo American will now hold 19.9 per cent of Valterra, and has a 90-day lock-up following the London listing. Anglo shareholders have been handed 47 per cent of the company, while the South African government pension fund holds 11.7 per cent.

Read more from Investors’ Chronicle

Chief executive Craig Miller told Investors’ Chronicle the underlying market was ripe for a turnaround. “The transition from internal combustion engines to battery electric vehicles is not necessarily going on the trajectory that people were forecasting,” he said, adding that another 1mn ounces (oz) of PGM demand a year could still emerge from combustion engine and hybrid vehicle sales.

Automotive demand last year was 12.7mn oz, according to Johnson Matthey.

The palladium and platinum markets are already in deficit but automakers and their suppliers have largely been running down existing stocks, limiting the price reaction. Jewellery and investment buyers are another demand source, but they are limited compared to gold and silver.

The platinum price jumped in early May to a 12-month high of close to $1,100 (£812) an oz, although palladium has remained stuck at around $1,000 an oz.

The latter metal drove profits for PGM miners at the start of the decade, as automakers shifted catalytic converters to use more palladium than platinum.

The sector as a whole is also gauging the impact of the trade war on the auto market, as well as others barriers to trade between the US, China and Europe.

“Growth [and] activity in the global auto sector this year remains modest, undermined by a confused global growth outlook and high [and] rising loan-servicing costs,” say analysts at Panmure Liberum. They note that a reduced mine supply should support prices as demand falls following the shift to electric vehicles.

Valterra’s Miller said “market development” would now be more of a focus for the independent company, ranging from jewellery to hydrogen technology.

The industry has for years pointed to the latter as an example of a new source of platinum demand, but lower than expected investment is one reason why just a fraction of that suggested demand has emerged.

“[Hydrogen fuell cell-powered small and large vehicles] will struggle to compete on an economic basis versus battery electric vehicles, and enthusiasm for hydrogen has fallen dramatically,” said RBC analysts Ben Davis and Marina Calero earlier this year.

But last week RBC said Valterra was best placed in the sector to generate free cash flow even if prices do not climb significantly. “Platinum and rhodium are finally showing signs of life after years of sustained deficits,” said Davis and Calero. “Any near term volatility in the equity could provide attractive entry points for the quality name in the space.”

That turbulence will come as passive investment entities such as ETFs, which track FTSE indices and will find themselves with Valterra positions due to their Anglo American exposure, sell the shares.

The London listing was added in a bid to limit this so-called flowback, where trackers and major holders sell stocks that are not in their benchmark or don’t fit their mandate.

Miller said there was likely to be volatility in the shares for some months. “Once it’s made clear in terms of what [Anglo intends] to do with its equity stake, then you’ll see the equity re-rating,” he added.

Prior to the demerger, Valterra announced a special dividend worth $852mn (£629mn) which, when combined with its regular payout for 2024, handed $600mn back to Anglo.

When asked about the special payout, Miller described the demerger “an opportunity for us to really set the balance sheet up in terms of how we then ensure a sustainable company going forward”.

He added that Valterra had “always distributed the excess cash we’ve generated”, and that the company remained in a net cash position after the special dividend.

But Davis and Calero described Valterra as being “drained” of surplus cash before its separation from Anglo American..

Next on the agenda for Anglo is completing the troubled sale of its coal assets in Australia to Peabody Energy (US:BTU), while the De Beers spinoff or sale appears to be held up by a weak diamond market.