Retail futures trading is growing in popularity as consumers shift their purchasing behaviors. From tech gadgets to commodities like gold, trends reveal new opportunities in investment and retail strategies.

In Canada, shoppers increasingly seek value-driven decisions. This shift also impacts sectors where retail meets finance, like trading or diversifying portfolios with tangible goods.

What does this mean for retailers and investors? Understanding these connections allows both parties to align priorities while exploring options tied directly to consumer demands today.

Understanding Retail Futures and Their Role in Commodities Trading

Here’s something investors, especially those just getting started should know. Retail futures provide a way to secure prices on assets before market conditions shift. These contracts allow buyers and sellers to lock in future transactions, making them useful for managing risks tied to volatile markets.

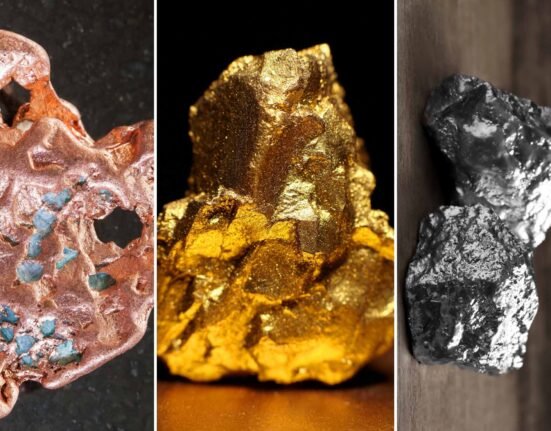

In the commodities space, retail futures often intersect with consumer-driven demand. Items like precious metals or agricultural products see pricing influenced by trends ranging from inflation fears to increased interest in sustainable resources.

How Consumer Sentiment Drives Demand for Tangible Investments

Picture a shopper weighing the appeal of a designer handbag versus an ounce of gold. Consumer sentiment heavily impacts tangible investments, more so in uncertain times. People turn to physical assets, like metals or collectibles, as perceived safe-havens.

This behavior is fueled by fluctuating trust in markets and a desire for long-term stability. Retailers offering investment-grade goods see increased demand, bridging personal finance with purchasing trends shaped by both logic and emotion.

The Rising Interest in Asset-backed Purchases Among Consumers

In recent years, there has been a noticeable shift toward asset-backed purchases gaining traction in consumer markets. This trend reflects the desire to pair retail transactions with investment potential.

Markets see rising demand for goods like fine art, bullion coins, and even collectibles that carry inherent value beyond aesthetics.

Products such as US Mint American Eagle coins embody this blend of practicality and preservation. They offer a dual benefit: tangible ownership and financial stability for uncertain times ahead.

Bridging Traditional Retail with Financial Market Opportunities

Retail and finance are also converging in unexpected ways. Modern retailers now leverage financial market strategies to expand their product offerings, attracting investment-minded customers.

The luxury market, in particular, sees goods that double as portfolio assets or exclusive investments driving demand. From high-end watches to tradable commodities, the boundaries between retail and investment continue to blur.

This alignment opens doors for consumers seeking value beyond purchases, blending lifestyle choices with smart financial opportunities under one seamless experience.

Impacts of Economic Uncertainty on Retail Futures Trends

When markets wobble, priorities shift, influencing how retail futures operate and adapt. Economic uncertainty often acts as a magnifying glass for shifting consumer behaviors.

Key impacts include:

- Increased preference for assets with lasting value (e.g., metals).

- Greater attention to hedging options through tangible goods.

- Heightened demand for stable, tradable contracts in commodities.

- Shifts toward investment-grade retail purchases over disposable ones.

These trends emphasize the interconnection between economic stability and consumer-driven futures activity shaping global trade strategies today.

Key Examples of Diversified Goods Reshaping Investment Decisions

Diversification is an investor’s cornerstone, and today’s retail goods are evolving to meet this principle. Consumers now explore items that merge practicality with investment potential.

Examples include:

- Rare wines that appreciate in value over time.

- Collectible watches offering both function and tradability.

- Precious metals, like gold bullion coins, as inflation hedges.

- Limited-edition artwork securing a growing resale market.

Products like these underscore how retail evolves into avenues for wealth preservation alongside personal enjoyment.

The Link Between Physical Goods and Financial Hedge Strategies

What steps have you taken to protect your financial future? That might be a story for another day, but physical goods often play a pivotal role in such strategies.

Assets like rare coins, investment-grade jewelry, or even luxury cars are increasingly used as hedges against inflation or market instability. Such tangible items offer intrinsic value that doesn’t erode with economic fluctuations, serving as both financial safeguards and personal treasures with enduring appeal.

Financial innovation continues to expand what investors consider valuable. Retail futures bridge gaps between traditional assets and emerging opportunities.

From agricultural contracts ensuring supply chain stability to commodity-linked consumer goods offering dual-purpose utility, these tools redefine portfolio diversification.

By tapping into this dynamic space, buyers connect financial goals with tangible investments that resonate in both personal and professional contexts.

Retail futures illustrate how consumer behaviors shape both markets and investments. Understanding these connections highlights opportunities to secure financial stability, blending practicality with strategic growth in an evolving economic landscape.