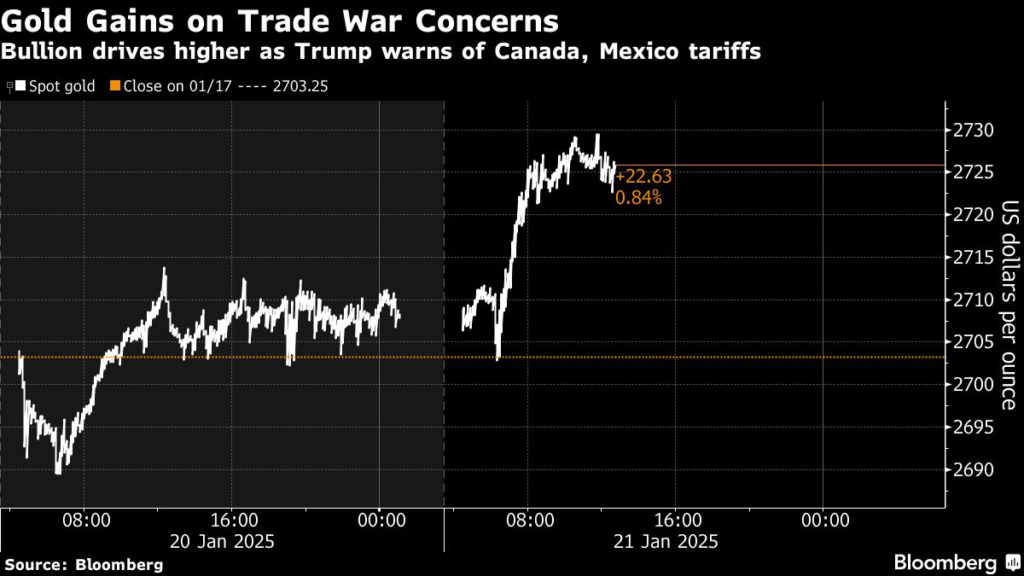

Bullion extended gains from Monday and silver futures briefly spiked after Trump’s comments. Mexico is the top miner of silver, and it is unclear whether the tariffs would apply to imports of the metal.

The possibility of both silver and gold being caught up in the sweeping tariff measures has whipsawed the market in recent weeks, driving premiums for futures deliverable in New York to elevated levels.

“Continued uncertainty will keep the roller coaster from coming to a stop,” said Daniel Ghali, senior commodity strategist at TD Securities. Money managers may continue to buy bullion to hedge against uncertainty after boosting their bullish wagers last week, according to Ghali.

Investors were also weighing the outlook for inflation, with Trump’s domestic agenda of tax cuts and increased spending potentially pointing to ongoing price pressures this year. That may limit the Federal Reserve’s ability to keep easing monetary policy. Higher borrowing costs typically pose a headwind for bullion, as it does not pay interest.

Gold set a series of records in 2024, with gains driven by the Fed’s pivot to looser monetary policy, geopolitical tensions, and central-bank buying. The precious metal may yet receive a further boost from demand for haven assets amid concerns about the new US president’s immigration policy, as well as scope for increasingly fraught relations with other nations.

Spot gold was up 1.3% to $2,744.45 an ounce as of 12:06 p.m. in New York. The Bloomberg Dollar Spot Index was little changed. Silver, platinum and palladium all advanced.

(By Yvonne Yue Li)

Read More: Trump tariff risks fuel a chaotic hunt for gold in London