- Gold climbed above $3,400, supported by broad USD weakness and escalating geopolitical tensions.

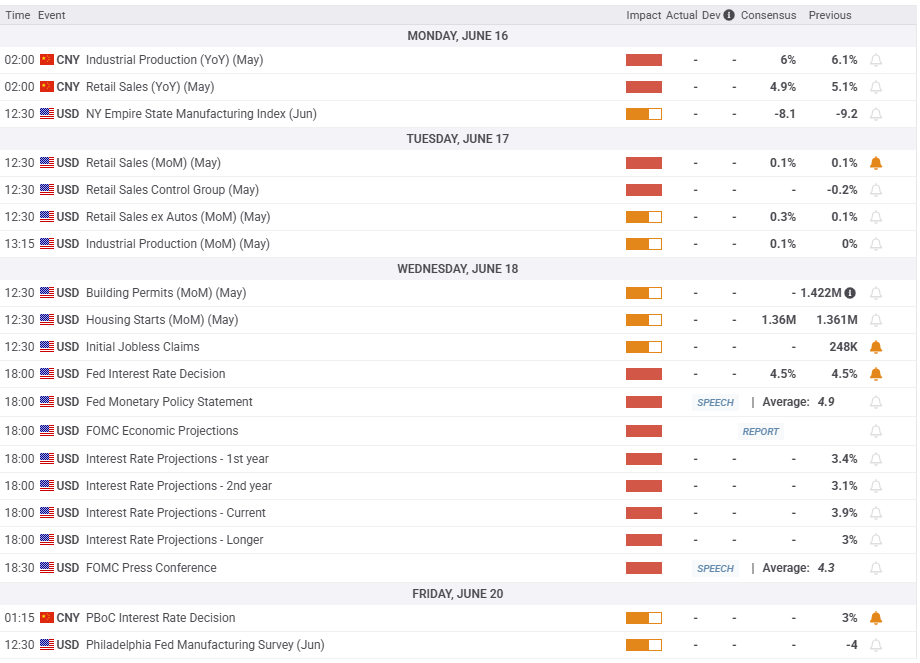

- The Federal Reserve will announce the interest rate decision and publish the dot plot on Wednesday.

- The near-term technical outlook points to a buildup of bullish momentum.

Gold (XAU/USD) turned north and climbed to its highest level since early May above $3,400. The Federal Reserve’s (Fed) monetary policy announcements and developments surrounding the Israel-Iran conflict could continue to impact XAU/USD’s performance in the near term.

Gold gathers bullish momentum

Gold struggled to find direction at the beginning of the week and closed virtually unchanged on Monday and Tuesday. The relatively upbeat market mood, driven by growing optimism about the US and China resolving the trade dispute, made it difficult for XAU/USD to gain traction. Representatives from China and the US met in London for the next round of trade talks on Monday. The Wall Street Journal reported that US President Donald Trump gave the green light to his negotiators, led by Treasury Secretary Scott Bessent, to lift export controls on a variety of Chinese products. Following the second day of talks on Tuesday, the US and China decided to ease export curbs, including those on rare earths, and agreed on a framework to keep the tariff truce alive.

On Wednesday, the US Dollar (USD) came under renewed selling pressure, allowing XAU/USD to turn north. The data published by the US Bureau of Labor Statistics showed that annual inflation, as measured by the change in the Consumer Price Index (CPI), edged higher to 2.4% in May from 2.3% in April. This reading came in below the market expectation of 2.5%. Additionally, the CPI and the core CPI both rose 0.1% on a monthly basis, at a softer pace than anticipated.

After rising nearly 1% on Wednesday, Gold preserved its bullish momentum on Thursday. Weaker-than-anticipated producer inflation data, combined with a disappointing weekly Initial Jobless Claims reading, further weighed on the USD.

Gold extended its weekly uptrend early Friday after Israel’s Prime Minister Benjamin Netanyahu said that they have launched “Operation Rising Lion,” targeting Iran’s nuclear infrastructure, ballistic missile factories and its military capabilities. Netanyahu also noted that the operation will continue for as many days as it takes. In response, Iran’s Armed Forces General staff said that Israel and the US will “pay a very heavy price.” Gold capitalized on safe-haven flows and broke above $3,400.

Gold investors could react to revisions in Fed dot plot, geopolitics

The economic calendar will not offer any high-tier data releases that could drive Gold’s valuation in the first half of the week. Hence, investors will continue to pay close attention to geopolitical developments. In case the tensions in the Middle East escalate further, Gold could continue to find demand as a safe-haven asset.

On Wednesday, the Fed will announce its interest rate decision and publish the revised Summary of Economic Projections (SEP), the so-called dot plot.

The Fed is widely expected to keep the policy rate unchanged at the 4.25%-4.5% range. In case the dot plot shows that policymakers are still projecting two 25-basis-point (bps) rate cuts in 2025, the USD could come under selling pressure with the immediate reaction and open the door for a leg higher in XAU/USD. On the other hand, a hawkish revision to the SEP, with policymakers forecasting only one rate cut this year, could fuel a USD rally and cause XAU/USD to turn south.

Market participants could also react to comments from Fed Chairman Jerome Powell. If Powell acknowledges softer inflation data and adopts an optimistic tone about the outlook, the USD could have a difficult time finding demand. Conversely, the USD could hold its ground in case Powell reiterates that the central bank needs to remain patient with regard to policy easing, citing relatively healthy conditions in the labor market.

On Thursday, financial markets in the US will remain closed in observance of the Juneteenth holiday.

Gold technical analysis

The Relative Strength Index (RSI) indicator on the daily chart rose slightly above 60 and Gold broke out of the symmetric triangle to the upside, pointing to a buildup of bullish momentum.

Looking north, the immediate resistance level could be seen at $3,450, where the mid-point of the six-month-old ascending regression channel is located. Once Gold stabilizes above this level, $3,500 (all-time high set on April 22) could be seen as the next hurdle before $3,580 (upper limit of the ascending channel).

On the downside, support levels could be spotted at $3,330-$3,320 (20-day Simple Moving Average (SMA), lower limit of the ascending channel), $3,285 (50-day SMA, Fibonacci 23.6% retracement level) and $3,200 (static level, round level).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.