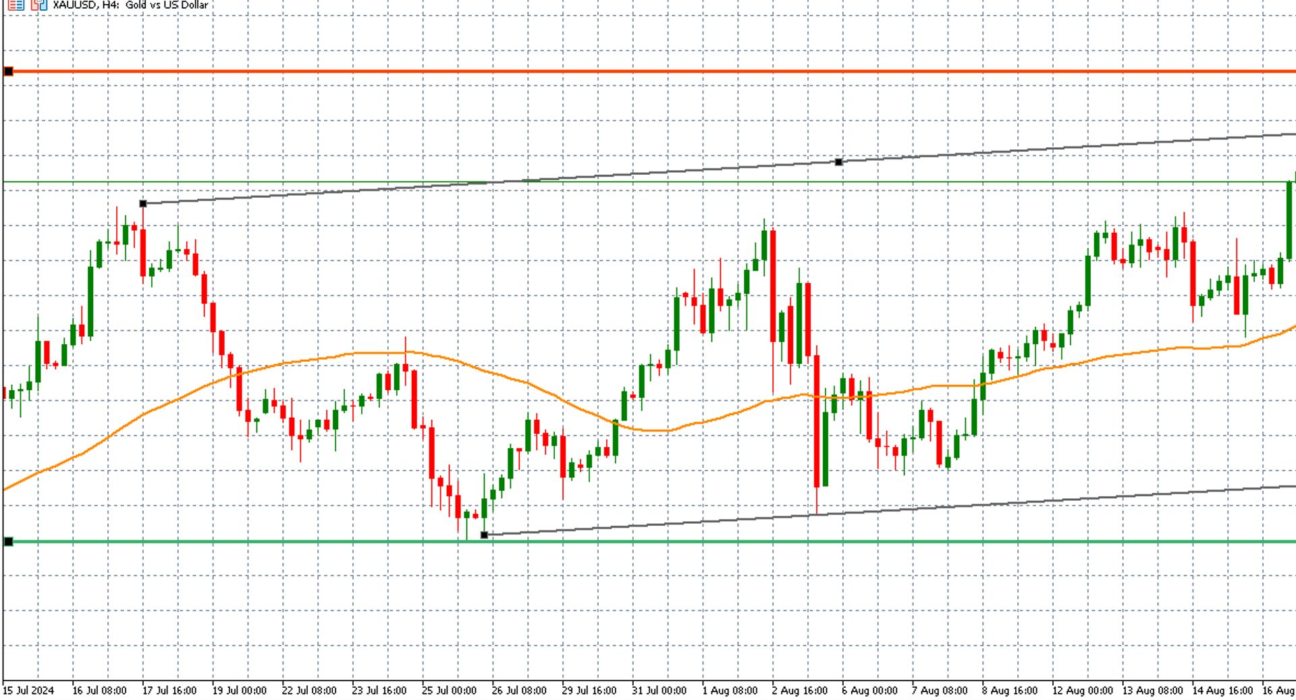

Gold gains over 1% as Powell comments hint at September rate cut

“The time has come” to cut interest rates – Powell Dollar down 0.8% against its rivals Gold set for a weekly gain Aug 23 (Reuters) – Gold prices gained more than 1% on Friday as the dollar and Treasury yields retreated following comments from Federal Reserve Chair Jerome Powell that signalled an interest rate cut