Sharing Services’ Q1 Spin-Off to Be Followed By Impact Biomedical

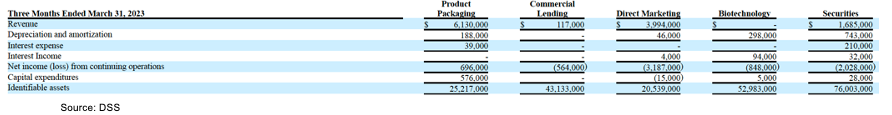

By Lisa Thompson NYSE:DSS READ THE FULL DSS RESEARCH REPORT DSS (NYSE:DSS) continued to make progress in Q1 to reduce its cash burn by spinning off Sharing Services Global. Although Sharing has not year reported its March quarter we believe it contributed about $3 million in revenues and the same amount in operating expenses to