What housing inventory trends mean to homebuyers and sellers

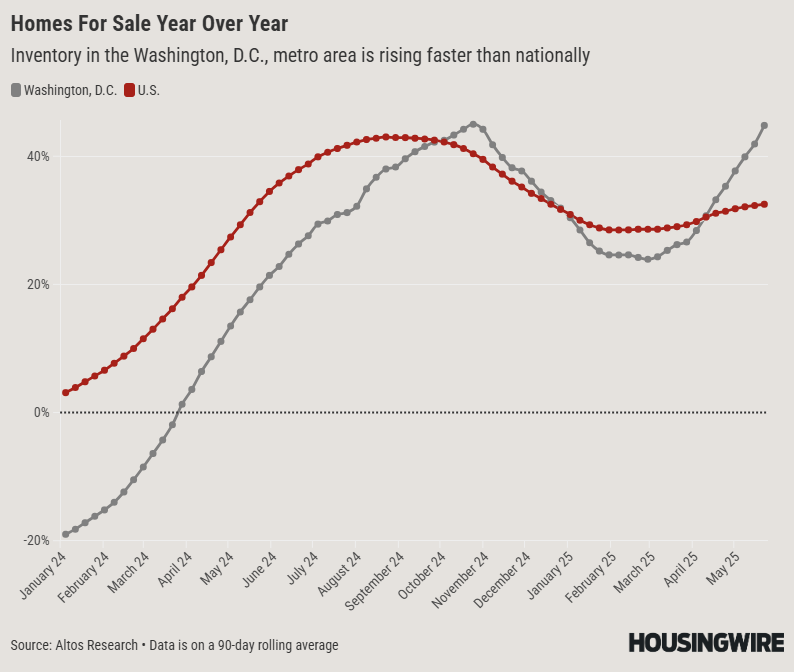

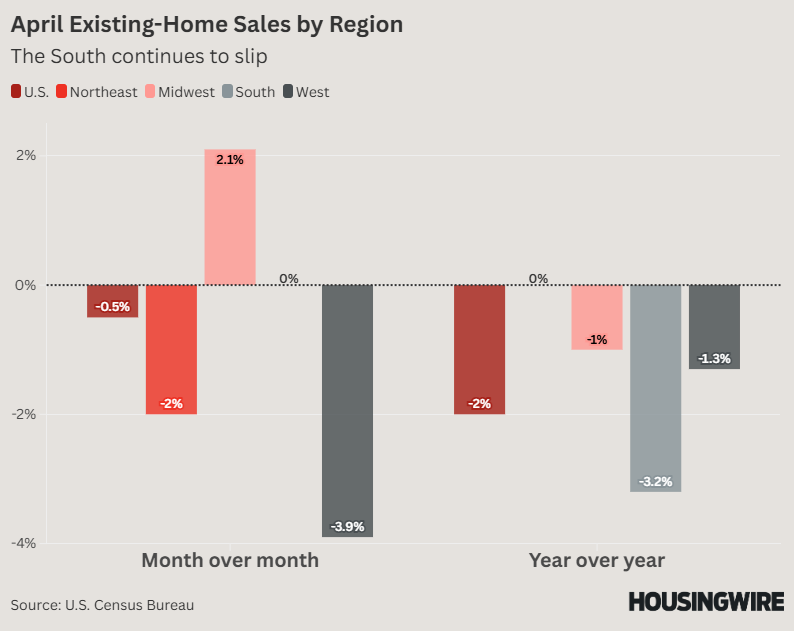

The economics of inventory At its core, the housing market follows the basic rules of economics. When homes are scarce, demand pushes prices higher. When inventory grows, buyers gain leverage, often leading to more negotiable terms and softer prices. Short-term spikes vs. long-term shifts Low inventory often results in multiple offers and competitive bidding, which