What To Expect From Investing in Gold in 2025

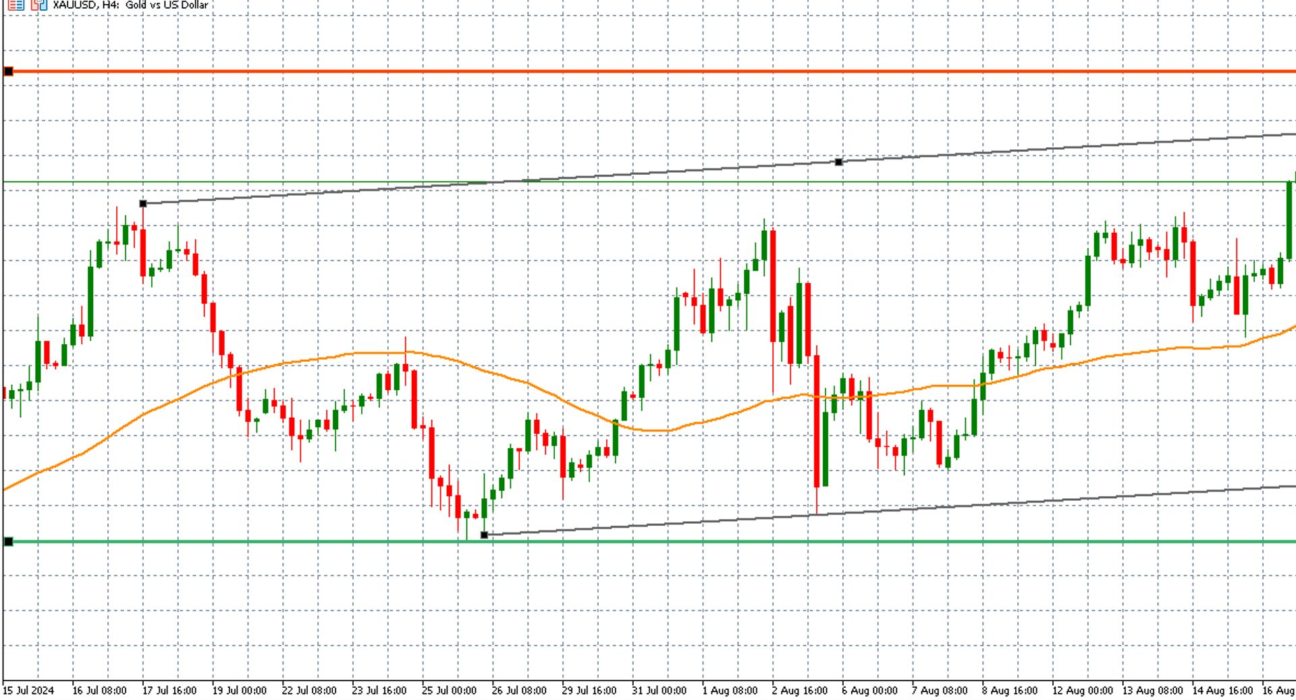

Gold has always been the treasure, both figuratively and literally, when it comes to investment. However, when the economy feels uncertain, it gets even more appealing to put your money into something that seems to withstand the test of time, like precious metals and gold futures. When demand is high, its price is high, too,