Gold ETF Inflows Turn Positive Again In June, Says World Gold Council

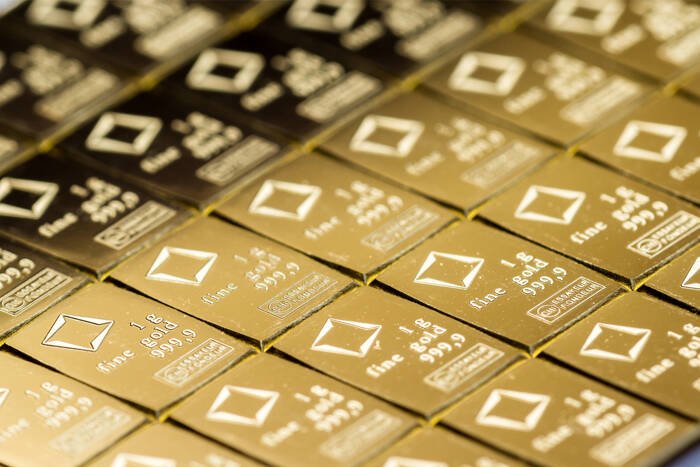

Photo by DAVID GRAY/AFP via Getty Images AFP via Getty Images Bullion-backed exchange traded funds (ETFs) reported returning net inflows last month, meaning half-year flows reached levels not seen for five years, data from the World Gold Council (WGC) showed. The organization noted that “all regions saw inflows last month, with North American and European