Stock market will crash 80% AFTER Donald Trump’s tariff-induced sell-offs, leading investor warns, saying: ‘Armageddon will come’

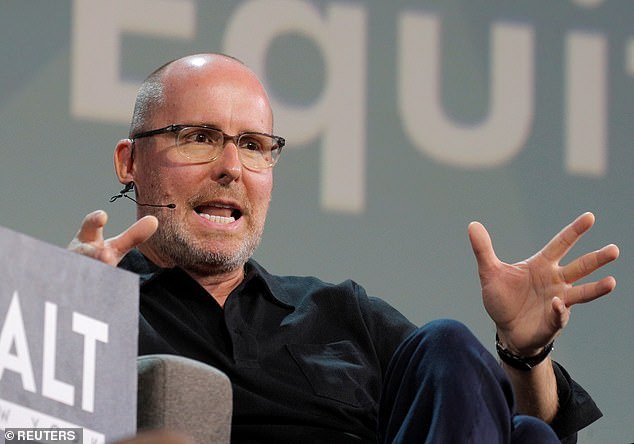

One of Wall Street’s most successful investors has warned that the stock market slide in the wake of Donald Trump‘s tariffs is merely a pothole in the road toward a sheer cliff edge. Mark Spitznagel, chief investment officer and founder of Universa Investments, told MarketWatch he expected an ‘80% crash’ was lurking around the corner.