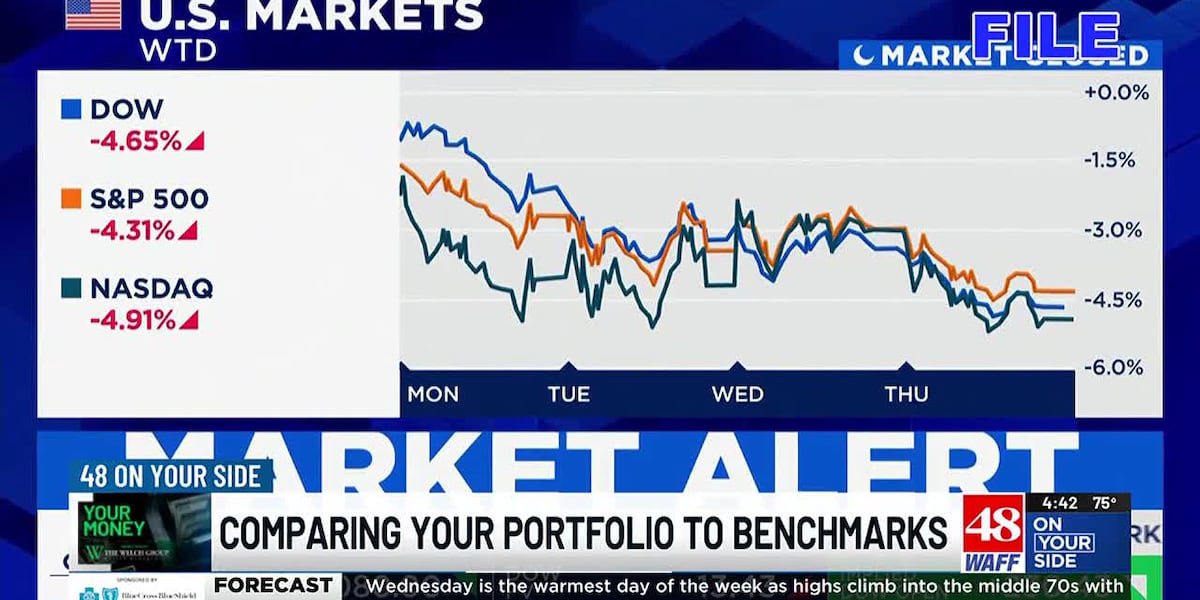

HUNTSVILLE, Ala. (WAFF) – As market volatility dominates headlines, many investors feel pressure to track daily market movements and compare their portfolios to major indexes like the S&P 500. However, financial expert Marshall Clay with The Welch Group warns that this mindset can lead to unnecessary risks and short-term thinking.

The Illusion of Diversification

“It’s easy to assume that major indexes like the S&P 500 offer broad diversification,” Clay says. “But what people don’t always realize is the risk built into these benchmarks.”

The S&P 500, for example, is a market-cap-weighted index, meaning that larger companies have a much bigger influence on performance. “Right now, just 10 companies make up 35% of the index, and 9 of those are in the tech sector,” Clay explains. This concentration means that market movements—both up and down—are heavily influenced by a handful of stocks, making it riskier than it may seem at first glance.

Why Chasing Benchmarks Can Backfire

Clay warns that constantly comparing a personal portfolio to the S&P 500 or other benchmarks can lead investors to take on more risk than they realize.

“If you’re always chasing an index, you may overlook the potential downside,” he says. “More risk means more volatility—both to the upside and downside.”

Rather than reacting to short-term market swings, Clay recommends stepping back and looking at the bigger picture.

Long-Term Goals Over Short-Term Gains

Market fluctuations are part of investing, but Clay stresses that focusing on long-term financial goals is a more effective strategy.

“We’ve seen this for years—the S&P 500 goes up and down,” he says. “Instead of reacting to year-to-year changes, step back and look at a five-year period. So far this year, the market is down 5%, but that doesn’t tell the full story.”

Instead of fixating on beating an index, Clay encourages investors to consider their broader financial objectives.

“Think about why you’re investing,” he advises. “It’s not about outperforming an index—it’s about maintaining purchasing power, keeping up with inflation, and ensuring your financial security.”

Setting Realistic Expectations

Clay also suggests working with a financial advisor to set a long-term return goal that aligns with personal needs.

“A reasonable long-term return goal might be around 6-7%, depending on your situation,” he says. “The key is to stay focused on your financial goals, not just today’s market movements.”

The Bottom Line

Chasing high returns or reacting emotionally to market fluctuations can lead to unnecessary risk, and in some cases, panic selling when markets dip.

“Taking risks isn’t necessarily bad,” Clay notes, “but it’s important to be aware of the potential downsides. Don’t get lured into investments that don’t align with your financial plan.”

His advice? Stick to your investment strategy, avoid market noise, and keep your focus on long-term success.

To learn more about The Welch Group, click here.

Click Here to Subscribe on YouTube: Watch the latest WAFF 48 news, sports & weather videos on our YouTube channel!

Copyright 2025 WAFF. All rights reserved.