NYSE:DSS

READ THE FULL DSS RESEARCH REPORT

DSS (NYSE:DSS) continued to make progress in Q1 to reduce its cash burn by spinning off Sharing Services Global. Although Sharing has not year reported its March quarter we believe it contributed about $3 million in revenues and the same amount in operating expenses to DSS. In Q2 we expect one month of Sharing will be in DSS’ income statement and then it will revert to a marketable security. We have adjusted our model accordingly. To recap on May 4th, DSS distributed approximately 280 million shares of Sharing Services to holders of DSS common stock as of the record date of April 28, 2023. Each share of DSS entitled the holder to receive two SHRG shares. DSS now owns 7% of Sharing Services Global Corporation (or 25 million shares worth $190,000) which will now be found in marketable securities.

We expect the record date for the spin-off of Impact Biomedical to be on or near June 30th. On Monday it filed what we expect to be the final amendment to its S-1 which contains audited financials and a business plan. It plans an IPO to follow, probably in Q3. After the IPO DSS should still have 55% of Impact and its financials will still be consolidated with DSS. Impact hopes to raise $30-50 million in an IPO. Impact has many products already developed and it will be interesting to see how the market values the company and to monitor its progress toward generating revenues.

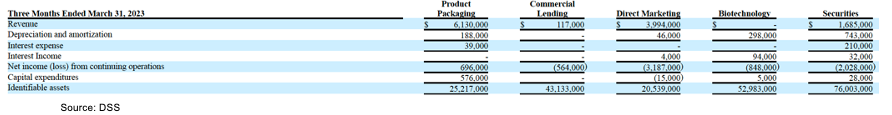

Q1 2023 Results

DSS reported Q1 revenues of $11.9 million, down 3% from the year ago’s $12.3 million. Printed product sales were up 72% year over year and up 15% sequentially. Most of that growth was driven by Premier’s new capacity and alleviation of the paper shortage. $3.0 million of the $5.8 million of Packaging Printing and Fabrication revenues were from Walgreens’ photo business which slipped into Q1 from Q4. Commercial and security printing had its best quarter since 2020 at $265,000 but we expect results there to continue to fluctuate. Direct marketing was down 42% year over year, but flat sequentially with Q4 2022. On April 5th, Sharing was dividended to shareholders with DSS retaining 7% of the shares. Next quarter Sharing will not be consolidated with DSS except for the first month and direct marketing revenues will decline significantly. In Q1 Sharing was most of the revenues and if Q4 is a guide that would be over $3 million of the $4 million.

The REIT contributed $1.7 million in revenues virtually the same as last quarter and Q1 2022. The bank and commodity broker revenues were combined this quarter and had revenues of $117,000 compared with revenues of $129,000 in Q1 2022. The brokerage business is expected to have variable results due to its trading business.