In a ‘normal’ year, 1.2 million properties are bought and sold. However, over the last few years, we’ve had anything but a ‘normal’ year – with property transactions varying from just over a million during the first lockdown in 2020 to almost 1.5 million in 2021, when there was a full year of being able to move.

In a ‘normal’ year, 1.2 million properties are bought and sold. However, over the last few years, we’ve had anything but a ‘normal’ year – with property transactions varying from just over a million during the first lockdown in 2020 to almost 1.5 million in 2021, when there was a full year of being able to move.

I don’t think many people understand the volatile nature of property transactions, especially those outside of the property industry. Trying to run a business when you have little or no control over what you have to sell is tough to do. Then trying to run a business that can see volumes increase by anything from 20 to 50% within a matter of months, or even days, with no warning – (think back to the Liz Truss disaster) and this makes it even tougher.

But the final thing to add is that operating in a market like this when it takes years to train most home moving experts, bearing in mind these fluctuations, it’s actually a miracle that so many people get moved during the year.

The impact of transaction highs and lows will especially be felt by finance, agents, legal professionals and removal companies as we head into yet another government-imposed Stamp Duty Land Tax holiday deadline (in England), which means that everyone is going to be racing to complete by the 31st March – or earlier based on the deadlines being imposed on conveyancing lawyers the week before.

Property transaction forecasting

The good news is that although we aren’t great at predicting property prices, we are getting a lot better at predicting at least the expected average number of sales for the year.

Richard Donnell from Zoopla has been forecasting transactions pretty well for many years. Lucian Cook and his team at Savills do a breakdown of the number of first-time buyers, cash buyers, home owners with a mortgage, and those investing in buy-to-let, which is equally useful.

However, one problem has always been that the data we get on transactions has been quite out of date, especially if we are reliant on the Land Registry data.

Which is why it is super useful to use the TwentyEA data which provides this information every Sunday. The data really helps us understand what is happening now, how it compares to the last few quarters and how transactions are looking year on year – going back to 2019.

This allows all home moving services to see how they are doing versus the market on a weekly basis, giving an early warning if sales are increasing – or, perhaps more importantly, falling.

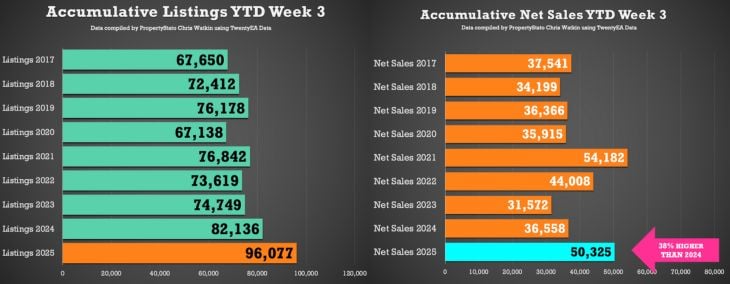

Their latest data shows that listings are higher than in any year since 2017. We are even seeing listings 25% higher than the 2021 pandemic sales peak and 17% higher than 2024.

However, we all know listings can be easy to secure, while being expensive to list if they don’t sell, so looking at the net sales, it’s good to see that versus previous years, net sales are tracking 37% up from last year, but, they are 7% down on 2021, suggesting that the market is more buoyant for buyers than it is for sellers.

Regional variations

On a regional basis though, these numbers can vary dramatically. For example, thanks to Christopher Watkin and TwentyEA data, here’s a snapshot of net sales year to date versus the busy days of 2021.

Although in many regions listings may be up, we are not seeing as many net sales being concluded – with London and Scotland the only regions seeing more net sales this year.

Looking at feedback from the indices, overall, they appear to be backing the data above showing that listings are up, while net sales have a little catching up to do:-

“While there is speculation that demand may cool after stamp duty costs rise from April 2025, we find that there is an increased appetite amongst consumers to move home in the next 2 years. Zoopla’s Monthly Consumer Tracker shows there has been an increase in the proportion of renters and existing homeowners looking to buy compared to a year ago. This is down to households delaying decisions in the face of higher mortgage rates in recent years and expectations of base rates cuts in 2025.”

“Buyer activity is also starting the year encouragingly, as many festivity-distracted buyers return to make their move happen. Since Boxing Day, the number of buyers contacting estate agents about homes for sale is up by 9% on the same period last year. The combination of good choice and healthy buyer demand has kept the sales trend positive, with the number of sales being agreed between buyers and sellers now 11% ahead of this time last year.

“Rightmove has also recorded its busiest start to a year for prospective home-movers applying for a Mortgage in Principle to understand what they may be able to borrow from a lender, which is evidence of future buyer intent. All of these very early lead indicators at the start of this year point to a busier 2025. Rightmove forecasts a larger number of transactions this year of 1.15 million, and an average asking price increase of +4%.”

“Affordability is still a challenge for many would-be buyers, but the market’s resilience is noteworthy. There’s strong demand for new mortgages and growth in lending. With a stamp duty increase looming, some of this demand may have come from first-time buyers eager to complete transactions before the end of March.

“Despite geopolitical uncertainties, and waning consumer confidence, other key indicators look fairly positive for the housing market. The Bank of England has made its first base rate cut of the year, and there are probably more to come. Household earnings are expected to continue outpacing inflation – albeit that gap may narrow – easing some of the financial pressure still being felt from the cost-of- living squeeze.

“As things stand, mortgage rates are likely to hover between 4% and 5% in 2025, influenced by both global financial markets and domestic monetary policy. Over the past year, buyers have been getting used to this new normal, understanding that rates are unlikely to return to the historical lows of 1%. But the fundamental issue in the housing market remains the lack of supply. This long-term trend, coupled with a gradual improvement in affordability, should support further modest house price growth this year.”