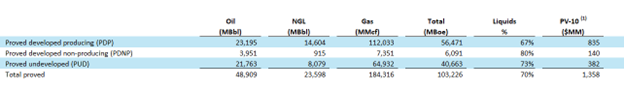

Pro-Forma Reserve Data

Reconciliation of Non-GAAP Measure

Expands footprint in DJ Basin to ~55,000 net acres and inventory life to ~10 years

Increases average daily production by ~25,700 net BOEPD

Immediately accretive and maintains strong balance sheet

Houston, TX, March 26, 2025 (GLOBE NEWSWIRE) — Prairie Operating Co. (Nasdaq: PROP) (the “Company,” “Prairie,” “we,” “our” or “us”), today announced the successful closing of its previously announced $602.75 million acquisition of certain Denver-Julesburg Basin (DJ Basin) assets (the “Bayswater Assets”) from Bayswater Exploration and Production and its affiliated entities (collectively, “Bayswater”). This acquisition further strengthens Prairie’s position as a leading operator in the DJ Basin, enhancing its production base and long-term growth potential.

“This acquisition is a pivotal moment for Prairie, significantly expanding our operational footprint in the DJ Basin,” said Edward Kovalik, Chairman and CEO of Prairie. “By integrating these high-quality assets, we are materially enhancing our production profile, strengthening our financial position, and creating meaningful value for our shareholders. Prairie remains singularly focused on executing our strategic vision to become a premier high-growth, low-cost oil producer.”

Gary Hanna, President of Prairie, added, “the addition of the Bayswater Assets further establishes Prairie as a leading operator in the DJ Basin. These assets are a strong complement to our existing portfolio, and we remain focused on maximizing operational efficiencies, optimizing production, and delivering sustainable growth for shareholders.”

Transaction Highlights:

-

Expands Footprint / Inventory Life: Additional 24,000 net acres, adding to approximately 600 highly economic drilling locations and roughly 10 years of drilling inventory.

-

Significantly Increases Free Cash Flow: Expected to be immediately accretive to per-share cash flow metrics.

-

Maintains Strong Balance Sheet: Expected leverage ratio of ~1.0x at closing with upsized credit facility and ample liquidity.

-

Meaningful Infrastructure Synergies: Leverages advantageous takeaway contracts and existing infrastructure to drive operational efficiencies and reduce development costs.

Completed at an attractive valuation, the assets contribute 77.9 million barrels of oil equivalent (MMBOE) in proved reserves with an estimated PV-10 value of $1.1 billion (a non-GAAP financial measure reconciled below), further enhancing the Company’s financial position. With this expansion, Prairie anticipates a substantial uplift in its 2025 production, revenue, and adjusted EBITDA, reinforcing its commitment to delivering long-term shareholder value.