The skyline of SA’s financial capital, Johannesburg. (Westend61/ Getty Images)

While Cape Town residential property prices rose by almost 6% over the past year, Johannesburg prices fell as the city struggled with severe water and electricity problems, a major hike in the municipal rates as well as tumultuous local governance.

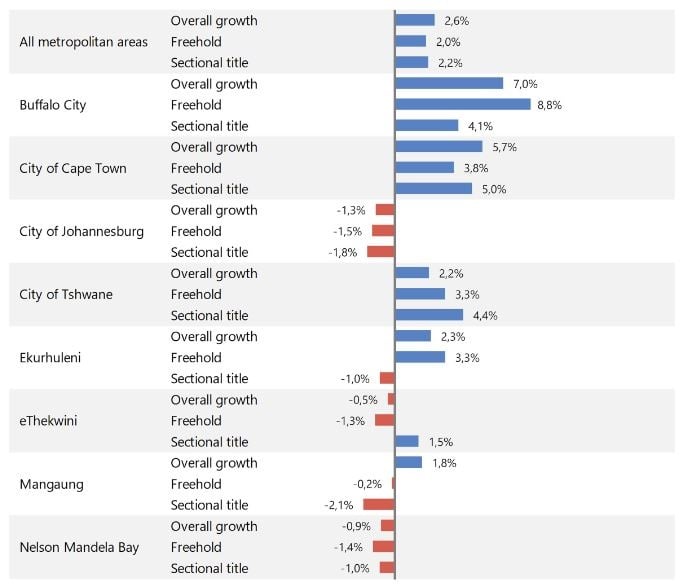

The Statistics SA’s latest Residential Property Price Index shows that prices in the City of Johannesburg (-1.3%), Nelson Mandela Bay Municipality (-0.9%) and eThekwini Municipality (-0.5%) declined over the year to March 2024. The index tracks prices, sourced from the Deeds Office, for houses, townhouses, and flats that are purchased by private individuals.

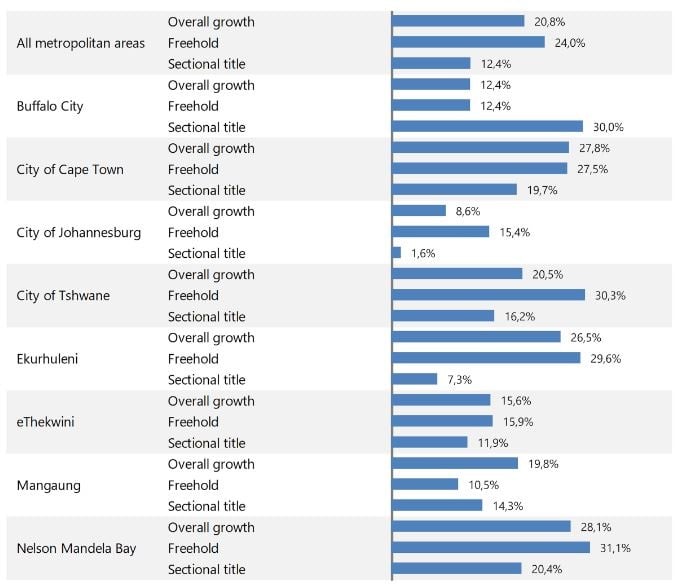

Over the previous five years, Cape Town residential prices rose by 30%, while Johannesburg prices grew only 8.6% – the weakest of all the metropolitan areas.

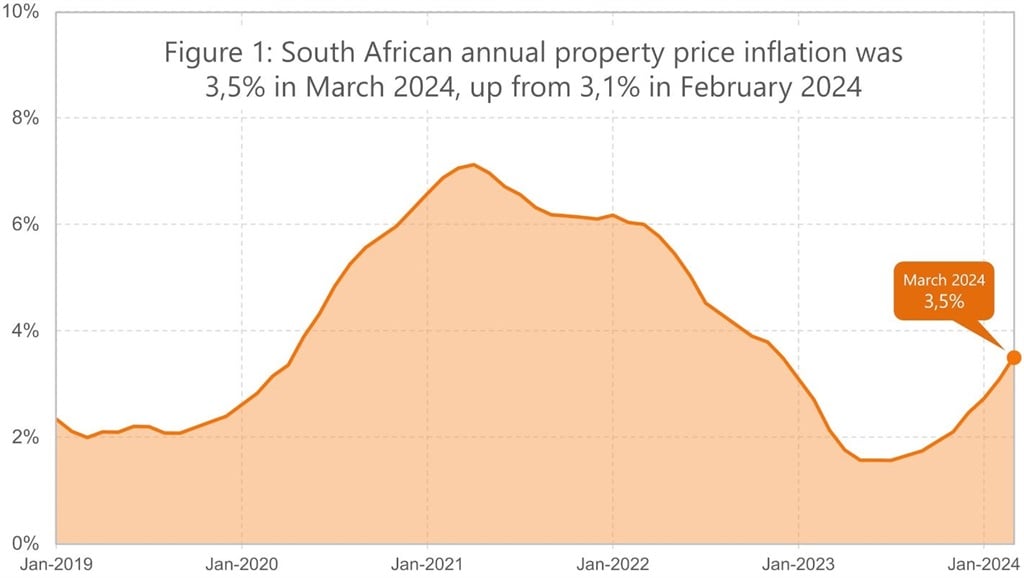

Overall, SA residential prices increased by 3.5% in the 12 months to March 2024, which is an improvement on 3.1% in February 2024. In May 2023, the annual price increase reached a low of 1.6%.

While property prices in the Western Cape (+7.7%) and North West (+5.5%) gained over the year, prices fell in the Northern Cape (-4.8%) and Limpopo (-2.3%). Of SA’s cities, Buffalo City showed the largest price increase (+7.0%).

Since March 2024, when the survey was completed, pressure on property markets may have increased, with an FNB survey of estate agents showing that properties remained on the market for an average of 12 weeks and two days in the second quarter, up from 10 weeks and six days in the first.

Sales due to financial pressures increased to 21% of all sales, the survey showed. Downscaling due to life stage (which includes those moving to retirement homes) accounted for 22%, while semigration remained at 14%. Upgrading to a more expensive home slowed significantly to 11%, FNB reported, while emigration-related sales remained unchanged at 8%.

FNB senior economist Siphamandla Mkhwanazi said that slower price increases and the possibility of interest rate cuts could support the bottoming out of the market.

“Additionally, if the new administration implements pro-growth policies, lower interest rates could further support potential buyers and lead to a revitalised housing market.”