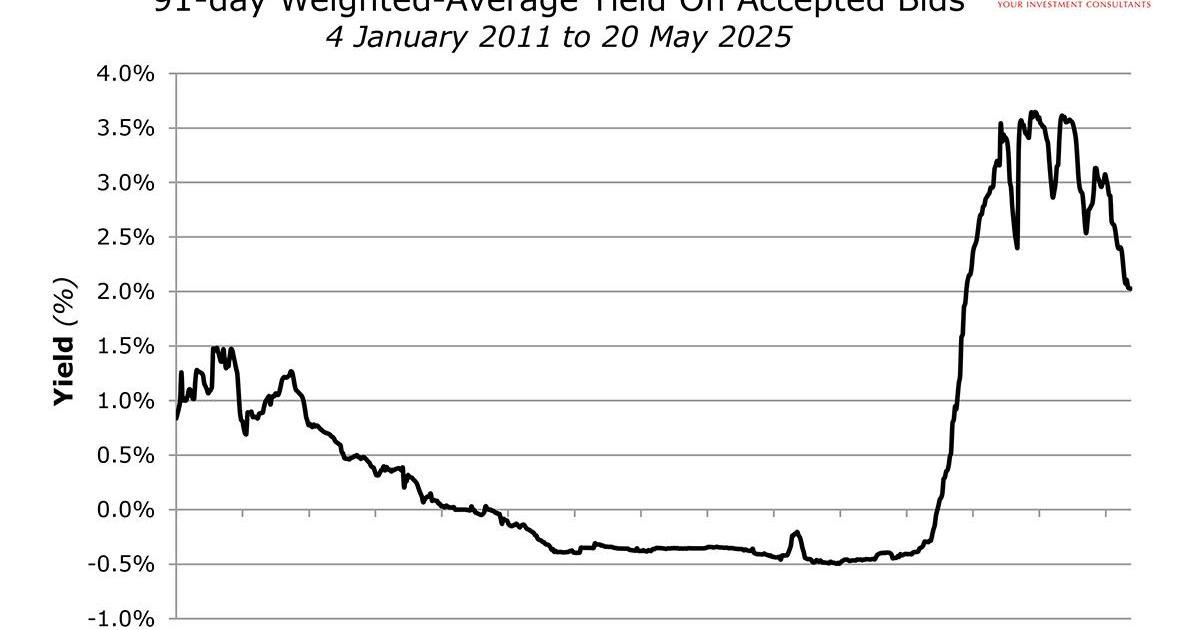

In my weekly media contributions over recent years, on an occasional basis I gave prominence to movements in yields on short-term financial instruments since these gained popularity following the strong upturn in interest rates within the euro area as from the second half of 2022.

In the decade prior to 2022, it was virtually impossible for retail and corporate investors to generate a positive return from idle liquidity held at the bank. Moreover, for a brief period of time, both retail and corporate customers of a number of banks internationally and also locally in a limited manner, were also exposed to the unfortunate reality of negative interest rates.

Essentially, bank charges were levied on retail and corporate deposits in excess of specific amounts typically above a value of €1 million.

It was, therefore, understandable that the gradual and consistent increase in yields on short-term financial instruments, such as Malta Government Treasury bills (T-bills) with a three-month maturity (91 days) or six-month maturity (182 days), became a popular investment option. After a decade of low to negative interest rates, several retail and corporate investors participated regularly in the weekly auctions conducted locally for T-bills every Tuesday morning.

As yields increased by the end of 2022 above the 2% level, participation among the investment community widened considerably and several investors also ventured into the eurozone bond markets, as short-term instruments of sovereign and supra-national issuers also produced a yield that was sufficiently attractive for treasury management purposes especially for investors participating with sizeable amounts.

Apart from local and international marketable securities, the change in the interest rate environment was also evident in the banking system. Several local banks, with the exception of the two largest institutions, widely advertised interest rates on various term deposits.

Once again, certain investors also entertained this traditional investment approach and placed some idle liquidity into these bank deposits. The appetite for these fixed deposits was undoubtedly aided by the deposit guarantee scheme in place.

However, it was also highly evident that while some of these investors participating in short-term instruments (fixed deposits and T-Bills) were truly seeking treasury management options to generate income ahead of other capital commitments, many other investors participated in T-bills and other short-term instruments merely to follow the ‘herd instinct’ and to shift some idle liquidity at the bank into another investment to generate regular income, without keeping in mind their ultimate objective which goes beyond treasury management.

Given the consistent rise in yields in the second half of 2022 and with regular mention in the business media of the of the elevated inflation levels following the supply shock from COVID, as well as the start of the war in Ukraine, it was understandable to favour short-term securities in view of the consensus view that interest rates by the major central banks were to continue to rise during the course of 2023.

Yields on T-bills surpassed the 3% level in the first half of 2023 and maintained this level for most of the time during the next 18 months until the end of 2024. During this period, yields also surpassed the 3.6% level. On certain occasions, there were also times when yields declined briefly due to supply-and-demand dynamics peculiar to the local auctioning system.

However, during the latter part of 2023 and in early 2024, there were clear indications that the deposit rate at the European Central Bank (established at the level of 4% as from September 2023) had peaked in view of the inflation rate easing in various parts of the world. During this period, the participation rate in Malta Government T-bills and other short-term financial instruments remained elevated, although various investors did not specifically need short-term investment options only.

Several investors had failed to consider the reinvestment risk during an eventual declining interest rate environment and continued to favour short-term securities, despite their ultimate objective of generating a steady stream of income for the medium and long-term in order to supplement their pension and other sources of income.

Earlier this year, we had reported on the decline in short-term yields towards the 2.5% level from just over 3% at the start of 2025. The reduction in yields was consistent over recent months with the latest auction for three-month T-bills at the 2% level.

This was not surprising, given the similar decline in reference interest rates across the eurozone and the looser monetary policy adopted by the ECB, as the deposit rate dropped from a high of 4% until June 2024 to the 3% level at the end of 2024 and to 2.25% as from last month.

In recent days, some international economists predicted that the ECB could continue to lower rates in the weeks and months ahead towards the 1.5% level by the end of 2025.

Most of the local banks offering competitive rates on term deposits have also opted to reduce interest rate for customers seeking new fixed deposits. In fact, those customers in receipt of maturing term deposits would immediately realise the difference between the new rates as opposed to those rates prevalent over the past two years when these deposits were widely advertised.

In view of the material decline in rates, it is fair to expect customers to search for alternatives rather than simply placing their liquidity into low-yielding term deposits or leaving too much cash sitting idle in a current or savings account.

In the midst of these evident changes in the interest rate environment, a recent product launch being widely marketed by Malta’s largest bank grabbed the attention of many investors in view of the high interest rate being advertised.

However, upon reading the smaller text quoting the annualised return equating to just above 2% per annum, one realises that this rate is identical to the recent yields on local and international short-term financial instruments.

While short-term yields have been declining, those of medium- to long-term investments have been edging higher. This change in the structure of the yield curve presents opportunities to those investors whose investment objectives are not solely focused on treasury management but need to cater for ongoing investment income in the years to come.

In this respect, it would be important to gauge the appetite for the upcoming bond issue by Bank of Valletta plc, together with other corporate bonds in the pipeline.

Internationally, there are also multiple options for investors even in renowned US-based companies issuing bonds in EUR, with the added benefit of the significant depth in the market providing a very simple entry and exit route for investors throughout the term of the bond. This has become increasingly important for several investors. Unfortunately, securities listed on the Malta Stock Exchange can never provide this level of liquidity.

Rizzo, Farrugia & Co. (Stockbrokers) Ltd, ‘Rizzo Farrugia’, is a member of the Malta Stock Exchange and licensed by the Malta Financial Services Authority. This report has been prepared in accordance with legal requirements. It has not been disclosed to the company/s herein mentioned before its publication. It is based on public information only and is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. The author and other relevant persons may not trade in the securities to which this report relates (other than executing unsolicited client orders) until such time as the recipients of this report have had a reasonable opportunity to act thereon. Rizzo Farrugia, its directors, the author of this report, other employees or Rizzo Farrugia on behalf of its clients, have holdings in the securities herein mentioned and may at any time make purchases and/or sales in them as principal or agent, and may also have other business relationships with the company/s. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Neither Rizzo Farrugia, nor any of its directors or employees accept any liability for any loss or damage arising out of the use of all or any part thereof and no representation or warranty is provided in respect of the reliability of the information contained in this report.

© 2025 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved.