[SYDNEY, Australia] Centurion Corporation has unveiled a premium brand for its latest purpose-built student accommodation (PBSA) property in Macquarie Park in Sydney.

The rates at facilities in the Epiisod stable are likely to be higher than those for Centurion’s current Dwell brand, which is targeted at the more budget-conscious market.

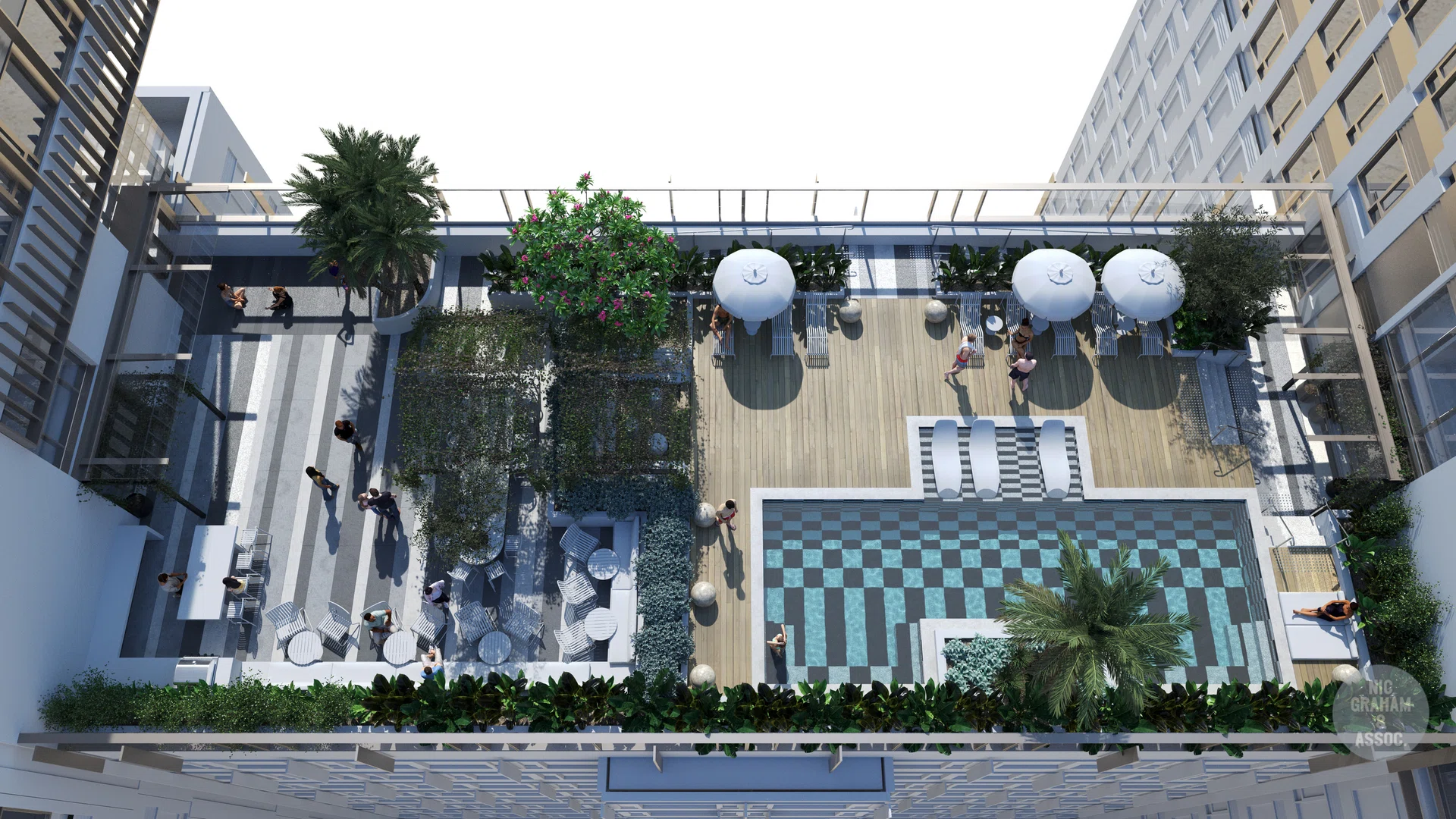

The Macquarie Park property, for example, has amenities such as a rooftop infinity pool, wellness centre with sauna, ice pool and yoga facilities. It will have more than 700 beds in either studio apartments or cluster apartment formats, with shared communal spaces, including kitchen space.

David Loh, executive director and joint chairman of Centurion, said at the launch event: “Students need more than just a bed and a desk. They need space that inspires creativity, common areas that encourage collaboration, wellness facilities that support their physical and mental health, and technological infrastructure that keep them connected.”

Epiisod will target a more adult audience among the student population, said Kong Chee Ming, chief executive of Centurion.

Epiisod’s rental reversions are likely to be higher than those at Dwell in absolute terms, but Kong noted that they would remain within the market range of 3 to 6 per cent.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Plans have been drawn up for another four Epiisod properties in Australia – two in Melbourne and another two in Perth; the ones in Perth will be developed as a joint venture between the parent company Centurion Properties and Centurion Corp.

Centurion Corp is launching the Centurion Accommodation Reit without the full complement of Epiisod properties for a start because of limitations in taking in development projects.

“We select the assets based on the merits of what is suitable for the Reit,” said Kong.

Epiisod is just starting out, and so will not be injected into the Reit just yet; Centurion will look into stabilising the properties before offering them to the Reit.

Centurion assets that are not slated to be injected into the Reit are those in which the sponsor does not own the land rights, or those that are operating under special conditions, such as its ASPRI-Westlite Papan facility in Jurong, which houses workers in the process, construction and maintenance industries.

Centurion’s purpose-built worker accommodation (PBWA) assets across Malaysia are also not going to be injected into the Reit in the face of investors’ concerns over exposure to Malaysia.

The portfolio mix for PBSA in the Reit will still predominantly be under the Dwell brand, which has over 3,700 beds.

The company is taking on more planning risks in Australia, for example with the Epiisod-branded Mckenzie property in Melbourne. Centurion plans to do more of this in Australia, said Kong.

Finding the right location and site for purpose-built accommodations – be they for students or workers – is not easy, and regulatory risks need to be navigated. Kong cited a project for a PBWA property for miners in Port Hedland in Western Australia; the land was purchased, and the project seemed to be on track – only to be vetoed by a higher authority on the back of concerns over the dust from mining.

“Planning risk is real. Learning from that, we track carefully. If there are such issues, we tread a bit more carefully in where we put our money,” he said.

Kong said Centurion’s PBWA asset partners took a bit of convincing to agree to inject their assets into the Reit. However, he added that even if they refused, Centurion has the flexibility to continue operating the asset.

“Most of the JV partners would like to have an exit strategy for any real estate,” he said.

With the Reit in play eventually, Centurion hopes to speed up its growth through capital recycling via divestment of suitable properties to the Reit, which would boost the growth of its assets under management.

“We are divesting to a Reit we control, and will be able to offload when we do development. This will scale up our growth,” said Kong.