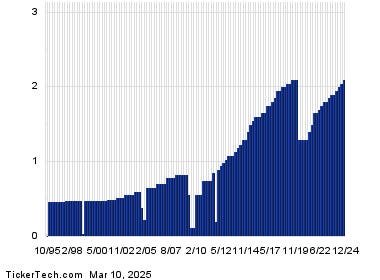

What is Celanese Cash, Cash Equivalents, Marketable Securities?

Celanese‘s quarterly cash, cash equivalents, marketable securities

declined

from Dec. 2023 ($1,805.00 Mil) to Mar. 2024 ($1,483.00 Mil) but then

stayed the same

from Mar. 2024 ($1,483.00 Mil) to Jun. 2024 ($1,185.00 Mil).

Celanese‘s annual cash, cash equivalents, marketable securities

increased

from Dec. 2021 ($536.00 Mil) to Dec. 2022 ($1,508.00 Mil) and

increased

from Dec. 2022 ($1,508.00 Mil) to Dec. 2023 ($1,805.00 Mil).

Celanese Cash, Cash Equivalents, Marketable Securities Historical Data

The historical data trend for Celanese‘s Cash, Cash Equivalents, Marketable Securities can be seen below:

* For Operating Data section: All numbers are indicated by the unit behind each term and all currency related amount are in USD.

* For other sections: All numbers are in millions except for per share data, ratio, and percentage. All currency related amount are indicated in the company’s associated stock exchange currency.

Celanese Cash, Cash Equivalents, Marketable Securities Chart

Celanese Cash, Cash Equivalents, Marketable Securities Calculation

Cash and cash equivalents are the most liquid assets on the balance sheet. Cash equivalents are assets that are readily convertible into cash, such as money market holdings, short-term government bonds or Treasury bills, marketable securities and commercial paper.

Marketable Securities are very liquid securities that can be converted into cash quickly at a reasonable price.

Marketable securities are very liquid as they tend to have maturities of less than one year. Furthermore, the rate at which these securities can be bought or sold has little effect on their prices.

A high number means either:

1) The company has competitive advantage generating lots of cash

2) Just sold a business or bonds (not necessarily good)

A low stockpile of cash usually means poor to mediocre economics.

There are 3 ways to create large cash reserve.

1) Sell new bonds or equity to public

2) Sell business or asset

3) It has an ongoing business generating more cash than it burns (usually means durable competitive advantage)

When a company is suffering a short term problem, Buffett looks at cash or marketable securities to see whether it has the financial strength to ride it out.

Important: Lots of cash and marketable securities + little debt = good chance that the business will sail on through tough times.

Test to see what is creating cash by looking at past 7 yrs of balance sheets. This will reveal how the cash was created.

Celanese Cash, Cash Equivalents, Marketable Securities Related Terms

Thank you for viewing the detailed overview of Celanese’s Cash, Cash Equivalents, Marketable Securities provided by GuruFocus.com. Please click on the following links to see related term pages.

Celanese Business Description

Traded in Other Exchanges

Address

222 W. Las Colinas Boulevard, Suite 900N, Irving, TX, USA, 75039-5421

Celanese is one of the world’s largest producers of acetic acid and its downstream derivative chemicals, which are used in various end markets, including coatings and adhesives. The company is also one of the largest producers of specialty polymers, which are used in the automotive, electronics, medical, building, and consumer end markets. The company also makes cellulose derivatives used in cigarette filters.

Executives

| Thomas Francis Kelly | officer: SVP, EM | 222 W LAS COLINAS BLVD, SUITE 900N, IRVING TX 75039 |

| Mark Christopher Murray | officer: VP – Bus. Strat & Development | 100 MATSONFORD ROAD, RADNOR PA 19087 |

| Aaron M Mcgilvray | officer: Chief Accounting Officer | 222 W. LAS COLINAS BLVD, SUITE 900N, IRVING TX 75039 |

| Rahul Ghai | director | GENERAL ELECTRIC COMPANY, 5 NECCO STREET, BOSTON MA 02210 |

| Michael Koenig | director | 222 W. LAS COLINAS BLVD., SUITE 900N, IRVING TX 75039 |

| Vanessa Dupuis | officer: SVP, HR (CHRO) | C/O CELANESE CORPORATION, 222 W LAS COLINAS BLVD, SUITE 900N, IRVING TX 75039 |

| Scott A Richardson | officer: SVP & CFO | C/O CELANESE CORPORATION, 222 W LAS COLINAS BLVD, SUITE 900N, IRVING TX 75039 |

| John K Wulff | director | C/O HERCULES INC, 1313 NORTH MARKET STREET, WILMINGTON DE 19894-0001 |

| Deborah J. Kissire | director | 210 E. EARLL DRIVE, PHOENIX AZ 85012 |

| John G Fotheringham | officer: SVP, Acetyl Chain | 222 W LAS COLINAS BLVD, SUITE 900N, IRVING TX 75039 |

| Lori Ryerkerk | director, officer: CEO | AXALTA COATING SYSTEMS LTD., 2001 MARKET STREET, SUITE 3600, PHILADELPHIA PA 19103 |

| Todd L Elliott | officer: SVP, Acetyl Chain | C/O CELANESE CORPORATION, 222 W LAS COLINAS BLVD, SUITE 900N, IRVING TX 75039 |

| A. Lynne Puckett | officer: SVP & GC | C/O 222 W LAS COLINAS BLVD, SUITE 900N, IRVING TX 75039 |

| Rucker Kim K.w. | director | KRAFT FOODS GROUP, INC., THREE LAKES DRIVE, NORTHFIELD IL 60093 |

| Peter G Edwards | officer: EVP & GC | C/O BAXALTA INCORPORATED, 1200 LAKESIDE DRIVE, BANNOCKBURN IL 60015 |