The U.S. government is barreling toward its fourth shutdown in 10 years if Congress can’t agree to pass a spending bill that keeps it funded. The continuing resolution that Congress enacted to keep the government funded expires this Friday, leaving lawmakers with little time to meet the deadline.

During past shutdowns, federal employees have either been furloughed or had to work without pay; national parks and museums have temporarily closed; and some government functions, like data collection, have come to a halt.

The upheaval during these shutdowns has left many concerned about what services will be available in the event of a shutdown this time around. While some will get disrupted, operations will continue as normal for some agencies. You can still expect Social Security payments to come, you will still receive mail from the U.S. Postal Service, and you can still purchase securities from TreasuryDirect, which is run by the U.S. Treasury’s Bureau of the Fiscal Service.

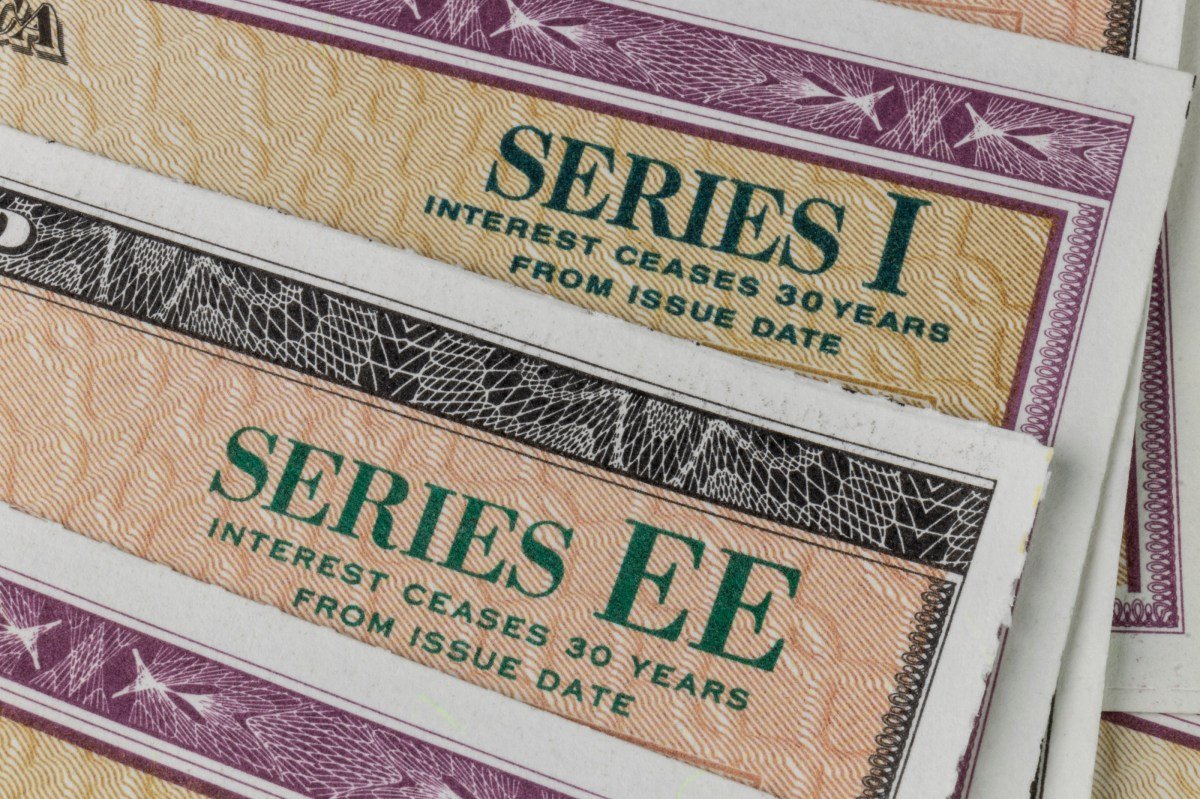

Through TreasuryDirect, you can buy Treasury marketable securities, such as notes, bills and bonds, along with non-marketable securities, which include Series EE Savings Bonds and Series I Savings Bonds. While you can buy marketable securities from other brokerage firms, you can only electronically buy EE and I bonds from TreasuryDirect. Both of these savings bonds are considered low-risk and reach maturity after 30 years.

Marketplace got confirmation from the U.S. Treasury’s Bureau of the Fiscal Service back in October, when a rep told us that “TreasuryDirect will still be operational in the event of a partial or full government shutdown.”

That not only means you can access the site to buy securities, but if you call, its representatives will still be working to address any issues with your account, such as getting locked out.

Matt Garber, the chief customer officer for the Bureau of the Fiscal Service, told us last month that wait times are now under a minute, so if you need to reset your account, you should still expect that same quick service.

EE bonds offer a fixed interest rate for the first 20 years, but that rate could change for the final 10 years. The TreasuryDirect website states that your EE bond at 20 years is guaranteed to “be double what you paid for it.” On the other hand, the earnings on I bonds are based on a fixed rate and an inflation rate that gets calculated every six months. TreasuryDirect states that the interest rate on these bonds “will never fall below zero.”

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.