Matteo Colombo

Investment Update

Brookdale Senior Living, Inc. (NYSE:NYSE:BKD) operates a network of 652 senior living communities spread across 41 states. The company provides senior and aged care residential services to ~59,000 residents.

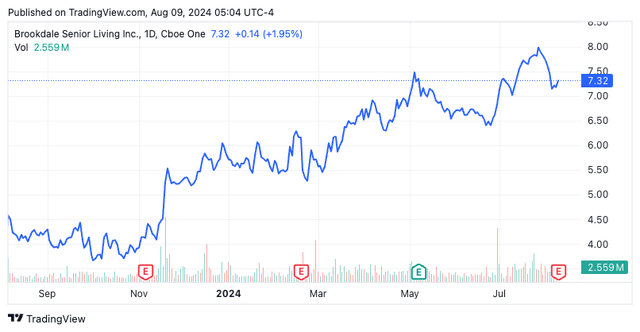

Since my last publication on BKD in August last year, the stock has rallied 74% to the upside. I reiterated the business hold then based on numerous factors, namely:

- The economic realities of the company’s growth weren’t investment-grade in my view.

- It is a capital-intensive, profit-light business producing anaemic returns on the capital that’s been invested into it to operate.

- FCFs routinely negative (which is fine in a high ROIC business) but funds are being deployed back into an enterprise earning ~4-5% on every $1 recycled.

- Valuations unsupportive with the company valued >2x capital at the time which in my view was unsustainable.

Following its Q2 ’24 numbers overnight my views on the investment prospects of the company remain unchanged. I continue to rate the stock a hold on 1) fundamentals, 2) quality being low [low ROICs + profitability], and 3) valuations. My view is the business is worth ~$11–$15/share today, supporting a hold.

This is a name I have covered extensively here on SA. See my earlier publications here, here.

Figure 1.

Q2 earnings insights

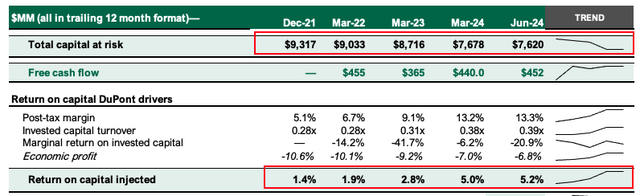

It was another period of top-line growth for the business in Q2 with resident fees +420bps YoY to $740mm, on cash OpEx of $64mm and total OpEx of $537mm (+120bps YoY). Fees were higher YoY as revenue per occupied room (“RevPOR”) was +430bps YoY to ~$6,200, but were down sequentially.

Additional takeouts from the quarter include the following:

- Revenue per available room (RevPAR) was +6.4% to $4,800 – driven by annual in-place rate increases it put in place this year. Occupancy rates (discussed below) were also higher, contributing to the growth.

- Same-community weighted average occupancy for Q2 2024 was +160bps YoY to 78.1% – this continues the uptrend observed in prior quarters. But, as with resident fees + RevPOR, it was 20bps lower sequentially due to mix shifts. This resulted in lower occupancy rates and RevPAR vs. Q1 ’24.

- Same-community operating margins decompressed 160bps YoY, underlined by the ~6% growth in revenue and a moderate 3.6% growth in facility operating expenses.

- Management now guides RevPAR growth of ~6.75% at the upper end of range and sees adj. EBITDA of ~$95mm on this. This excludes ~$180mm of CapEX. Consensus sees ~4-5% CAGR in sales by FY’26E with ~20% earnings growth. This appears fair in my view given 1) recovery to pre-Covid revenue growth, 2) the fact it’s sorted the Omega Healthcare saga [discussed below] and 3) that management doesn’t really have an extensive runway to redeploy capital at high rates of return, so I’m not expecting anything above long-term growth rates.

Figure 2.

Company filings

- The amended master lease with Omega Healthcare Investors (covering 24 communities) provides up to $80mm in funding for CapEx through 2037. I had viewed this as a major drag on stock performance in prior analyses. Whilst I’m acutely aware the capital restructuring is more or less resolved, it doesn’t change my economic view of the company.

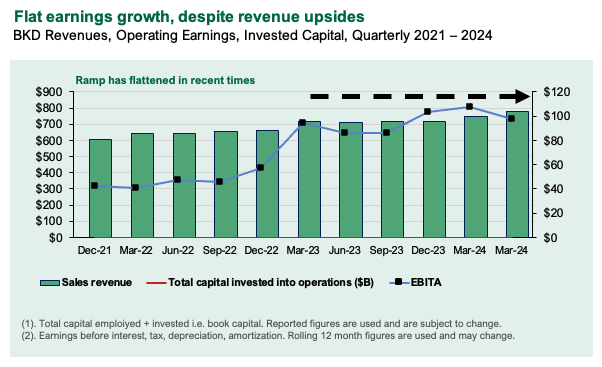

- Despite recent sales upsides, quarterly operating earnings aren’t exhibiting upsides when adjusted for maintenance CapEx (approximated at the level of depreciation). Pre-tax earnings peaked in Q1 ’23 (Figure 3) and have rotated around this mark since. My view is this trend is likely to consider as management continues to shed capital from the asset base.

Figure 3.

Company filings

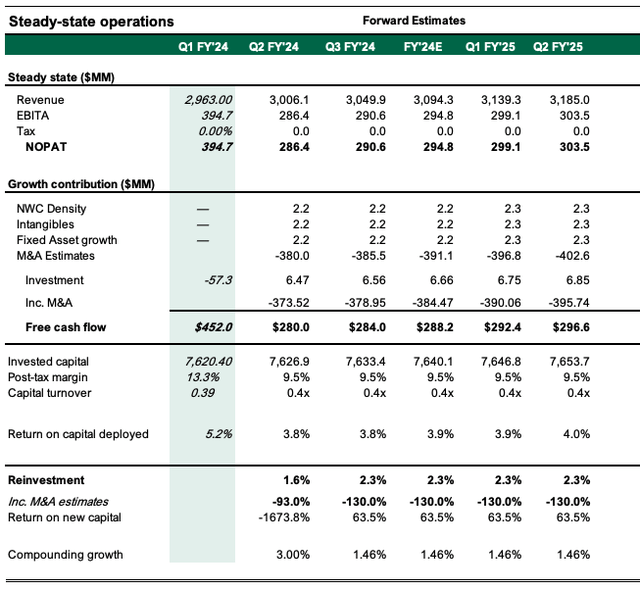

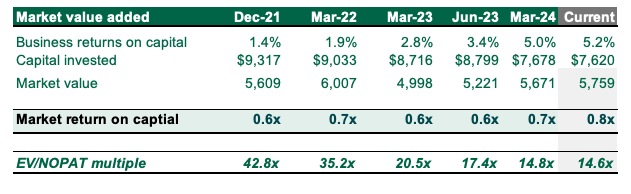

- In fact it has shed ~$1.7Bn from the business since FY’21 and this has lifted earnings on that capital to a rate of 5.2% vs. 1.4% back then. Thing is, even with the sharp contraction in capital intensity (capital turns are now 0.4x vs. 0.3x), and more profit (post-tax margins are +800bps), this has only produced ~5% ROICs (Figure 4).

- The fact of the matter is though that management has not made any new investments into the business over this entire testing period, Q2 included. In the 12 months leading up to the second quarter, management divested around $58 million. Even though profit grew $12 million over this period, the returns on the base were still <10% as mentioned, and this does not align with our investment tenets. Especially in a highly competitive industry, and offering commodity-like economics. The fact is that aged care and community living are somewhat of a commodity type of service. Margins are tremendously low given this competitiveness, and it is often a race to the bottom on fees versus services provided. Then you have large national operators that consolidate operating expenses such that returns are a function of capital employed.

- Moreover, for a business with this much tangible operating capital I would expect far higher capital turnover on this. BKD is producing <$1 in revenues for every dollar of investor capital that has been put into the business (including retained earnings). As such it is not pulling its economic weight – especially the fact that these assets must be eventually “replaced” at today’s, highly inflated dollars. Whilst the business does have an accelerated depreciation schedule, creating a charge against earnings and providing a tax benefit, these depreciation charges also approximate maintenance capital expenditures.

- In my view, these expenditures are likely to increase over the next decade as 1) the cost of capital is now higher, 2) capital is now less abundant, and 3) to achieve a proper recovery of your underlying asset, including capital and return and capital, the benchmark is now far higher than it was over the past decade. Sure, embedded expectations are low. However, the quality factor of the business is not present and this is a mitigating factor to rating it a buy.

Figure 4.

Trading below invested capital, not a statistical discount

The business is priced at a discount to sector peers at 0.5x sales, but BKD is valued correctly below 1x EV/IC in my opinion given the fact that produces such slack returns on its operating capital (Figure 5). A business should trade at a premium to capital if it is producing returns greater than what investors could reasonably expect to achieve elsewhere. This is not the case here, and the Market has got it right in my view. Moreover, this is not a statistical discount in my opinion given the low quality factor. As such, there is risk that we are paying less than 100 cents on the dollar for assets that are worth less than 100 cents on the dollar in the market.

Figure 5.

Company filings, author

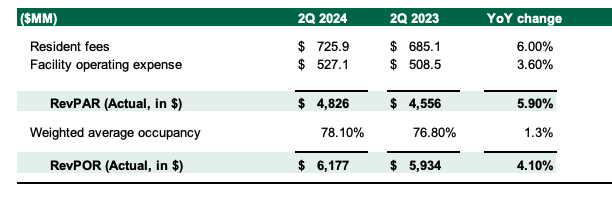

Valuation insights

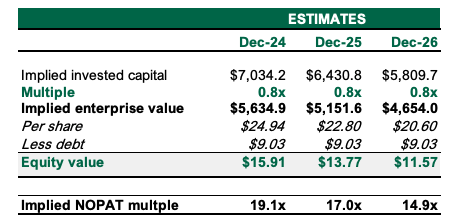

- I have updated my modelling to reflect the company’s latest numbers and projections. There has not been much of a change as the second-quarter results were largely in line with expectations. In my forward estimates (see: Appendix 1) I have the business reinvesting around 5 to 10% of post-tax earnings each 12 months, producing similar levels of returns on these incremental investments as it has been in the past (around 5%). At the current 0.8x multiple, this gets me to a valuation of $16 per share, fading down to $11.50 per share by FY 26. Critically, my estimates on valuation multiples also fade down to 15x which is a risk in the valuation calculus in my view.

- The other thing is in creating scenarios for the distribution of valuation outcomes, a tremendously high hurdle must be to corroborate a buy rating. For instance, my business must grow sales at 10% annually on pre-tax margins of more than 12%, turning over capital more than 1x every period. This would see it produce returns in capital above 11 to 12%, our threshold margin. However, it is difficult to see BKD achieving this any time soon therefore my opinion is that this is not a statistical discount and that we must look for more selective opportunities in this current climate.

Figure 6.

Author’s estimates

Risks to investment thesis

The major upside risk to the thesis is if management start producing sales growth greater than six or 7%. This could add a tailwind to the valuation and see investors pay a higher multiple. Further if it does reduce asset size more, and continues growing earnings, then business returns may increase as well. This would add a few points to my evaluation and could see it trade justifiably above $18 per share.

On the downside, the risk is in a further degradation of the business returns below 5%. This would occur with a major clamp on sales and or profitability. I give this a 30% probability given the current circumstances whereby capital is not as abundant and is more costly.

Investors must recognize these risks in full before proceeding.

In short

BKD remains a hold in my opinion given the fact there has been little to no change in the fundamental economics of the business after its Q2 numbers. This is still a low-margin, low capital turnover enterprise, producing slack returns on all the capital that has been put into its operations – of which, there is plenty. Whilst management has been shedding capital from the asset base in recent years, this has not resulted in a corresponding uptick in profitability beyond levels investors could reasonably achieve themselves elsewhere. As such, there is an economic opportunity cost for holding this name in my firm opinion, and we are guided to more selective opportunities elsewhere. Net net, reiterate hold.

Appendix 1.