Pebblebrook Hotel Trust is suing the city of San Francisco in the hopes of securing tax refunds amid declining property values downtown.

The hotel investor claims in its lawsuit that the city applied faulty calculations that ended up taxing “intangible assets” like the value of the hotels’ workforce, parking and laundry services or management agreements between hotel owners and operators, the San Francisco Chronicle reported.

By using these “erroneous, invalid and illegal assessment methodologies,” the city allegedly overestimated the fair market values of four hotels in the Union Square and South of Market neighborhoods that Pebblebrook acquired in a merger with LaSalle Hotel Properties.

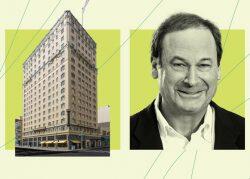

The Bethesda, Maryland-based investor is looking for a refund of “any and all” taxes paid based on the original assessments of the properties. The hotels in question include the 189-room Villa Florence at 201 Powell Street; The Marker, a 208-room hotel at 501 Geary Street; the 236-room Hotel Spero at 401 Taylor Street; and the 200-room Hotel Vitale at 8 Mission Street.

Pebblebrook’s attorney Colin Fraser pointed out that intangible assets are generally exempt under California law, citing legal precedents.

“When you have a hotel, obviously there’s the property, but there’s also a going-concern business operating there, and the trick is identifying and assessing the property and excluding from assessment the value of those intangible assets,” Fraser told the Chronicle.

“California courts have reached a conclusion many times that it’s not real property — it’s an intangible asset. You have to exclude it from the assessment,” he added. “This is not a novel case. We are just trying to apply established law to our case.”

In the case of The Marker hotel, Pebblebrook paid $85.5 million for the Union Square property in 2018 and sold it for $77 million in 2022. But during that time, it paid taxes based on the city’s assessment of the hotel’s “fair market value,” placed at $133.7 million.

Pebblebrook sold three of the four hotels in question to new owners in the years following the LaSalle merger. The sale prices highlighted a significant discrepancy with the city’s assessed market values, with differences ranging between $42.5 million and $72.5 million.

The firm is seeking tens of millions of dollars in tax refunds to make up for overpaying in the years it owned the properties.

“There are several years here where they were paying taxes on these very high values, and they’d like to get a refund once they can establish that the assessed values are incorrect because they include intangible assets and were determined using illegal methodologies,” Fraser said.

— Chris Malone Méndez

Read more

Pebblebrook nabs $140M refi for Jimmy Buffett-inspired Margaritaville resort in Hollywood

Pebblebrook appears poised to sell two more San Francisco hotels

Pebblebrook hotel selloff in SF continues with Hotel Spero