It was 2011, and just a few years into the smartphone wars, Apple sued Samsung for allegedly infringing its design patents. While this was not the first major patent battle in tech, the case is remarkable for one particular design patent owned by Apple: a rectangular cuboid with rounded corners.

Essentially, Apple claimed that Samsung violated its patents by producing a smartphone in the shape that everyone is now familiar with. It seemed almost hilarious at the time that Apple could patent something as essential as the rectangle.

Seven years and countless court hours later, Apple and Samsung settled this dispute. But patent disputes seem to come up every time there’s a new mobile device category enjoying an inflection point.

Take the case of Bengaluru-based healthtech startup Ultrahuman

Founded in 2019, just as that Apple-Samsung battle was winding down, Ultrahuman rapidly scaled itself into a global brand on the back of smart rings, health sensors, and a vision of quantifying human wellbeing and physiology.

The company rapidly gained market share in the US, soon after launching its products, but not everyone was happy. In particular, Finnish-American electronics company Oura claimed Ultrahuman had violated its design patents for smart rings.

In fact, Oura won a preliminary ruling in the US International Trade Commission (ITC) case against Ultrahuman. While the decision is not final, the presiding ITC judge found that Ultrahuman’s Ring Air violated several of Oura’s design and utility patents.

The ruling also noted that Ultrahuman presented questionable evidence about its manufacturing capacity in the US. If the company is unable to get the ITC to reverse its preliminary determination, Ultrahuman would be banned from importing its smart ring into the US market.

Being the company’s largest market, the US is a key battleground between Ultrahuman and Oura. Even as giants such as Samsung have ventured into the smart ring category, the Ultrahuman-Oura case might determine the fate of one of the most promising healthtech companies to emerge out of India.

Where does this leave Ultrahuman and what recourse does the company have to solve this stalemate? Will the startup go back to the design table or does it have enough substance to defend its position against Oura? Let’s take a look.

The Early Ultrahuman Days

Ultrahuman was founded by former Zomato execs Mohit Kumar and Vatsal Singhal, who were inspired by sensors used by athletes to monitor various stats and improve performance.

The duo believed that such sensors, if utilised well, could revamp the workout paradigms for ordinary individuals and empower them with the data that athletes leverage.

The company’s first product was a subscription-based fitness app offering workouts, meditation, sleep aid, and sound therapy. Ultrahuman teamed up with top athletes, coaches, and musicians to create high-quality content that catered to these use cases, besides leveraging smartphone sensors.

Ultrahuman’s early days were all about using content to guide wellness, building a loyal community. The startup built a community called ‘The Cyborg Army’, where users participated in discussions about health, nutrition, and product feedback.

Starting in 2022, Ultrahuman began making moves into dedicated fitness hardware. In April that year, the company acquired LazyCo, a startup that made smart rings, including one called Aina.

And in just over a year, the company released its smart ring called the Ultrahuman Ring Air. The product was well received and even won a Red Dot design award in Berlin.

But Oura was already the leading player in the smart ring space then, having launched in 2015. Naturally, the Ring Air drew immediate comparisons with the Oura Ring, both in online reviews and user conversations.

Between 2023 and 2024, this rivalry grew stronger as both brands released new features and updates, with tech reviewers often doing side-by-side comparisons. These reviews focused on things like design, battery life, health tracking accuracy, and user experience.

By 2025, this head-to-head battle between Oura and Ultrahuman had become a defining part of the smart ring market.

Ultrahuman was being seen as a serious challenger to Oura’s long-held lead, and that’s where the patent battle broke out.

Putting A Ring On It

The case between the two wearables companies centres on a US patent granted to Oura in January 2024. The patent covers specific design and technical features used in smart rings, including how the battery and electronics are arranged, the shape of the battery, built-in health sensors, and the materials used.

Oura claims Ultrahuman’s Ring Air uses all of these elements without any modification. It also says that former employees and investors of Oura leaked confidential information to Ultrahuman in 2021.

Through its case, Oura is asking for a US ban on importing and selling Ultrahuman’s product. It also wants the ITC to take action under trade law and is seeking compensation for copying its product design. Oura says the lawsuit is about protecting genuine innovation, not blocking competition.

However, in conversations with Inc42, Ultrahuman cofounder Mohit Kumar denied these claims. He claimed Oura didn’t invent the patented features but bought them from another company.

The other allegation against Ultrahuman is that it misrepresented its ability to manufacture in the US. Since the case revolves around imports of infringing products into the US, Ultrahuman is banking on the fact that it has manufacturing facilities in the US to skirt around any potential import ban.

However, in its case, Oura claims Ultrahuman misstated the extent to which it can manufacture in the US. In particular, the allegation is that Ultrahuman misled investigators and authorities by passing off an assembly partner as its manufacturing unit.

Defending his company’s position, Kumar told Inc42 that Ultrahuman has a manufacturing facility in Texas, which would mitigate any potential US import ban if the ITC rules against the company.

When asked if the cofounder and CEO is also working on an updated version of the smart ring, he told Inc42 that at Ultrahuman is “there is innovation happening all the time”.

However, it’s not clear if Ultrahuman is working on a design revision for the Ring Air, or a new product.

Ultrahuman argues that Oura is trying to shut down its main competitor through a frivolous patent lawsuit, primarily because Ultrahuman offers a cheaper, subscription-free smart ring alternative.

Ultrahuman and Oura’s rings are priced quite similarly at first glance, but their long-term costs and access to features are very different. Both start at $349 (INR 30,000) in the US, though Oura’s higher-end models can go up to $499, while Ultrahuman sells all its rings at the same price.

Even though Kumar told Inc42 that Ultrahuman is considering a subscription service, he sees higher potential in a software-driven revenue model.

Ultrahuman also offers luxury models made of 18K gold or platinum, priced as high as $2,200, but these also come with lifetime access to all features. Oura’s only luxury offering is a limited-edition Gucci ring at $949, and even that requires an additional subscription to unlock full functionality.

So there’s some merit in what Kumar claims. Ultrahuman does seem to be more affordable for users who want complete health insights without paying a subscription fee.

The Hurdle In Ultrahuman’s Way

As of April 2025, Ultrahuman and another company, RingConn, are potentially looking at an import ban in the US. The ITC judge also said that some of Ultrahuman’s documents were false and unreliable.

According to a person familiar with the matter and the US patents ecosystem, based on current evidence, Oura appears to have the stronger legal position. “The patent is valid, even though it was bought. The ITC found full infringement and said Ultrahuman’s defence was not credible. Ultrahuman could lose access to the US market, and its plan to shift production to Texas has not been proven. Its argument about fair competition is unlikely to carry much weight in court,” the person told us.

The final ruling is expected in November 2025, and could impact Ultrahuman’s US business. But Kumar is confident of the merits of his company’s case. Taking a critical view of Oura’s actions, he described the case as “litigation by acquisition”, adding that Samsung has also filed a challenge to invalidate the concerning patent held by Oura.

“If the patent gets invalidated, then also there’s no import issue and if Ultrahuman loses, the ITC can only ban imports, not locally manufactured goods,” said Kumar. The Texas facility exists, in part, for this scenario.

However, sources close to Oura dispute this claim. The petitioning company claimed Ultrahuman’s Texas unit’s current output is not enough to justify Ultrahuman’s claims of manufacturing in the US. Oura insiders believe this is possibly a move designed to create legal insulation.

Kumar denied this, claiming capacity utilisation is already high, and demand consistently outpaces supply.

“Everything we produce gets shipped in 10 days,” he said, adding that the ruling is due in November 2025 by which time this import question might be moot.

Notably, Ultrahuman owns and operates a facility in Bengaluru capable of producing 1.2 Lakh units per month at peak. A second facility in Texas, run with an EMS Partners, is smaller and makes about 18,000 units per month at peak capacity.

This is sufficient for the US needs, Kumar claimed, adding that the company is earning 50% of its revenue from the US market, hinting that most of its products sold in the US are being imported from the Bengaluru facility.

Not to mention that one of the documents that the court found unreliable was the evidence of a US factory where Ultrahuman photoshopped its logo on the EMS Partners’ building.

Nonetheless, Kumar says that the Ultrahuman Ring Air will end up proving 15% costlier if it was completely manufactured in Texas.

What’s The Next Big Thing?

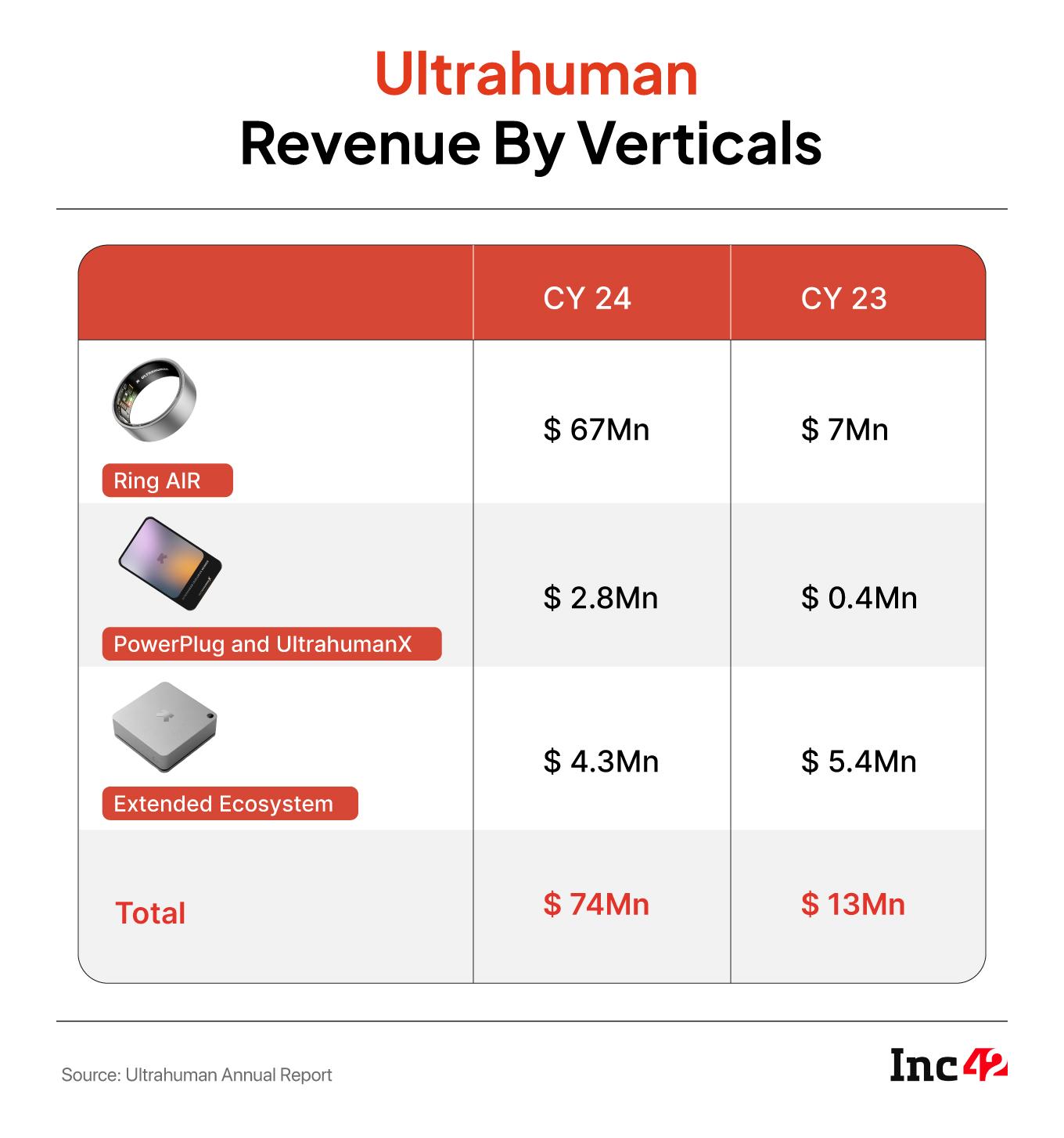

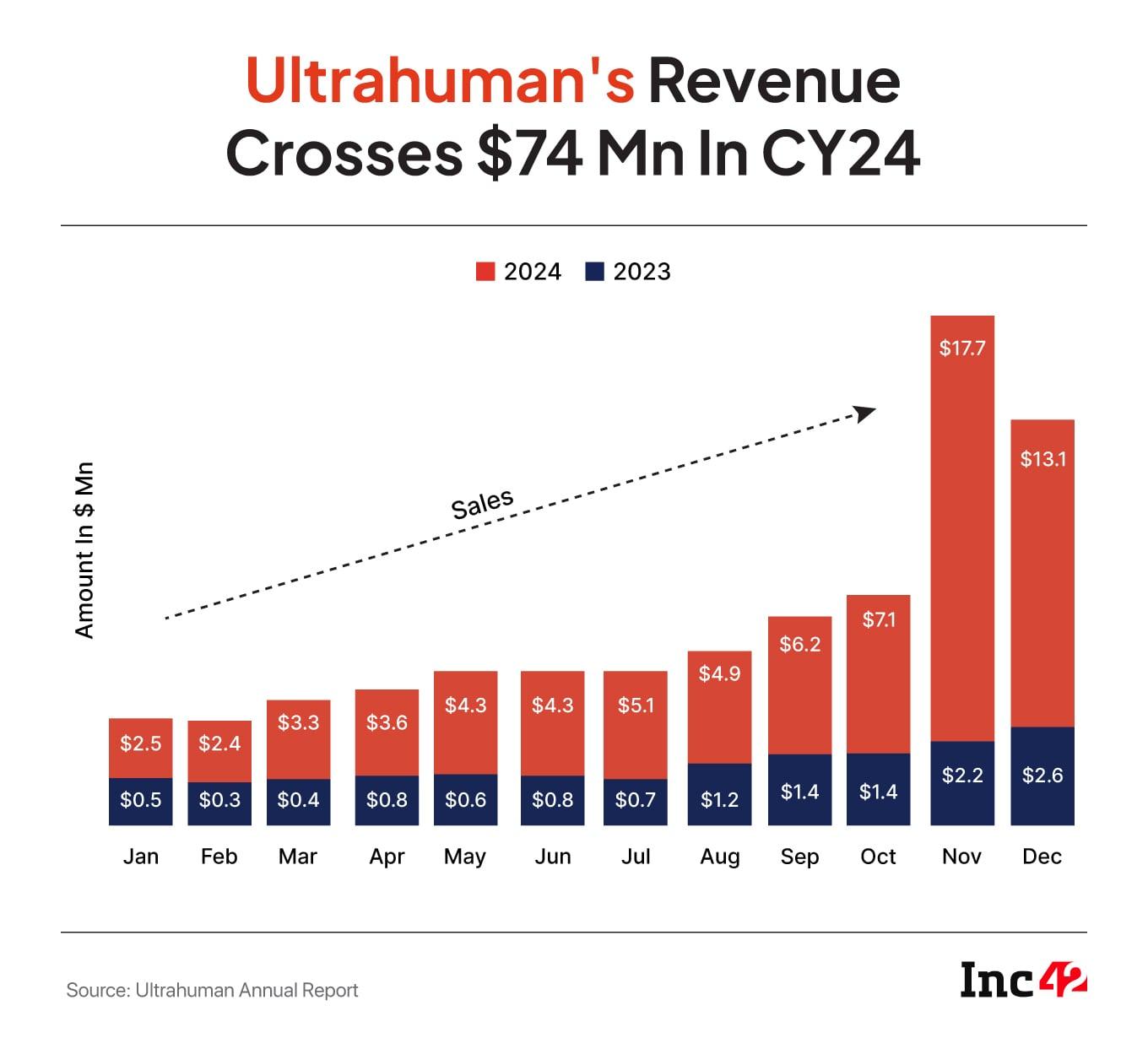

Ultrahuman claims to have grown its topline from INR 104 Cr to around INR 600 Cr in FY25 (as of March 2025), with a reported EBITDA margin of about 10% (INR 55–60 Cr).

Without revealing specifics about the bottom line, Kumar claimed the profit after tax was slightly higher in FY25 as compared to FY24, due to interest income on cash reserves. Incidentally, the company reports numbers for the classical fiscal year (April-March) as well as the calendar year.

In FY24, it incurred a total loss of INR 39 Cr, but Ultrahuman claims 11% profit before tax and 8% EBITDA for calendar year CY24. This also makes Ultrahuman a rare India-born consumer device startup to scale its revenue with profits despite an asset-heavy model.

Incidentally, the primary driver of this spike was the US market, now contributing nearly 50% of overall revenue. Europe and the UK together account for another 13%, while the UAE sits behind them.

India, by contrast, has slipped to under 7%, placing it seventh or eighth in market share, according to Ultrahuman CEO Mohit Kumar.

For FY26, the company is aiming at $150-200 Mn in revenue (INR 1,250–1,650 Cr), essentially doubling again. The roadmap largely includes expanding retail partnerships in the US, launches in new geographies, increasing software monetisation to 15% of revenue, and potentially releasing the next generation of its wearables in other form factors

The startup has also partnered with government-linked health institutions and academic researchers in the US. Ultrahuman is now also present in Walmart, Costco, Best Buy, and several international chains, and roughly 30% of sales come through physical retail while another 40–45% comes via direct and marketplaces

The company’s subscription model for plug-ins (for example, $5 per month for AFib detection) is both a monetisation lever and a hedge against fluctuating hardware margins. However, this model is not without risks especially now that Ultrahuman is a big company.

For instance, Netherlands-based developer Sander Belaen alleges that Ultrahuman copied his idea to launch the Ultra Age feature most recently. This feature combines sleep data, cardiovascular signals and blood markers to provide a single indicator that tells you how your body is ageing.

As per a report in The Morning Context, Belaen claims that Ultrahuman copied his idea and was in touch with him before launching Ultra Age, an allegation that Ultrahuman has denied. So there could be more trouble on the horizon for the wearables companies.

Over the next year, Ultrahuman plans to launch more such features and explore form factors beyond the ring. “There are parts of the body still untouched,” Kumar said cryptically.

It won’t be easy to break into non-ring categories given the high degree of commoditisation in the wearables space, especially fitness bands and smartwatches. The company is already looking to move on beyond a smart ring.

In early June, Ultrahuman entered the smart home space with Ultrahuman Home, a sensor-filled device that monitors light, air, temperature, and noise, helping residents optimise their space for better sleep, focus, and wellbeing.

Even if the November verdict goes against its favour, Ultrahuman may have cleared the track for its next big play. What it will hope is that this time around, there is no patent hurdle on this track.