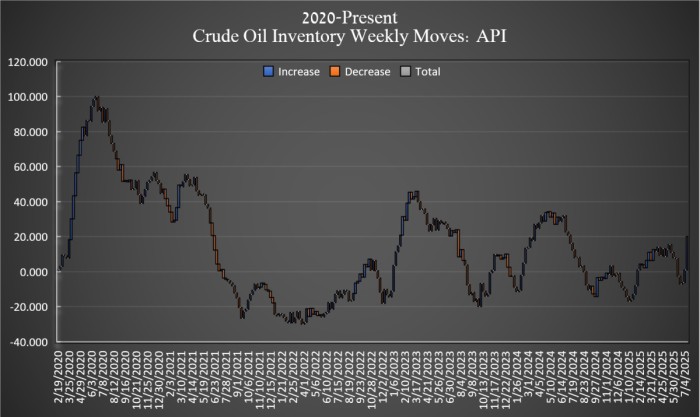

The American Petroleum Institute (API) estimated that crude oil inventories in the United States rose sharply for the second week in a row, this time gaining an additional 19.10 million barrels in the week ending July 11. That’s on top of last week’s 7.1 million barrel build. It is the largest single week build reported by the API in at least a decade.

Analysts were a mile off, estimating a 2.0-million-barrel draw.

So far this year, crude oil inventories are up 30 million barrels, according to Oilprice calculations of API data, with the trajectory of crude oil demand running contrary to the expected seasonal drawdown brought on by the typical spike in summer demand.

Earlier this week, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) saw a rare drop this week, by 300,000 barrels to 402.7 million barrels in the week ending July 11. Inventory levels in the SPR are hundreds of millions shy of the levels in inventory prior to the SPR withdrawal that took place under the Biden Administration.

At 3:47 pm ET, Brent crude was trading down $0.43 (0.62%) on the day, landing at $68.78—down almost $2 per barrel from last Tuesday.

WTI was also trading down on the day, by $0.34 (-0.51%) at $66.64—also down roughly $2 per barrel from last week’s price.

Gasoline inventories fell in the week ending July 11 by 4.53 million barrels, compared to last week’s 2.2-million-barrel decrease in the week prior. As of last week, gasoline inventories were 1% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories also fell this week, by 2.390 million barrels. In the week prior, distillate inventories slipped 800,000 barrels. Distillate inventories were already a staggering 23% below the five-year average as of the week ending July 4, the latest EIA data shows.

Cushing inventories—the benchmark crude stored and traded at the key delivery point for U.S. futures contracts in Cushing, Oklahoma—fell by 980,000 barrels in the week after gaining a modest 100,000 barrels in the week prior.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com: