-

Mortgage rates forecast to fall

-

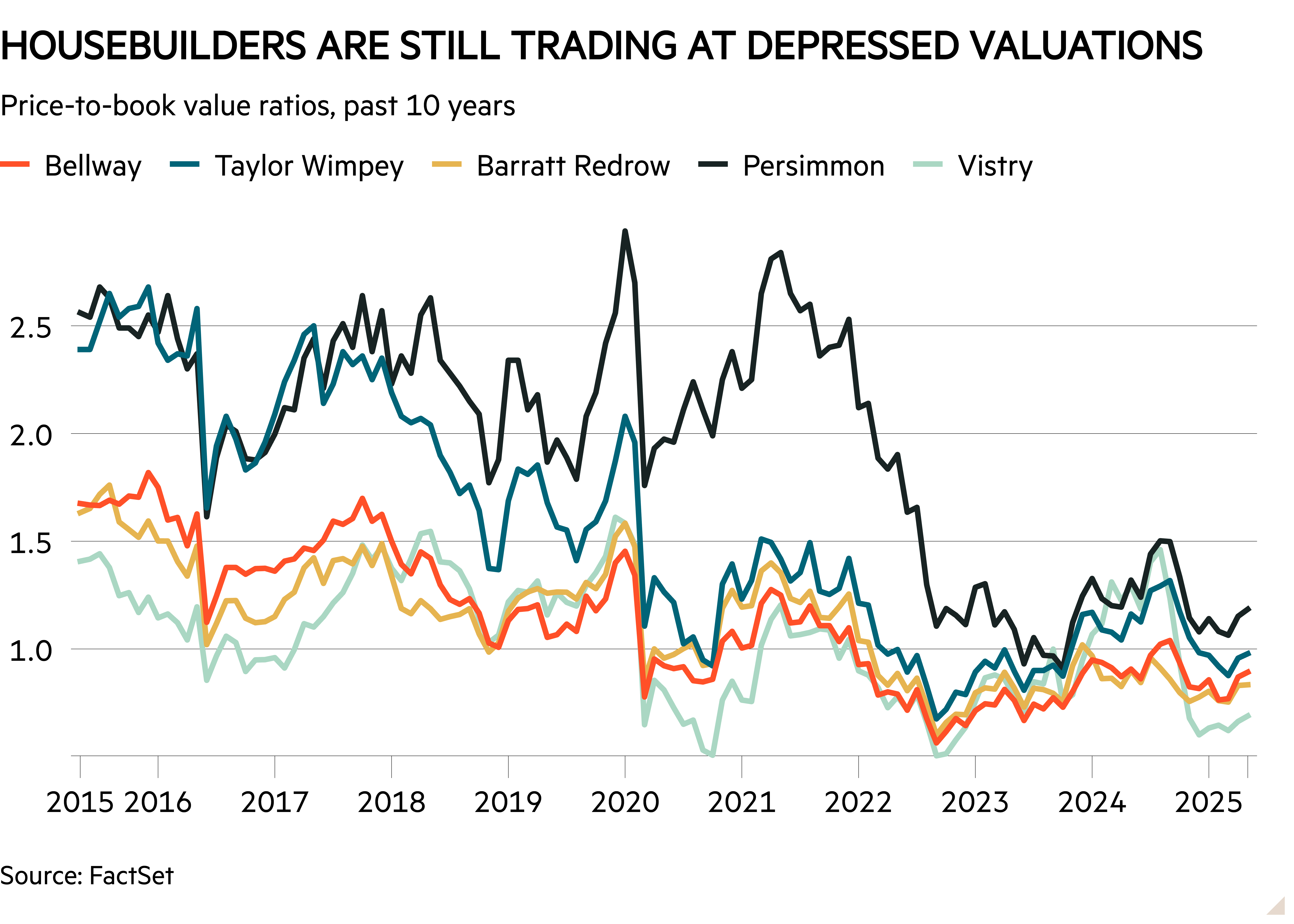

Valuations at financial crisis levels

-

Increased focus on returns

When looking for safe havens from the upheaval caused by President Trump’s on-again, off-again tariff pronouncements, UK housebuilders might not seem like the most obvious place to start.

However, the sector has been an unlikely beneficiary during this period. A month on from the reciprocal duties being unveiled in the White House Rose Garden, the S&P 500, the FTSE 100 and Europe’s Stoxx 600 remained 2 per cent below their prior levels. Yet a basket of UK housebuilders tracked by Goldman Sachs was up 13 per cent.

There are two main reasons for this. The first is that the sector continues to show signs of a recovery, with Persimmon (PSN) and Taylor Wimpey (TW.) both posting trading updates last week showing good growth in forward sales.

The other is that the 40 basis point fall in UK swap rates since the tariffs were announced could mean that two-year fixed mortgage rates fall to 4.1 per cent, from 4.5 per cent previously, according to Capital Economics. Its analysts now expect the average quoted mortgage rate to sit at 4.2 per cent this year, falling to 4.1 per cent next year and 4 per cent the year after.

Read more from Investors’ Chronicle

This would cut mortgage payments for new buyers from 38 per cent of income at the end of last year to about 35 per cent. Although this figure remains above 2019’s pre-pandemic average of 28 per cent, Capital Economics expects borrowers to be able to lower payments further by stretching them over longer periods – the number of people taking out mortgages for 40 years jumped from 3 per cent in 2021 to 10 per cent in 2023.

And while there hasn’t yet been much evidence of Labour’s election pledge to “get Britain building again”, changes to planning laws are still working their way through parliament. Industry executives are already highlighting a more lenient attitude among some councils to planning submissions.

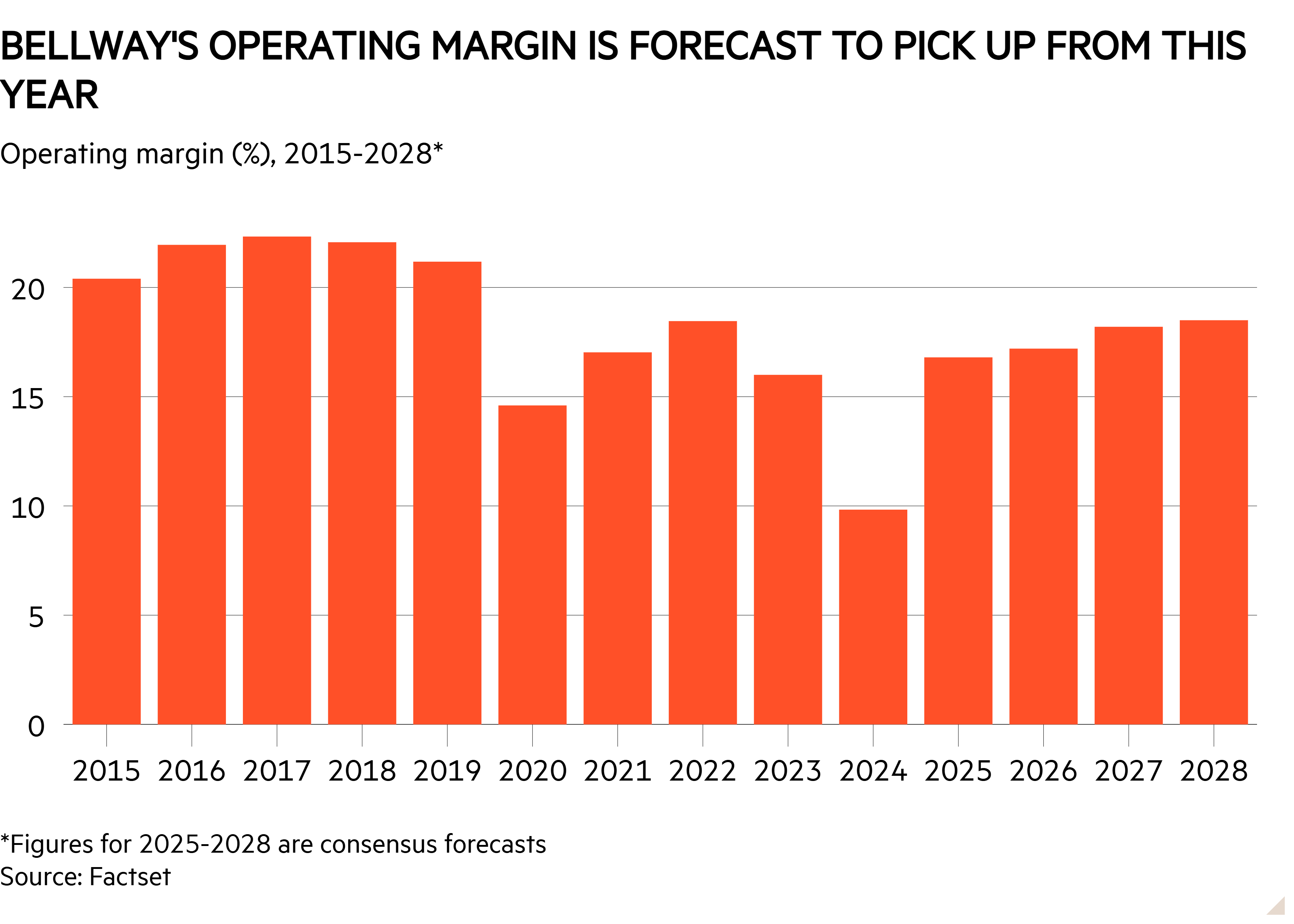

Despite the recent rally, most housebuilders are still in bargain basement territory in valuation terms. Following a couple of rough years of falling sales, margins remain at their lowest level since the financial crisis. The sector’s average return on equity is stuck below 5 per cent.

Yet the more positive outlook means that analysts are bullish about its prospects – consensus estimates are for revenue to grow at a compound annual rate of 15 per cent and earnings by 40 per cent over the next two years, Goldman’s analysts said last week.

Home advantage

For investors looking to capitalise, there are exchange traded funds tracking the sector. But the divergence in performance between the major players suggests that a stockpicker’s approach might yield better results.

Although there are slight differences in business models, none of the housebuilders can really claim to have enough branding power to be able to charge a premium for their homes – the sheer size of the existing housing stock compared with the number of homes they bring to market means that they are necessarily price takers.

This is reflected in balance sheets: few have much in the way of intangible assets when set against the carrying value of their land banks.

And while there are differing views on how to value housebuilders (‘How to spot a housebuilder recovery’, IC, 27 October 2023), most analysts think that a price-to-book (or to net asset) value makes more sense than price/earnings ratios, as the denominator of the latter can be volatile in what is a cyclical market.

Why not, then, just pick the company trading at the biggest discount – especially as there are several in the sector currently worth less than their net asset value?

| How housebuilders measure up: the five-year view | |||||

|---|---|---|---|---|---|

| Bellway | Barratt Redrow | Persimmon | Taylor Wimpey | Vistry | |

| Operating margin (%) | 15.2 | 15.6 | 18.8 | 15.7 | 6.2 |

| Return on equity (%) | 8.1 | 8.4 | 14.4 | 9.3 | 6.4 |

| Price-to-book value (x) | 1 | 0.9 | 1.7 | 1.2 | 0.7 |

| Price/earnings ratio (x) | 14.5 | 16 | 12.8 | 15.6 | 17 |

| Figures are five-year averages. Source: FactSet |

A look at the five largest companies in the sector shows that the cheapest, with a market capitalisation of just 69 per cent of its net asset value, is Vistry (VTY). The UK’s fifth-biggest housebuilder is cheap for a reason, though, following three profit warnings in three months late last year and grumblings around governance as power has coalesced around executive chair and chief executive Greg Fitzgerald. Its poor recent results also highlighted some of the challenges of its partnerships model, such as the reliability or otherwise of public sector funding and Vistry’s ability to deliver operationally at scale, analysts at Berenberg said in March.

Two more of the big five also trade at a discount to book value – Barratt Redrow (BTRW) at 85 per cent and Bellway (BWY) at 93 per cent.

The former is now comfortably the largest UK housebuilder, following Barratt’s £2.6bn takeover of Redrow last year. The all-share merger hasn’t stretched the balance sheet, and the integration appears to be progressing well, with the company stating in April that it is “on track to deliver the increased target of £100mn of cost [savings]”.

Yet almost a fifth of Barratt Redrow’s book value is now comprised of intangible assets, which means there is a greater risk of writedowns if expectations aren’t delivered.

By contrast, 100 per cent of Bellway’s book value consists of tangible assets. It doesn’t make many acquisitions, and although it entered talks with Crest Nicholson (CRST) about a potential takeover last year, the fact that it backed away is a sign of management’s conservative approach.

Crest is another example of a housebuilder whose shares look cheap, at a mere 66 per cent of book value. However, a £158mn hit to its balance sheet in February related to further work required to fix flammable cladding issues in the wake of the Grenfell Tower fire shows why investors have been circumspect. Bellway merely said when abandoning talks last year that it was confident in its own ability to deliver value for shareholders given the strength of its balance sheet, land bank and operational track record.

Smooth operator

Bellway has been a very steady performer over the years. RBC Capital Markets analyst Anthony Codling describes the housebuilder as “the easy listening choice, in that it never blows the doors off and it never crashes, either”.

Bellway’s half-year results show the company has a land bank containing more than 95,000 plots. Some 31,000 of these have detailed planning permission, which equates to more than three-and-a-half years of supply at this year’s expected build rate of 8,500 homes – an 11 per cent increase on 2024. Easing planning restrictions mean analysts expect completions to reach more than 11,000 a year by 2028, according to FactSet.

Peel Hunt’s analysts argued after the half-year figures were published in March that they didn’t see much scope for a re-rating until Bellway’s return on equity improved from its “depressed” level of 5-6 per cent.

Improving returns has become an area of heightened focus. Chief executive Jason Honeyman told investors that the company’s return on capital employed (which divides underlying operating profit by total assets minus current liabilities) of 9 per cent was “not good enough”.

New chief financial officer Shane Doherty, who joined Bellway six months ago from Irish housebuilder Cairn Homes (CRN), said the combined value of the company’s land bank and work in progress is higher than its book value, but as more work completes this will trigger strong cash generation, offering “value creation opportunities” for shareholders.

In general, improved capital efficiency is a positive – as it shows that the company is delivering more using fewer assets – but in housebuilding there is a trade-off. Reducing capital generally means holding less land, yet as Codling notes, it is generally those that have the biggest land banks that generate the highest returns, as older parts of the land bank benefit from a greater value uplift by the time homes are completed.

Still, with a growing order book, improving margins and a renewed approach to capital allocation to be outlined later this year, there are enough reasons to believe that the recent rally in Bellway’s shares can be maintained – whatever strife global markets face.

| Company details | Name | Mkt Cap | Price | 52-Wk Hi/Lo |

| Bellway (BWY) | £3.27bn | 2,752p | 3,384p / 2,134p | |

| Size/Debt | NAV per share* | Net Cash / Debt(-) | Net Debt / Ebitda | Op Cash/ Ebitda |

| 2,920p | -£8.0mn | 1.0 x | 2% | |

| Valuation | Fwd PE (+12mths) | Fwd DY (+12mths) | FCF yld (+12mths) | CAPE |

| 15 | 2.70% | 5.00% | 9.6 | |

| Quality/Growth | EBIT Margin | ROCE | 5yr Sales CAGR | 5yr EPS CAGR |

| 9.90% | 6.00% | -5.80% | -24.20% | |

| Forecasts/ Momentum | Fwd EPS grth NTM | Fwd EPS grth STM | 3-mth Mom | 3-mth Fwd EPS change% |

| 19% | 21% | 5.00% | -0.70% |

| Year End 31 Jul | Sales (£bn) | Profit before tax (£mn) | EPS (p) |

| 2022 | 3.54 | 650 | 421 |

| 2023 | 3.4 | 529 | 324 |

| 2024 | 2.38 | 226 | 134 |

| f’cst 2025 | 2.67 | 274 | 163 |

| f’cst 2026 | 2.97 | 323 | 192 |

| chg (%) | 11 | 18 | 18 |

| Source: FactSet, adjusted PTP and EPS figures | |||

| NTM = Next Twelve Months | |||

| STM = Second Twelve Months (ie one year from now) |