- Gold price sits at fresh weekly highs, remains poised to test $3,400.

- The US Dollar extends declines amid trade uncertainties, renewed dovish Fed bets.

- Gold price eyes acceptance above $3,377 yet again amid bullish daily technical setup.

Gold price is sitting at fresh weekly highs near the $3,380 neighborhood, building on the previous upswing early Thursday. Gold buyers closely eye the Middle East geopolitical tensions and the US Producer Price Index (PPI) data for a fresh leg north.

Gold price cheers softer US Dollar, geopolitical woes

Amid escalating geopolitical tensions in the Middle East, markets are slightly risk averse and prefer to flock to the traditional safe-haven Gold price.

According to CBS News senior White House reporter Jennifer Jacobs, United States (US) officials have been told Israel is fully ready to launch an operation into Iran.

“US anticipates Iran could retaliate on certain US sites in Iraq,” Jacobs added.

This comes as US President Trump’s Middle East envoy Steve Witkoff is still planning to meet with Iran for a sixth round of talks on the country’s nuclear program on Sunday.

Bolstering the Gold price advance, the US Dollar (USD) extends the softer US inflation data-led decline and flirts with two-month lows against its major currency rivals.

The US Consumer Price Index i(CPI) increased 0.1% for the month, putting the annual inflation rate at 2.4%. Both prints undermined expectations of 0.2% and 2.5% respectively. Core figures also came in below estimates across the time horizons.

Tame US CPI data ramped up odds for a US Federal Reserve (Fed) interest rate cut in September, with markets now pricing in about a 62% probability of 25 basis points (bps) rate cut, per CME Group’s FedWatch tool, up from 52% seen pre-data release.

The latest downtick in the US Dollar is sponsored by the looming uncertainty surrounding Trump’s tariffs even as US-China trade tensions ease.

Trump said on Wednesday he would be willing to extend a July 8 deadline for completing trade talks with countries before higher US tariffs are imposed.

Meanwhile, the Wall Street Journal (WSJ) reported late Wednesday that China is putting a six-month limit on rare-earth export licenses for US automakers and manufacturers.

The USD will likely remain defensive as markets try to make sense of the latest trade developments and its impact on the economic outlook.

However, hot US PPI inflation data could offer some respite to USD buyers, limiting the Gold price upside.

The US PPI is forecast to rise at an annual rate of 2.6% in May, following a 2.4% increase in April. The monthly PPI inflation is set to rebound to 0.2% in the same period. Core PPI is expected to rise 3.1% over the year and 0.3% on a monthly basis last month.

Also, of note will remain the simmering Israel-Iran geopolitical conflict and trade headlines, which could have a significant impact on the USD and hence, the bright metal.

Finally, it’s worth mentioning that record purchases by global central banks and rising prices have strengthened Gold’s position as the second biggest reserve holding in value terms, first being the USD, a report published by the European Central Bank (ECB) showed on Wednesday.

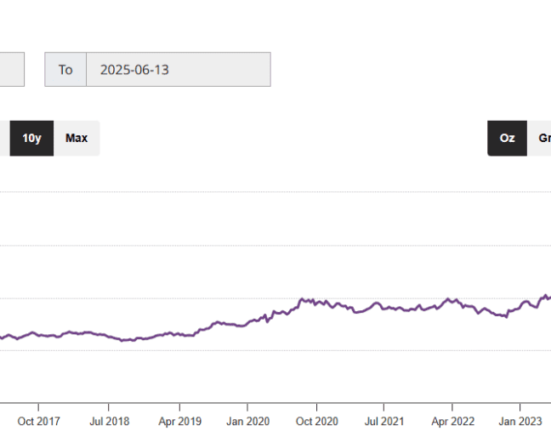

Gold price technical analysis: Daily chart

The bullish outlook for Gold price in the short term has been solidified as buyers staged a solid reversal from the critical $3,297 level.

That level is the 38.2% Fibonacci Retracement (Fibo) level of the April record rally.

The 14-day Relative Strength Index (RSI) points north above the midline, currently near 57.50, justifying the renewed upside.

For a sustained uptrend, Gold price must find a foothold above the 23.6% Fibo resistance at $3,377 on a daily closing basis.

The next stiff resistance is spotted at the $3,400 mark, above which the May high of $3,439 will come into the picture.

On the downside, the immediate support is aligned at the 21-day Simple Moving Average (SMA) of $3,315.

Gold sellers need a decisive break below the abovementioned strong support at $3,297 to challenge the 50-day SMA cushion at $3,279.

The last line of defense for buyers is aligned at $3,232, the 50% Fibo level of the same ascent.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.