In an era of economic uncertainty and global instability, more and more investors are looking for safe and steady ways to protect and grow their wealth. One of these tried and tested methods is gold investment. The demand for gold has been increasing in recent years as investors worldwide realize that gold serves as a “safe haven” in turbulent times.

Why gold is considered a safe haven

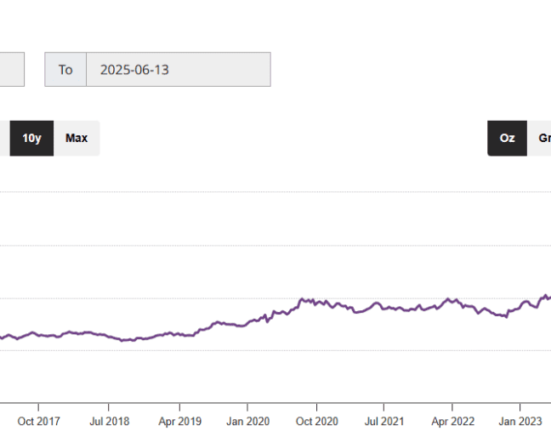

Gold has maintained its status as a valuable resource for thousands of years. In particular, its independence from political and economic developments plays a key role. While currencies and stock markets are subject to strong fluctuations, the historical performance of gold has shown remarkable stability.

Historical stability of gold

Since time immemorial, gold has been valued for its rarity and intrinsic value. Even in Ancient Egypt and the Roman Empire, gold served as a currency and symbol of wealth. Even in modern times, such as during the 2008 financial crisis, investors flocked to the gold market to hedge their assets. This historical consistency is a key reason why gold investment is seen as a safe haven in today’s uncertain times.

Gold price today

The growing popularity of gold investments

Global uncertainties and economic turmoil

Recent global challenges – from geopolitical tensions to rapid technological changes – have increased the need for safe investments among investors worldwide. Gold offers an attractive option as, unlike equities or real estate, it is not dependent on corporate profits or housing demand.

Protection against inflation and currency devaluation

Another decisive advantage of gold investments is protection against inflation and currency devaluation. While paper money can be printed at will by central banks, the amount of gold available remains limited and its purchasing power stable. This makes it a reliable investment for investors in times of high inflation or devaluing currencies.

Diversification of the portfolio

For many investors, investing in gold is also a way of diversifying their portfolio. Diversification is a proven principle of risk management in which assets are spread across different asset classes. By adding gold to the portfolio, investors can offset potential losses in other areas and thus minimize the overall risk.

Practical tips for gold investments

Physical gold: coins and bars

The classic form of gold investment is the purchase of physical gold in the form of coins or bars. These can be stored securely in vaults or bank safe deposit boxes. The best-known gold coins include the Krugerrand from South Africa, the American Eagle from the USA and the Vienna Philharmonic from Austria.

Buy gold now

Gold ETFs and funds

Exchange-traded funds (ETFs) and funds offer a practical alternative for investors who do not wish to hold physical stocks. These funds invest in gold and reflect the price of the precious metal without having to worry about storing or insuring the physical gold.

Certificates and derivatives

Experienced investors also use certificates and derivatives to profit from the price development of gold. These financial instruments offer the opportunity to invest in gold without physically owning it. However, they are associated with higher risks and require in-depth market knowledge.

Conclusion: Gold investment as a reliable anchor

In a time characterized by economic uncertainty and unpredictable global events, gold investment remains a reliable way to protect wealth and secure long-term value. Its historical stability, protection against inflation and currency devaluation as well as the possibility of diversification make gold an indispensable component of a balanced investment portfolio.

You can find more information on gold at www.de.gold

NexTao GmbH

Königsallee 27

40212 Düsseldorf

Germany

Mail: redaktion@nextao.de

Phone: 015775588888

Website: www.nextao.de

NexTao GmbH is a professional marketing agency that also specializes in the creation and publication of press releases. It offers customized communication solutions to increase visibility and strengthen brand presence. Contact us at info@nextao.de for more information.

This release was published on openPR.