Amid a cost-of-living crisis and rising inflation rates, people are seeking additional ways to boost their income safely. So, should Brits consider investing in gold, and what are the safest ways to do so during global uncertainty?

Rick Kanda, Managing Director at The Gold Bullion Company, has revealed the key things you need to know before choosing to invest in gold and why it needs to be seen as a long-term investment and not a quick solution.

Investing in gold in 2025: Is now the right time?

“Over the past two years, the price of gold has surged, with the metal rising by more than 2% last week (Monday, 2nd June 2025) to its highest in over three weeks. Global geopolitical tensions and trade uncertainty have put the price of gold in a strong position, with many experts believing there has never been a better time to invest in the metal.”

“Gold investment should not be dependent on whether the market is either surging or falling; you should be more focused on whether your financial situation enables you to do so at that particular time. Gold should always be seen as a long-term investment strategy. The time is right if you have the funds, you are in a financially stable position, and you’re looking for an investment that will store value long-term without thought towards any short-term price fluctuations.”

How has gold performed during the cost-of-living crisis?

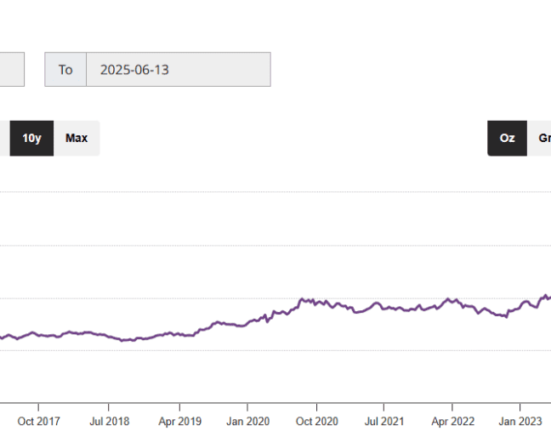

“Almost three years after the beginning of the cost-of-living crisis, many investors have experienced turbulent times as stocks, shares, and the property market continue to remain volatile. However, when looking at the range of investment options, gold tops the list of best-performing assets by far.”

“When looking at figures from the past 3 years, we can see that a £10,000 investment in gold has had a nominal return of £15,004 and a real return of £12,481, which outpaces alternative investment options..”

Investing in gold is a long-term investment. Here’s why.

According to the World Gold Council, only around 216,265 tonnes of gold have ever been mined, which highlights how limited the supply is. This data has resulted in many investors and consumers believing that gold is a ‘safe haven’ and will have a better chance of retaining its value compared to other investment options, such as stocks, shares and property, which yield returns annually.”

Rick finishes: “For gold to reach its maximum potential in terms of value, investors need to rely on an increase in value to reap the returns. With this in mind, it’s understandable why gold needs to be seen as a long-term investment and not a quick win.”

“Gold should not be looked at as an asset you react to impulsively. Remember that gold is a long-term investment, not a short-term trade, and market fluctuations are a natural part of the cycle, not a reason to panic. If you have invested in gold for the right reasons, which are long-term financial storage, short-term declines in the market should not hurt your confidence.”