President Trump promised to shake things up and that’s at least one promise he’s delivered on. His tariffs on imports from Canada, Mexico and China have shaken up Wall Street and put stocks in a steep dive.

So is this the time to dump stocks and buy gold? Well, it might be if you like to sell low and buy high. On the other hand, no one ever knows how low stocks will go, so both gold and cash can be a good way to hedge your bets. Be sure to calculate the tax consequences of selling stock. You don’t want to incur a big capital gains tab.

The advantage of gold is that it’s considered a safe-haven asset, historically attracting investors during times of economic uncertainty, which is what we’re living through right now. Gold is trading around $2,916 per troy ounce as of March 11, according to GoldPrice.org, reflecting a significant rise from previous years.

Meanwhile, the Dow Jones Industrial Average is down more than 450 points Tuesday afternoon, prompting an outbreak of angina in many households. The tech-heavy Nasdaq Composite index also fell into correction territory, meaning it fell from 10% from its most recent high, and the S&P 500 is nearing a correction.

Historically, economic uncertainty drives many investors toward gold, seeking stability amid market volatility. Investors who are well-diversified nearly always have some gold in their portfolio and there’s no reason smaller investors shouldn’t do the same, even if they don’t unload all their equities.

These days, it is typical for investors to buy gold through exchange-traded funds, such as the iShares Gold Trust Micro and SPDR Gold MiniShares Trust.

Gold’s performance and forecasts

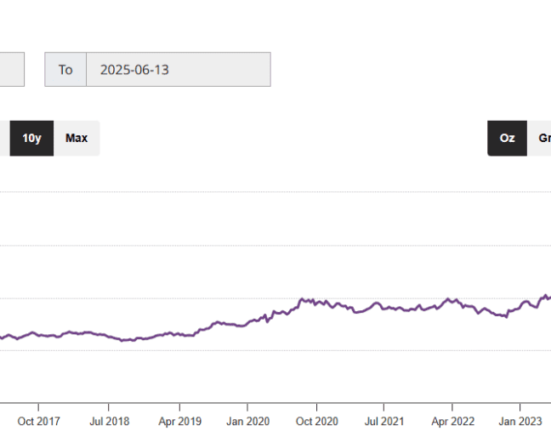

Gold’s price trajectory has been notably bullish.In early 2025, prices reached a new high of $2,915 per ounce, marking a 100% increase from the March 2020 low of $1,451 per ounce. This upward trend is anticipated to continue, with Goldman Sachs revising its year-end 2025 forecast to $3,100 per ounce, up from the previous $2,890.

Similarly, J.P. Morgan predicts an average gold price of $2,950 in 2025, potentially reaching $3,000 per ounce. These projections are underpinned by factors such as sustained inflation, geopolitical risks, and robust demand from central banks.

Still, the World Gold Council has cautioned the rally may cool in 2025 after gold’s stellar performance in 2024.

Investment considerations

While gold’s recent performance and optimistic forecasts are compelling, potential investors should approach with caution, as they would with any investment.

David Rosenberg, founder of Rosenberg Research, advises following Warren Buffett’s prudent investment strategy, emphasizing the importance of “de-risking” portfolios during uncertain economic times.

Rosenberg, in a Marketwatch report, highlights the necessity of increasing cash reserves and investing in defensive sectors, including assets like gold that traditionally perform well during periods of instability.

Keep in mind that market corrections can occur, and gold is not immune to price fluctuations.Factors such as changes in interest rates, currency strength, and shifts in investor sentiment can influence gold’s value. Therefore, diversification remains a key principle in investment strategies, ensuring that portfolios are balanced across various asset classes to mitigate potential risks.

Newcomers considering exposure to gold without directly purchasing the physical metal, investing in gold mining companies presents an alternative. Others argue that, although it’s a little bulky and needs careful handling, actual, physical gold is still king. ConsumerAffairs reviews gold dealers here.

Be bold but careful

Given the current economic landscape, characterized by trade tensions and inflationary pressures, gold continues to serve as a viable hedge against uncertainty.The metal’s strong performance and favorable forecasts suggest potential for further appreciation.However, investors should consider a diversified approach to their portfolios.

Consulting with financial advisors and conducting thorough research are prudent steps to ensure alignment with individual financial goals and risk tolerance.