- Gold price attracts buyers for the third straight day amid the global flight to safety.

- Rising geopolitical risks and trade uncertainties boost traditional safe-haven assets.

- Fed rate cut bets also benefit the XAU/USD pair, though rebounding USD caps gains.

Gold price (XAU/USD) retains positive bias for the third consecutive day on Friday, albeit trimming a part of strong intraday gains to the highest level since April 22 during the early part of the European session. A goodish US Dollar (USD) rebound from the lowest level since March 2022 turns out to be a key factor acting as a headwind for the bullion. However, a fresh wave of the global risk-aversion trade continues to underpin demand for the safe-haven precious metal.

Against the backdrop of trade-related uncertainties, a further escalation of geopolitical tensions in the Middle East tempers investors’ appetite for riskier assets, which is evident from a sea of red across the global equity markets. Moreover, rising bets that the Federal Reserve (Fed) would lower borrowing costs further in 2025, amid signs of cooling inflation, could cap the USD recovery. This should contribute to limiting any corrective slide for the non-yielding Gold price.

Daily Digest Market Movers: Gold price bulls turn cautious amid rebounding USD

- Israel launched pre-emptive airstrikes against Iran on Friday, targeting its nuclear plant and military sites. This marks a dramatic escalation of the long-running regional conflict in the Middle East and lifts the safe-haven Gold price to its highest level since April 22 during the Asian session.

- Israel’s Prime Minister Benjamin Netanyahu said that the operation targeted Iran’s nuclear program and will continue for as many days as it takes to remove this threat. Israel declared a state of emergency, saying that retaliatory action from Iran was possible following the operation.

- Meanwhile, a spokesperson for Iran’s armed forces said that Israel carried out the attacks with support from the US. However, top US diplomat Marco Rubio said that America was not involved in the strikes and that Israel had told them that this action was necessary for its self-defense.

- Iran’s Supreme Leader, Ayatollah Ali Khamenei, said that with this attack, Israel has prepared a bitter fate for itself and vowed severe punishment for what he called a crime. This raises the risk of a region-wide and more devastating war, weighing on investors’ sentiment.

- On the trade-related front, US President Donald Trump expanded the 50% steel tariffs to a range of household appliances. US Commerce Secretary Howard Lutnick said that tariff levels on Chinese imports remain at 55% and would not change from this point onward.

- The US Bureau of Labour Statistics reported that the Producer Price Index remained muted in May and rose 0.1% compared to a revised 0.2% decline in April. This comes on top of a marginal rise in US consumer prices, backing the case for further easing by the Federal Reserve.

- Traders now look to the Preliminary release of the Michigan US Consumer Sentiment Index and Inflation Expectations for a short-term impetus. The focus, however, will remain glued to developments surrounding Trump’s trade policies and conflicts in the Middle East.

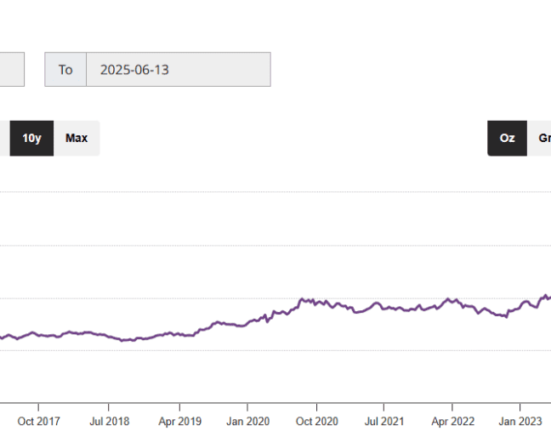

Gold price seems poised to climb further amid the formation of an ascending channel

From a technical perspective, the recent move higher witnessed over the past month or so has been along an upward-sloping channel. This points to a well-established short-term uptrend, which, along with the fact that oscillators on the daily chart are holding in bullish territory, validates the near-term positive outlook for the Gold price. Hence, a subsequent move towards challenging the all-time peak, around the $3,500 psychological mark touched in April, looks like a distinct possibility. The said handle coincides with the top boundary of the ascending channel, which if cleared decisively will be seen as a fresh trigger for bullish traders.

On the flip side, any corrective pullback might now be seen as a buying opportunity and find decent support near the $3,400 mark. Some follow-through selling below the $3,385 region, however, should pave the way for additional losses towards the $3,355 intermediate support en route to the $3,330-3,329 region, representing the lower end of the ascending channel. A convincing break below the latter would negate the constructive setup and shift the near-term bias in favor of bearish traders.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.