- Gold price is enjoying some support around $3,120 on Wednesday ahead of Trump’s announcement.

- Markets mull the impact of the official announcement of the implementation of reciprocal tariffs.

- Gold traders could unwind the Gold rally, should the size of tariffs be far less severe than anticipated.

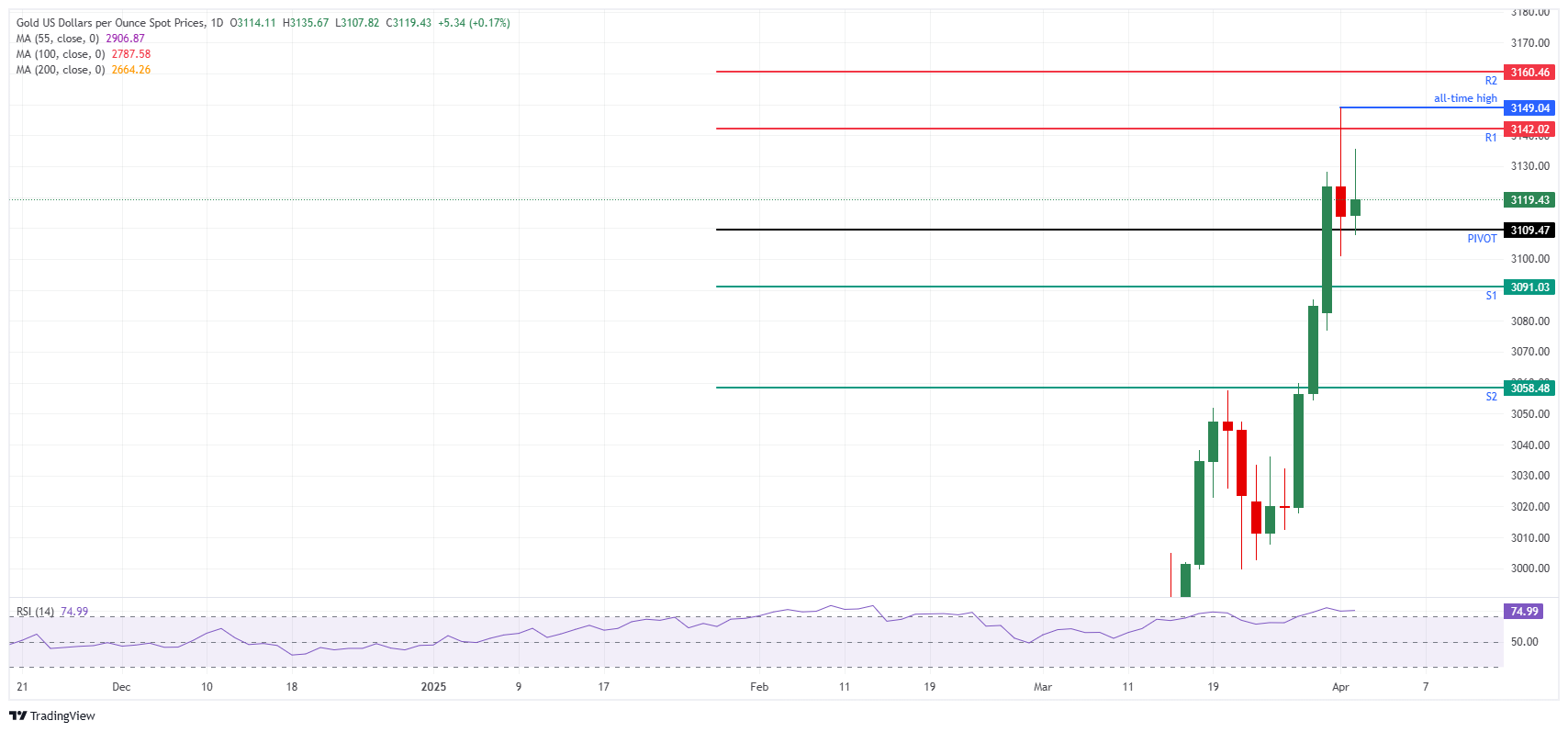

Gold price (XAU/USD) stabilizes above $3,120 at the time of writing on Wednesday with still the fresh all-time nearby, at $3,149. The Gold rush rally stalled ahead of United States (US) President Donald Trump officially announcing the reciprocal tariff implementation later this Wednesday at the White House with his entire cabinet present. However, with uncertainty building up towards this day, the announcement itself could be less impactful than initially thought, resulting in a sharp correction for Gold this week as a “buy the rumour, sell the news” event.

Meanwhile, traders are gearing up for the always-important private sector employment data provided by Automatic Data Processing (ADP). Although there is no proven correlation with the Nonfarm Payrolls (NFP) release on Friday, traders still see it as a litmus test. Expectations are for a surge of 105,000 new employment in private jobs in March, compared to 77,000 in February. This could make sense as the Department of Government Efficiency (DOGE) has been trying to push public sector employees towards private jobs.

Daily digest market movers: Markets hold their breath

- The White House has been reluctant to provide details of the targets and scale of the levies, which will be applied right after they are rolled out at the 20:00 GMT event in Washington this Wednesday. The pending announcement has driven a new wave of volatility, including a US stock selloff. While uncertain times are generally good for Gold, investors are keen to see the impact of the next set of levies on trade, the global economy and geopolitics, Bloomberg reports.

- The CME FedWatch tool sees chances for a rate cut in May standing at 15.8%. A rate cut in June is still the most plausible outcome, with only a 25.6% chance for rates to remain at current levels.

- Huaan Yifu Gold ETF, the largest such investment vehicle in China, received record inflows of 1.4 billion Yuan ($194 million) on Monday. Followed by another 1 billion Yuan, the second-highest, on the following day. The frantic pace of buying means Gold ETFs now have the biggest assets under management among all commodity-related peers in China, Reuters reports.

- Strong central bank demand and constraints in supply reinforce the bullish rally in gold, while the challenging growth-policy trade-off present risks for European equities, according to JPMorgan derivatives strategists, Reuters reports.

Gold Price Technical Analysis: How to avoid a massacre

Again, this is a “parental advisory” just ahead of the main event for this Wednesday. With the primary tailwind for the Goldrush set to be officially announced, the “buy the rumour, sell the fact” rule of thumb should be considered. The risk could be that once the reciprocal tariffs take effect on Wednesday, only easing due to profit-taking in Gold could occur once separate trade agreements and partial unwinds take place.

On the upside, the daily R1 resistance at $3,141 is the first level to consider, followed by the $3,149 all-time high. Further up, the R2 resistance at $3,169 could still be targeted later in the day. Beyond that, the broader upside target stands at $3,200.

On the downside, the S1 support at $3,093 is quite far, though it could still be tested without completely erasing this week’s gains. Further down, the S2 support at $3,073 should ensure that Gold does not fall back below $3,000.

XAU/USD: Daily Chart