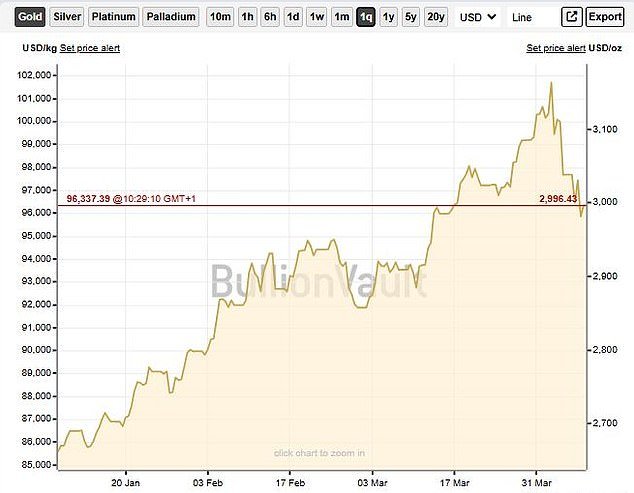

The gold price has recovered to around $3,000 (£2,349) after seeing wild swings since US president Donald Trump launched a trade war against the rest of the world.

The value of the precious metal hit an all-time high of $3,167.71 on 3 April as global markets were upended and investors initially rushed to buy traditional safe haven assets.

It then plunged in what finance experts explain is down to profit-taking, plus a sell-off to meet losses elsewhere.

The gold price started this year at around $2,600 and has hit a series of all-time highs in the past few months.

But the outlook for gold has tilted more cautious in the near term, even if demand for safety is going to be elevated amid the market turmoil, according to City Index market analyst Fawad Razaqzada.

He says investor confidence remains delicate amid the trade war rhetoric, with many reluctant to engage until the dust settles.

Gold price: This hit a new record of $3167.71 last week before tumbling back below the $3,000 mark (Source: BullionVault)

‘Despite its reputation as a safe haven, gold wasn’t immune to last week’s cross-asset liquidation, where even traditional hedges were sold off to meet margin calls,’ says Razaqzada.

A margin call is when brokers ask customers like hedge funds to deposit more cash or other assets in accounts as collateral against the amount they have borrowed to invest.

‘It’s worth noting that this move wasn’t driven by deteriorating fundamentals. Rather, it was the equities rout dragging everything down,’ says Razaqzada of recent trends.

‘If stock markets remain under pressure, gold could see further selling as traders raise liquidity — a forced unwinding that’s already underway.’

He adds that central bank demand may cool at these lofty price levels, but that longer-term fundamentals for the gold outlook remain constructive.

‘Elevated prices might prompt mining firms to step up production, though supply increases typically lag,’ Razaqzada adds.

Richard Hunter, head of markets at Interactive Investor, says some of the weakness seen in bond and gold havens was attributed to investors needing to raise funds for margin calls to cover their losses elsewhere.

Hunter says: ‘This rotation has been seen before and can turn out to be a self-perpetuating cycle and is one which could put further pressure, if it were needed, on markets globally.’

He adds: ‘Many investors have noted – with some exasperation – that unlike previous crises where a confluence of factors came together to cause extreme market weakness, this set of events is largely due to the actions of just one person.

‘To some extent, global indices are at the mercy of the President, and the growing backlash which the US is beginning to experience in terms of retaliatory tariffs and increasingly aggressive rhetoric are not even near the end of the beginning.’

Adrian Ash, director of research at BullionVault, says gold isn’t immune to ‘Trump’s everything crash’, but has dropped far less than the FTSE All Share and the US S&P 500.

‘If the plunge in risk assets continues, there’s a chance that gold will fall further as traders liquidate winning positions to cover losses elsewhere.

‘But as in the Lehmans and initial Covid crashes, that would likely spur yet further demand from private investors wanting to buy and hold gold as insurance against a longer-term slump in the stock market and the economy.’

What usually drives the gold price?

The precious metal is a store of wealth and hedge against inflation, a useful way to diversify and a safe haven asset during financial and political upsets.

But it generates no income and the price can be volatile, with many drivers that can act in concert or be in conflict, and hold weaker or more dominant sway at any one time.

We rounded up the main factors that influence the gold price here.

How to invest in gold

Exchange Traded Commodities (ETCs): This is similar to holding a index tracker fund, only for the gold price.

You need to check whether an ETC has exposure through derivatives rather than physically owning the precious metal, as these can be complicated.

Multi-asset or specialist funds: These are useful if you want to spread your risk in a well-diversified fund, or have an active manager make the important calls about current market trends.

Physical bars or coins: If you keep them at home you will need to ensure you have security and insurance cover. Many firms will hold them in a secure vault for you.

Mining stocks: These can be volatile so less experienced investors may prefer a fund whose manager specialises in this sector.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.