- Gold declined sharply after setting a new record high near $3,170.

- XAU/USD volatility is likely to remain high in the near term.

- The technical outlook points to a bearish tilt following the latest decline.

Gold (XAU/USD) pushed higher with the initial reaction to tariff announcements from the United States (US) on Wednesday and touched a record peak of $3,167 before staging a deep correction heading into the weekend. Investors will stay focused on tariff-related headlines and pay close attention to inflation data from the US.

Gold reverses direction after impressive upsurge

After ending the previous week on a bullish note, Gold continued to push higher on Monday as markets adopted a cautious stance in anticipation of the US tariff announcements. Following a modest decline on Tuesday, XAU/USD spent most of the day moving in a tight channel on Wednesday. Later in the American session, Gold gathered bullish momentum and registered its highest daily close on record at $3,135.

US President Donald Trump announced on “Liberation Day” that they will impose a 10% baseline tariff, effective April 5, on all imports to the US. United Kingdom, Australia and Saudi Arabia will be among the countries that will only face this base rate. Furthermore, Canada and Mexico will be exempt from this 10% increase as 25% tariffs set in March on this countries for not doing enough to curb migration and fentanyl trafficking remain in place. The President also noted that they will also impose higher reciprocal tariffs, which will go into effect on April 9, on about 60 countries they describe as “worst offenders.” The European Union, China and Japan will face 20%, 54% and 24% tariffs, respectively, under this new regime. Additionally, Trump confirmed they will impose 25% tariffs on all foreign-made automobiles. As safe-haven flows started to dominate the markets in the immediate aftermath, Gold pushed north and touched a new record high of $3,167 during the Asian trading hours on Thursday.

However, growing fears over the US’ trade policy weighing on the global economic activity and hurting the precious metal’s demand outlook caused XAU/USD to reverse its direction. Investors may also have seen the opportunity to book some profits before receiving more details on the trade war. After dropping all the way to $3,054, Gold recovered a portion of its daily losses before ending the day 0.65% lower on Thursday.

That day, the International Monetary Fund (IMF) Managing Director Kristalina Georgieva said that sweeping tariffs announced by the Trump administration represent a significant risk to the global economy at a time when growth has been sluggish. Meanwhile, Fitch Ratings said that the US growth in 2025 is likely to be slower than the 1.7% that they had projected in March, given higher-than-anticipated tariffs. “Tariff hikes will result in higher consumer prices and lower corporate profits in the US,” the agency noted.

On Friday, China’s Finance Ministry announced that they will impose additional tariffs of 34% on all US imports from April 10 in retaliation, and Gold recovered above $3,100 following this headline. Later in the session, the US Dollar (USD) gathered strength on the upbeat US employment data and forced XAU/USD to come under renewed bearish pressure. The US Bureau of Labor Statistics reported that Nonfarm Payrolls (NFP) rose by 228,000 in March, surpassing the market expectation of 135,000 by a wide margin. In this period, the Unemployment Rate edged higher to 4.2%, while the Labor Force Participation Rate ticked up to 62.5% from 62.4%.

Ahead of the weekend, Federal Reserve Chairman Jerome Powell said Trump’s tariffs are bigger than expected, and they risk higher inflation and slower growth. “Too soon to say what will be the appropriate path for monetary policy,” Powell noted and added that their obligation is to make certain that a one-time increase in price levels doesn’t become an ongoing inflation problem. Gold extended its correction following these comments.

Gold investors await fresh tariff headlines, US inflation data

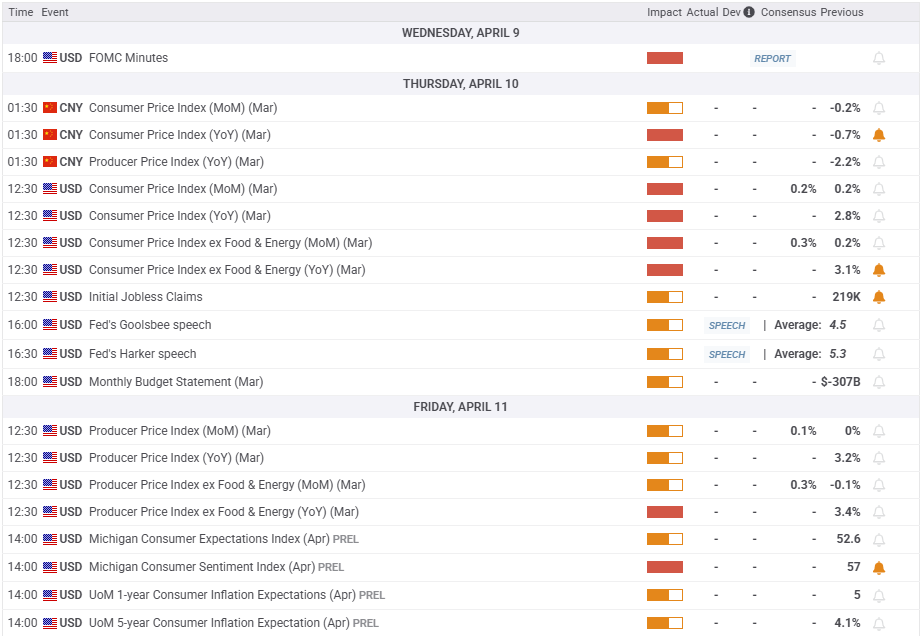

The economic calendar will not offer any data releases that could influence Gold’s valuation in a significant way in the first half of the week. The Fed will publish the minutes of the March policy meeting on Wednesday. If the publication shows that policymakers are much more concerned about how tariffs will affect inflation dynamics, rather than growth prospects, XAU/USD could extend its downward correction in the near term.

On Thursday, the US Bureau of Labor Statistics will publish the Consumer Price Index (CPI) data for March. “I am watching for evidence that tariffs are driving a persistent increase in price pressures,” Federal Reserve (Fed) Board of Governors member Lisa Cook said following the tariff announcements. Cook further added that she sees more emphasis on upside inflation risks.

In case there is a noticeable increase in the monthly core inflation rate, with a reading of 0.4% or higher, the USD could gather strength with the immediate reaction and weigh on XAU/USD. On the other hand, a soft print is likely to make it difficult for the USD to find demand.

The CME Group FedWatch Tool shows that investors are pricing in a nearly 40% probability of a 25 basis points (bps) Fed rate cut in May, up from about a 15% chance seen before tariffs were unveiled. Hence, the market positioning suggests that the USD is facing a two-way risk ahead of the inflation data.

Market participants will continue to scrutinize fresh developments surrounding the US trade policy. In case the Trump administration takes a step back and starts negotiating with nations to lift tariffs, investors could refrain from positioning themselves for a potential economic downturn in the US and help the USD stage a decisive rebound. On the flip side, Gold is likely to continue to benefit from safe-haven flows if geopolitical tensions remain high, with the US’ trade partners responding with their own retaliatory tariffs. At this juncture, it’s safe to assume that Gold’s volatility will remain high in the near term.

Gold technical analysis

The Relative Strength Index (RSI) indicator on the daily chart retreats toward 50 from the near-80 it touched on Thursday, suggesting that the latest decline is more than a technical correction.

A key pivot level is located at $3,030, where the lower limit of the ascending channel and the 20-day Simple Moving Average (SMA) align. Once that level is confirmed as resistance, $3,000 (psychological level, static level) could be seen as next support level $2,940 (50-day SMA) and $2,900 (static level, round level).

Looking north, the first resistance level could be spotted at $3,100 (mid-point of the ascending channel) ahead of $3,135 (static level) and $3,167-3,170 (record-high, upper limit of the ascending channel).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.