- Gold reclaimed $3,300 and broke a two-week losing streak.

- The near-term technical outlook doesn’t yet point to a buildup of bullish momentum.

- Markets will pay close attention to US trade talks.

Gold (XAU/USD) started the week on a firm footing and registered gains for three straight days before losing its momentum once it became clear that the US Federal Reserve (Fed) isn’t likely to cut interest rates soon. In the absence of high-tier macroeconomic data releases, headlines surrounding the US tariff negotiations could drive XAU/USD’s action in the short term.

Gold reclaims $3,300 but lacks strength

The broad-based selling pressure surrounding the US Dollar (USD) helped XAU/USD gain traction on Monday. White House press secretary Karoline Leavitt told reporters that United States (US) President Donald Trump sent a handwritten note to Federal Reserve (Fed) Chairman Jerome Powell, urging him to lower interest rates. She added that Trump believes interest rates should be lowered to about 1%.

Gold continued to stretch higher on Tuesday, possibly by attracting technical buyers after clearing $3,300. Nevertheless, hawkish remarks from Fed Chairman Powell at the European Central Bank’s (ECB) Forum on Central Banking helped the USD shake off the selling pressure and limited XAU/USD’s upside. Powell reiterated that, while the US economy remains solid, they are going to remain patient regarding policy easing and noted that they expect higher inflation readings over the summer.

The data published by Automatic Data Processing showed on Wednesday that employment in the private sector declined by 33,000 in June. This print missed the market expectation for an increase of 95,000 by a wide margin and weighed on the USD. In turn, XAU/USD edged higher and closed the third consecutive day in positive territory.

On Thursday, the US Bureau of Labor Statistics reported that Nonfarm Payrolls (NFP) rose by 147,000 in June, surpassing the market forecast of 110,000. Additionally, the Unemployment Rate declined to 4.1% from 4.2% in May.

The data, which showed the US labor market remains quite resilient, led to a sharp decline in bets for an interest-rate cut in July. The probability of a 25 basis points Fed rate cut later this month dropped to about 5% from nearly 20% ahead of the release of the upbeat labor market data, according to the CME FedWatch Tool.

The USD gathered strength as a result and caused Gold to erase a portion of its weekly gains. With the financial markets in the US remaining closed in observance of the July 4 holiday, Gold entered a consolidation phase on Friday.

Gold investors will keep a close eye on US trade talks

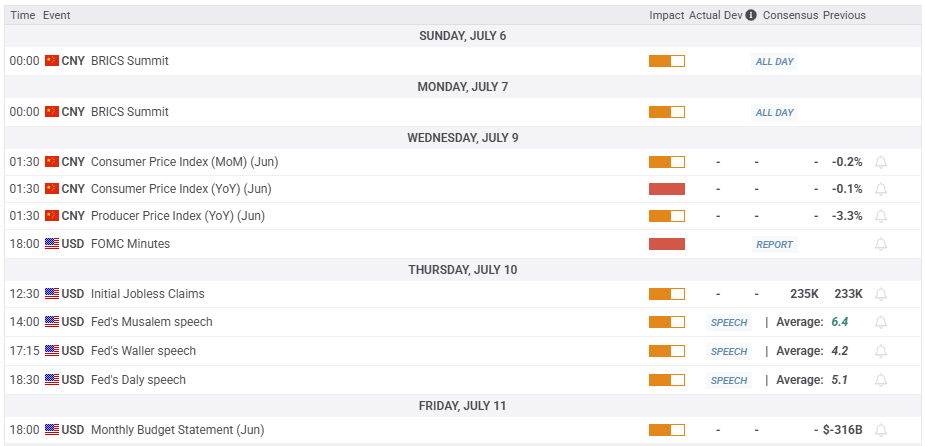

The economic calendar will not offer any high-impact data releases. On Wednesday, the Federal Reserve will publish the minutes of the June policy meeting. At this point, markets are largely convinced that the Fed will stay on hold in July and opt for a rate cut in September. Hence, this publication is unlikely to offer any fresh information that could cause markets to reassess the Fed’s rate outlook.

US President Donald Trump announced that they will start sending letters to trading partners from Friday, July 4, explaining the tariff rates they will face when the 90-day pause ends July 9. In case Trump’s team manages to finalize trade agreements ahead of the deadline, risk flows could dominate the action in financial markets.

This development could also ease fears over an economic downturn in the US. In this scenario, Gold could come under renewed selling pressure. Conversely, markets could turn cautious if they fail to reach a deal and Trump’s tariffs go into effect, especially on major trading partners such as the European Union, Canada and Japan.

Meanwhile, Hamas is reportedly moving closer to accepting a proposed deal for a ceasefire in Gaza. Earlier in the week, US President Trump claimed that Israel is ready to agree to a 60-day ceasefire and use that time to work on a final agreement to end the war. Israeli Prime Minister Benjamin Netanyahu is expected to meet with Trump on July 6 to discuss the war. If markets start the week with news of Israel-Hamas conflict ending, even if temporarily, Gold could turn south with the immediate reaction.

Gold technical analysis

Gold trades near the lower limit of the six-month-old ascending regression channel, currently located at $3,330, and the Relative Strength Index (RSI) indicator on the daily chart moves sideways near 50, reflecting a lack of directional momentum.

In case Gold drops below $3,330 and starts using this level as resistance, $3,285 (Fibonacci 23.6% retracement of the six-month-old uptrend) could be seen as the next support level before $3,185 (100-day Simple Moving Average) and $3,150 (Fibonacci 38.2% retracement).

On the upside, a static resistance level seems to have formed at $3,370 ahead of $3,400 (static level, round level) and $3,455 (static level).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.