Gold prices have been on the rise over the past several months, which has given a boost to stocks linked to gold mining. Rising geopolitical tensions, especially the ongoing tensions in the Middle East between Iran and Israel, with the United States now having joined the conflict, have been helping gold prices.

Given the current situation, investing in gold mining stocks such as Royal Gold, Inc. RGLD, Franco-Nevada Corporation FNV, Harmony Gold Mining Company Limited HMY and AngloGold Ashanti plc AU would be a wise decision. Each of these stocks carries a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

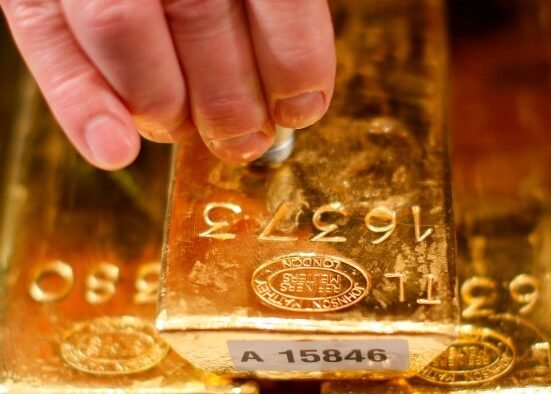

On Friday, spot gold hit $3,369.63 an ounce and is currently sitting above $3,300/ounce. The jump came as the United States attacked the nuclear sites of Iran on Sunday, joining the conflict between the Islamic Republic and Israel. This has given a boost to the demand for the yellow metal, which is often considered a safe haven.

The ongoing Middle East crisis isn’t acting as the only tailwind for the yellow metal. The three-year-long war between Russia and Ukraine has also been a catalyst for both spot and future gold prices.

Additionally, the World Gold Council recently said that the gold mining industry is struggling due to a shortage of the yellow metal. This is driving demand, and the central banks of several nations are buying gold at an aggressive pace as they are cutting interest rates in a bid to strengthen their economies.

Gold prices are likely to surge in the near term as demand for the yellow metal is also being driven by industries like healthcare and technology. Experts believe that the imbalance between demand and supply is likely to further boost gold prices, which could hit $4,000 an ounce by 2026.

Royal Gold, Inc., together with its subsidiaries, acquires and manages precious metals stream and royalty interests, with a primary focus on gold.

Royal Gold has an expected earnings growth rate of 35.9% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 9.3% over the past 60 days. RGLD currently sports a Zacks Rank #1.

Franco-Nevada Corporation operates as a gold-focused royalty and stream company with additional interests in silver, platinum group metals, oil & gas and other resource assets. FNV has a diversified portfolio of 54 producing assets consisting of four larger cash-flowing assets — Antamina, Antapaccay, Candelaria and Cobre Panama. It also has interests in 41 advanced assets (which are not yet producing) and interests in 223 exploration-stage mining properties.