Facing a severe liquidity crisis, Padma Islami Life Insurance – a concern of S Alam Group – has resorted to selling its fixed assets to settle a massive backlog of unpaid claims – a move aimed at restoring public trust in the company.

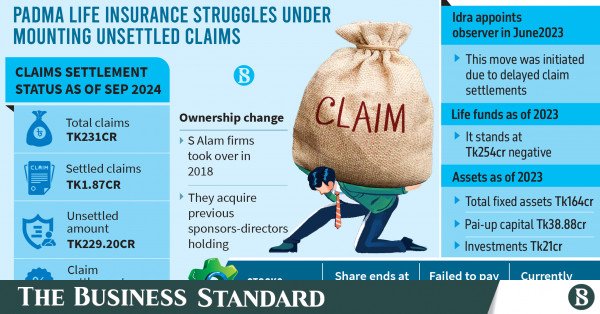

According to the Insurance Development and Regulatory Authority (Idra), the insurer had Tk229.20 crore in unpaid claims as of September 2024, representing 99.19% of its total claims.

Despite dues amounting to Tk231 crore, the company settled only Tk1.87 crore, leaving policyholders in limbo.

To address the crisis, the company secured Idra’s approval to sell its Cumilla-based assets, according to a Dhaka Stock Exchange (DSE) filing.

The firm’s 2023 annual report shows Tk164 crore in fixed assets and Tk21 crore in investments. However, its life fund remained negative at Tk254 crore, indicating it had exhausted policyholders’ funds – money meant to be repaid with profits upon policy maturity.

Due to the alarming volume of unsettled claims, Idra appointed an observer in 2023 to safeguard policyholders’ interests.

In a recent meeting with insurers, Idra and industry leaders emphasised that settling claims should be the top priority to restore confidence in the sector. They even recommended selling company assets if necessary to clear dues.

According to Idra, the total amount of insurance claims till September 2024 was Tk8,589 crore, of which Tk2,373 crore, or 28%, has been paid.

Of the total, the claim amount of life insurers was Tk5,449 crore, of which Tk2,058 crore has been paid. As such, around 62% of the claims remain unpaid.

In addition, the total claim amount of non-life insurers was Tk3,140 crore, of which Tk315 crore has been paid. Around 90% of the claims remain unpaid.

During a pre-budget discussion, National Board of Revenue Chairman Abdur Rahman Khan criticised insurers for treating policyholders’ premiums as personal funds – similar to how some banks misuse deposits.

“Insurance premium funds are public money and must be returned to the public. Misusing them has destroyed trust in the sector,” he said.

Ownership change

In October 2018, Padma Life’s board underwent restructuring following the transfer of 44.78% of its shares to S Alam Group’s sister concerns, including Pavilion International, Crest Holdings, Unitex LP Gas, Unitex Petroleum, and Affinity Assets.

However, there were already allegations of various irregularities and corruption against the previous owners of Padma Islami Life Insurance, which were stated as the reasons for its financial crisis at that time.

Padma Life’s Company Secretary Aktaruzzaman said earlier to The Business Standard that the company’s financial condition could not be improved mainly due to the negative impact of the country’s economy during Covid and the Russia-Ukraine war.

He also said the company’s life fund had become negative due to poor investments.

He explained that the company had bought land all over the country, and a lot of investment had to be made in the construction of Padma Life Tower. “And this money cannot be liquidated at will,” he added.

According to Padma Islami Life Insurance’s financial report, S Alam Group provided Tk154 crore as a loan to the company to cope with its financial crisis.

Padma Islami Life Insurance was listed on the stock exchanges in 2012 through an initial public offering by issuing 1.20 crore shares at a face value of Tk10 each.

Since 2018, when the S Alam Group took over, the company has managed to pay only a 2% cash dividend to shareholders in 2022.

Currently, it is traded under the Z category due to its failure to consistently declare dividends.

Its share closed at Tk25 on Monday at the Dhaka bourse.

According to DSE information, general shareholders held 50.02% of shares of Padma Islami Life Insurance as of February this year.