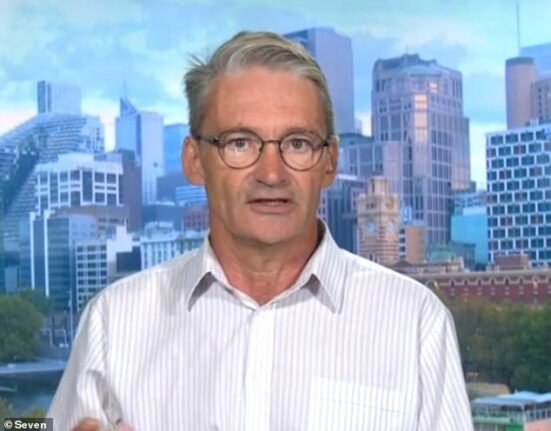

With interest rates moving, fixed-income assets are back in the spotlight—and retail investors are beginning to take notice. As the bond market matures and digital platforms drive accessibility, Aspero is emerging as a trusted bridge between opportunity and understanding. We caught up with Irfan Mohammed, CEO & MD of Aspero, to understand the dynamics shaping India’s bond ecosystem, the behavioural shifts among investors, and how Aspero is simplifying fixed-income investing for the masses.

Q1. RBI’s 50 bps repo rate cut and CRR reduction have created liquidity in the system. What’s your near-term outlook on the bond market?

Irfan Mohammed:

The bond market is clearly in a sweet spot right now. With the RBI slashing the repo rate by 50 basis points and reducing the CRR, yields on government and AAA-rated corporate bonds have already softened. For example, 10-year G-Secs are hovering around 6.3%, offering price appreciation opportunities for investors.

This is a good time to lock into high-quality bonds—sovereign or AAA to A+ rated corporate papers—which tend to perform well during periods of falling interest rates and carry lower default risks. In particular, short-duration bonds and funds are quick to react to rate cuts and are less sensitive to future volatility, making them a practical choice for investors seeking agility and stability.

Q2. Inflows into corporate bond funds have surged, even as FDs lose their sheen and equity markets remain volatile. Why are bonds becoming so attractive—and what should retail investors be cautious about?

Irfan Mohammed:

Retail investors are discovering the power of bonds—and the data supports it. Corporate bond funds saw inflows of nearly ₹11,983 crore in May, which shows growing awareness. With FD rates slipping below 6% and equity markets on edge, bonds offer a comforting balance of predictable income and lower volatility.

However, it’s not without its blind spots. Many retail investors underestimate risks such as credit quality (especially in high-yield bonds), interest rate sensitivity, or liquidity constraints. Bond pricing can also be opaque compared to stocks or FDs. That’s why a basic understanding of key concepts—like yield-to-maturity, duration, and credit ratings—is essential. Financial literacy is the foundation of smart fixed-income investing.

Q3. There’s been a shift in tax parity between debt mutual funds and bonds. What changes would you like to see to make bonds more compelling for new investors?

Irfan Mohammed:

Yes, with the tax arbitrage removed, both debt mutual funds and bonds are now on a level playing field tax-wise. But bonds still face friction—poor liquidity, limited access, and complexity in disclosures make them less attractive compared to MFs, which have investor familiarity on their side.

To accelerate bond adoption, we need structural reforms. A market-making mechanism for top-rated bonds can improve liquidity and price discovery. Reintroducing long-term indexation or a separate tax exemption bucket for listed debt securities could also encourage long-term participation. With the right ecosystem and policy support, bonds could become the go-to choice for India’s growing mass-affluent segment.

Q4. Indian investors still rely heavily on wealth managers for bond investments. Are you noticing any behavioural shifts? How is Aspero supporting this transition?

Irfan Mohammed:

There’s a gradual but noticeable shift. While wealth managers still play a key role—especially when it comes to understanding term sheets, covenants, and credit risks—we’re seeing more retail investors experiment with DIY investing, especially in low-risk, smaller-ticket instruments like G-Secs or AAA-rated bonds with ticket sizes starting at INR 10,000.

At Aspero, we’ve built two tailored platforms. For individual investors, our mobile app (on Android and iOS) simplifies bond discovery, research, and transactions. For institutional investors and corporates, we provide a high-efficiency platform with bulk transaction capabilities and access to deep research. We’re also expanding our presence in Tier 2 markets to stay close to the investor base that’s growing fastest.

Q5. Trust is key in financial services—especially for newer asset classes like bonds. How is Aspero building this trust, both technically and through user experience?

Irfan Mohammed:

Trust is everything, especially in financial products that require investor education. At Aspero, we blend compliance, transparency, and human support to build long-term credibility.

We’re a SEBI-registered Online Bond Platform Provider (OBPP), and are fully integrated with both BSE and NSE. We recently achieved SOC 2 Type 2 certification—an important marker of data security, privacy, and operational reliability. We also run monthly investor webinars, share real-time issuer updates, and offer direct support via call-backs and chat features. While many rely solely on AI, we’ve retained human advisors because trust is built through conversations.

Q6. What fixed-income strategy do you recommend today to investors looking to balance safety and returns in a volatile environment?

Irfan Mohammed:

Given the current rate cut cycle and macro uncertainty, I’d recommend a layered allocation model that balances credit quality, liquidity, and opportunistic returns. A suggested mix could be:

- 10% in ultra-liquid instruments (liquid/money market funds to cover short term needs)

- 30% in short-term AAA/AA rated corporate bonds (which offer stability if yields unexpectedly rise)

- 30% in medium-term bonds (3–7 years) to capture the benefits of the recent rate cuts while avoiding excessive duration risk

- 20% in target maturity funds (aligned to specific cash flows)

- 10% in dynamic or gilt funds (run by managers with proven rate-timing expertise so you can enhance returns in response to further policy moves)

This diversified portfolio helps manage duration risk, cushions against volatility, and still offers alpha potential when the yield curve shifts.

Q7. What new features has Aspero introduced to simplify fixed-income investing—especially for those new to bonds?

Irfan Mohammed:

We’re innovating constantly to make bond investing as intuitive as possible. A few highlights:

- We were the first to enable HUF investments on an online bond platform, addressing the needs of family-based investors.

- Our 5-minute, zero-upload KYC is among the fastest in the industry.

- We now offer higher yields on bulk bond purchases for seasoned users and have added high-return FDs as an easy entry point for beginners.

- UPI support (up to ₹2 lakh), an interactive portfolio dashboard, and simplified bond filters make the experience seamless.

- We’re also working on a ‘family portfolio view’, demat integration, and launching a Fixed Income Academy within our app to educate users continuously.

Conclusion:

As India’s retail investment landscape continues to mature, platforms like Aspero are helping decode fixed-income products and making them accessible, trustworthy, and rewarding. Whether you’re a first-time bond buyer or an institutional investor, Irfan Mohammed’s vision for a smarter, safer fixed-income future is steadily taking shape—one informed investor at a time.