If the government’s inheritance tax rules come into force as expected, this will mark a significant change in how advised clients access their pension pots, a senior spokesperson for BNY Investments has warned.

Speaking to FT Adviser ahead of the launch of the company’s Shaping Tomorrow’s Portfolios report, Michael Beveridge, UK head of intermediary distribution at BNY Investments, said advisers were “demanding” greater innovation in fixed income strategies for retirement.

This has been driven by multiple factors, especially the recent proposed changes to the IHT regime.

More and more clients are asking advisers whether they should take higher levels of income earlier on in retirement, despite the potential impact of sequencing risk on the remaining investments, simply to offset the impact of IHT on the remaining pension pot.

He said: “Advisers are currently telling clients ‘don’t do anything; wait til the proper rules come out’, while planning what to do when they do.

“If the IHT changes do play out as proposed in 2027, I think we will see a sea-change in the way people go to their retirement assets.

“A lot of people who would have previously gone for growth and left the pension pot to the family are now needing much more of a strategy, and advisers are already having these conversations with clients.”

He said this concern was ‘coming out’ in the BNY Investment’s 31-page report, which was based on interviews with 125 UK financial advisers, and carried out by NMG Consulting on behalf of BNY Investments.

The report aimed to explore changes and patterns in the ways in which advisers have been using fixed income funds within client portfolios, and the reasons behind investment allocation decisions.

Beveridge said while the rules could still change, and advisers are currently urging clients not to make changes now, “the shift has created new demands for fixed income solutions.

“Where previously advisers might have recommended leaving pension assets untouched for IHT purposes, they are now having conversations about earlier withdrawal strategies.”

The report found the proposals have already “fundamentally altered client behaviour”.

One adviser was quoted as saying: “Mr & Mrs Smith are just about to retire and have £1mn in cash and £1mn in pension and they have kids, now we are thinking – you might as well draw the pension efficiently.”

A heavy percentage of IFAs who had previously said ‘we would never touch the pension’ are now having to rethink all the advice.

Another said: “If my kids are going to be paying 40 per cent when I die, I don’t mind paying 20 per cent on my pension withdrawals.”

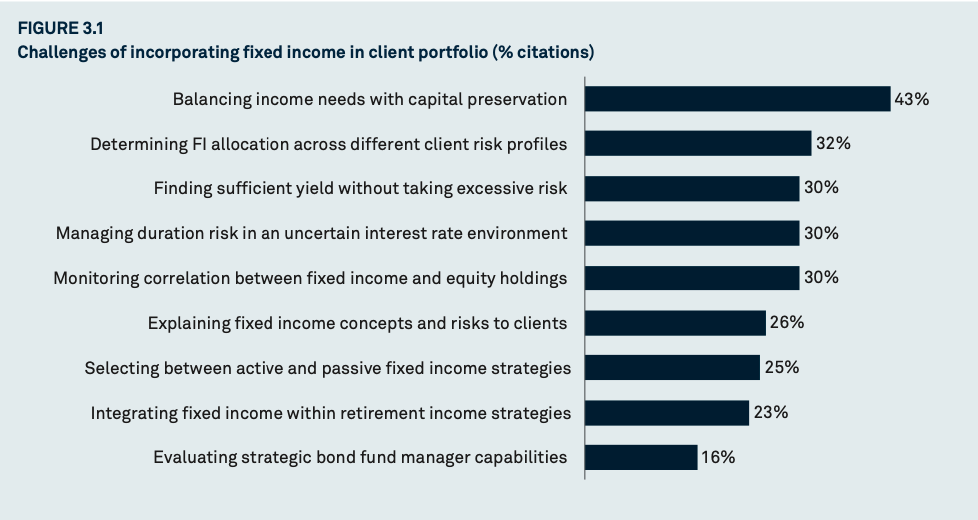

The dichotomy is, of course, how to balance the demand for income strategies – largely using fixed-income funds – and concerns about the “very volatile geopolitical environment, sequencing risk and inflation.”

As a result, 33 per cent of advisers in the research said this changing dynamic had made it more important to have innovation in fixed income, providing more secure income solutions for clients.

Instead of purely allowing income generation within a tax band, clients are asking advisers about different types of cash flow solutions that could support structured, personalised, withdrawal strategies.

Innovation

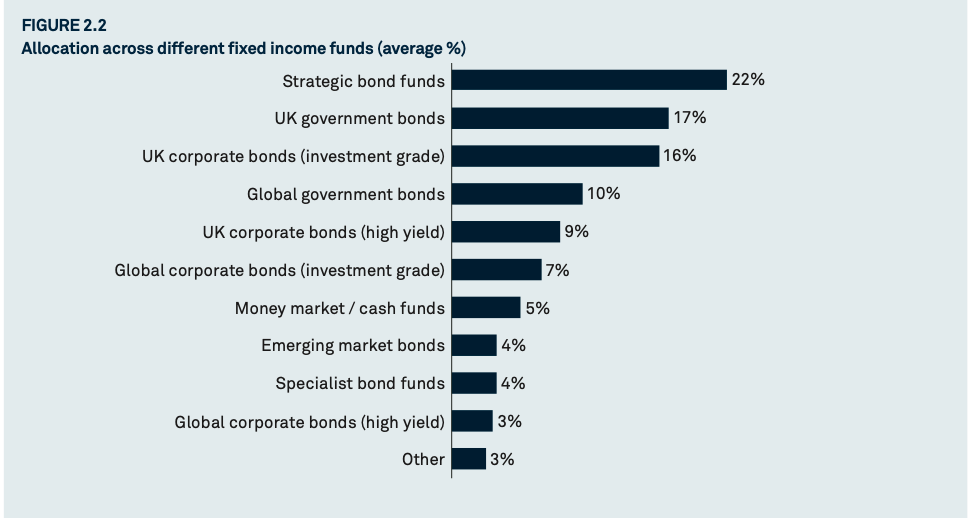

Beveridge pointed to page 10 of the report, which showed a rising trend for advisers using strategic bond funds in greater number in fixed income allocations.

According to the report, 22 per cent of direct fund allocations from advisers are now towards strategic bonds. Advisers in the study cited reasons such as manager’s ability to invest flexibly across the range of fixed-income issuance.

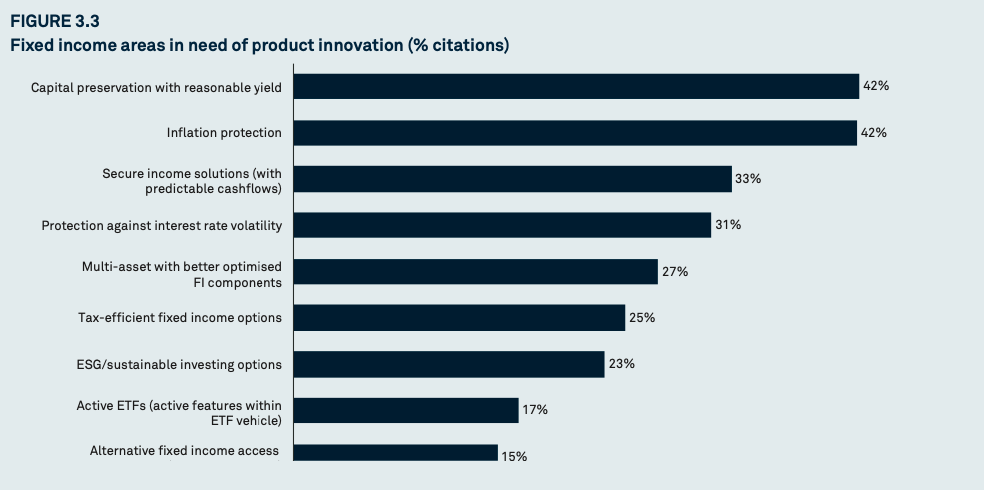

Michael said the report’s findings were pointing to a general theme of “demand for innovation in fixed income” among advisers and their clients.

This was not least because of the changing shape of retirement, a need to balance income needs with capital preservation, and managing duration risk in an increasingly uncertain economic environment.

He explained: “Pension freedom has generated significant demand for retirement advice, but we are quickly moving from retirement savings providing top-up income to generous defined benefit pensions to them being the mainstay of a client’s retirement income.”

According to the report, these shifts has been driving demand for strategies that can generate attractive levels of income while preserving capital.

He said: “It’s trying to match the needs of the client. I would say that a heavy percentage of IFAs who had previously said ‘we would never touch the pension’ are now having to rethink all the advice.

“If the IHT changes come in – and it is an if – we will have to be much more thoughtful of protecting that income, especially over the first seven years to avoid that sequencing risk.”

Regulation also plays a part in advisers making higher allocations to different types of fixed-income assets, the report said, which means in the future, providers will need to think about how to give advisers more innovation to meet client needs.

Beveridge commented: “Advisers also have the Retirement Income Advice review from the FCA about good practice in cash flow modelling, so there will have be more innovation in fixed income to meet these needs.”

Interest rate environment

In the immediate term, however, the report showed that interest rate concerns were still the predominant driver of current allocation decisions among advisers and wealth managers towards fixed income.

The report found:

-

55 per cent of advisers cited interest rates as the most important driver of fixed income allocation changes.

-

43% per cent were concerned with inflation expectations

-

42 per cent said decisions were being made based on relative value compared to other asset classes.

Only 30 per cent said the yields themselves were the main driver of higher asset allocation decisions towards fixed income funds.

Beveridge said there was a “lot of product” out there for advisers to choose from, ranging from fixed income ETFs to more strategic bond funds.

“There’s a lot of chatter online about ETFs but I think it will be more perhaps about trying to work out the individual’s decumulation journey to find something more akin to and aligned to that.

“We think people will try to make this more seamless, especially for the first seven years, and providers will have to come up with solutions for that decumulation journey. I think this is how it will evolve.”

He added the “dream scenario” is to make the retirement investment journey more individual for each clients.

Regardless, Beveridge said: “It will be an interesting time over the next couple of years. IFAs will be really busy – people really need this advice.

“It is a big decision and something that people will need to get right.”

The full report can be viewed on BNY Investments’ adviser page.