It has been a rocky road for fixed income investors recently, with rising inflation in 2022 leading to a swift sell-off for the asset class.

The persistence of inflation in most developed countries has prevented the sort of rapid progress in bond prices many may have hoped for as rates were cut.

We now enter a new world where, after Donald Trump’s ‘liberation day’, uncertainty surrounds even US government bonds.

But throughout the journey, three themes have remained constant for those exposed to that market.

The first is that for most of the period since the global financial crisis, duration has dominated bond market returns. If your fund manager got it wrong on rates, then no amount of security selection would have compensated.

Whether duration will be as big a driver in fixed income markets going forward remains to be seen.

The second factor has been the tightness of high-yield bond spreads over the past year or two, even as investors expected the US economy’s growth rate to slow down.

But the slowdown didn’t happen, and the sentiment expecting such an outcome didn’t dent high-yield bond prices, the asset class within fixed income most sensitive to changes in the economic cycle.

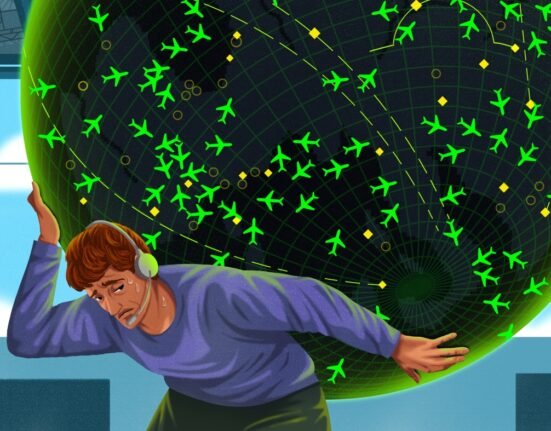

The third element has been the elevated volatility associated with government bonds, an asset class usually owned to dampen volatility.

Darius McDermott, who runs the VT Chelsea range of multi-manager funds, says he has reduced his government bond exposure as he is concerned the traditional, defensive role of US government bonds in particular has diminished.

That’s a theme taken up by Phil Milburn, fixed income fund manager at Liontrust, who says the public policy uncertainty has led to a change in how the market views US government debt — though he is still keen on the asset class and is of the opinion it can still perform the role of diversifier in most market conditions.

He says the impact of this is public policy uncertainty being most profoundly felt at the longer end of the yield curve, where the extra yield investors are demanding in exchange for lending for longer, known as the term premium, has risen sharply.

Duration

Milburn’s view is that duration will continue to play an outsized role in bond fund performance because the monetary policy outlook remains opaque.

He has invested at the short-end of the curve for his US government bond exposure and slightly longer for Eurozone bond exposure as he is more confident rates will be cut in the economic block.