Food Product Machinery Market

Dublin, Feb. 19, 2025 (GLOBE NEWSWIRE) — The “Food Product Machinery Market Opportunities and Strategies to 2033” report has been added to ResearchAndMarkets.com’s offering.

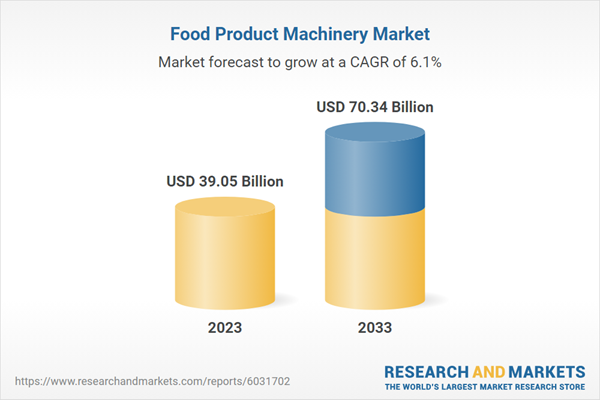

The global food product machinery market reached a value of nearly $39 billion in 2023, having grown at a compound annual growth rate (CAGR) of 4.7% since 2018. The market is expected to grow from $39 billion in 2023 to $53.8 billion in 2028 at a rate of 6.6%. The market is then expected to grow at a CAGR of 5.5% from 2028 and reach $70.3 billion in 2033.

The global food product machinery market is fairly fragmented, with a large number of small players operating in the market. The top ten competitors in the market made up to 14.90% of the total market in 2023. Marel was the largest competitor with a 4.09% share of the market, followed by John Bean Technologies Corp. (JBT Corporation) with 2.13%, Heat and Control Inc. with 2.02%, The Middleby Corporation with 1.85%, GEA Group AG. with 1.43%, Duravant with 1.00%, Alfa Laval AB with 0.76%, Interfood Technology Ltd with 0.67%, Illinois Tool Works Inc. with 0.54% and Sumitomo Heavy Industries Ltd. with 0.40%.

Market-trend-based strategies for the food product machinery market include focus on enhancing protein mixing efficiency to reduce product loss in food and beverage manufacturing, advanced baking technologies to enhance biscuit production, adopting cloud-based solutions for continuous monitoring and proactive maintenance, introducing tool-free valves for efficient liquid and steam control in food applications and pursuing strategic partnerships and collaborations.

Growth in the historic period resulted from the increased disposable income per capita, strong economic growth in emerging markets, increased consumption of bakery and dairy products and increased consumer preference for ready-to-eat meals. Factors that negatively affected growth in the historic period include shortage of skilled workforce.

Going forward, the increasing urbanization, expansion of the e-commerce industry, increasing demand for processed and packaged foods, government incentives for food processing sectors and growing food and beverage sector will drive the growth. Factors that could hinder the growth of the food product machinery market in the future include high costs associated with food products machinery.

The food product machinery market is segmented by type into dairy product plant machinery and equipment, bakery machinery and equipment, meat and poultry processing and preparation machinery, and other commercial food products machinery. The meat and poultry processing and preparation machinery market was the largest segment of the food product machinery market segmented by type, accounting for 33.9% or $13.2 billion of the total in 2023. Going forward, the bakery machinery and equipment segment is expected to be the fastest growing segment in the food product machinery market segmented by type, at a CAGR of 7.6% during 2023-2028.

The food product machinery market is segmented by product into depositors, extruding machines, mixers, refrigerators, slicers and dicers, and other products. The depositors market was the largest segment of the food product machinery market segmented by product, accounting for 25.1% or $9.8 billion of the total in 2023. Going forward, the depositors segment is expected to be the fastest growing segment in the food product machinery market segmented by product, at a CAGR of 7.5% during 2023-2028.

The food product machinery market is segmented by capacity into small, medium, and large. The medium market was the largest segment of the food product machinery market segmented by capacity, accounting for 50% or $19.5 billion of the total in 2023. Going forward, the large segment is expected to be the fastest growing segment in the food product machinery market segmented by capacity, at a CAGR of 7.3% during 2023-2028.

The food product machinery market is segmented by operation into autonomous, semi-autonomous, and manual. The autonomous market was the largest segment of the food product machinery market segmented by operation, accounting for 41% or $16 billion of the total in 2023. Going forward, the autonomous segment is expected to be the fastest growing segment in the food product machinery market segmented by operation, at a CAGR of 7.3% during 2023-2028.

Western Europe was the largest region in the food product machinery market, accounting for 43.6% or $17 billion of the total in 2023. It was followed by Asia-Pacific, North America and then the other regions. Going forward, the fastest-growing regions in the food product machinery market will be South America and Africa, where growth will be at CAGRs of 21.28% and 13.37% respectively. These will be followed by the Middle East and Asia-Pacific, where the markets are expected to grow at CAGRs of 12.58% and 6.48% respectively.

The top opportunities in the food product machinery market segmented by type will arise in the bakery machinery and equipment segment, which will gain $5.8 billion of global annual sales by 2028. The top opportunities in the food product machinery market by product will arise in the depositors segment, which will gain $4.3 billion of global annual sales by 2028. The top opportunities in the food product machinery market by capacity will arise in the medium segment, which will gain $7.2 billion of global annual sales by 2028. The top opportunities in the food product machinery market by operation will arise in the autonomous segment, which will gain $6.7 billion of global annual sales by 2028. The food product machinery market size will gain the most in Argentina at $1.6 billion.

To take advantage of the opportunities, the analyst recommends the food product machinery companies to focus on enhancing mixing efficiency, focus on advanced baking technologies, focus on cloud-based solutions, focus on tool-free valves for enhanced efficiency, focus on bakery machinery and equipment segment, focus on extruding machines for growth, focus on large machinery, focus on autonomous machinery segment, expand in emerging markets, focus on strategic partnerships for innovation, provide competitively priced offerings, continue to use B2B promotions, participate in trade shows and events and focus on building strong relationships with end-users.

Key Attributes: