[HONG KONG] There is “undoubtedly” value in Chinese equities, and within Asia, China is where asset management giant Fidelity International sees some of the best opportunities.

In particular, the best value can be found in “some of the more boring areas”, such as beer producers in the consumer staples space and machine-tooling companies in the industrials sector.

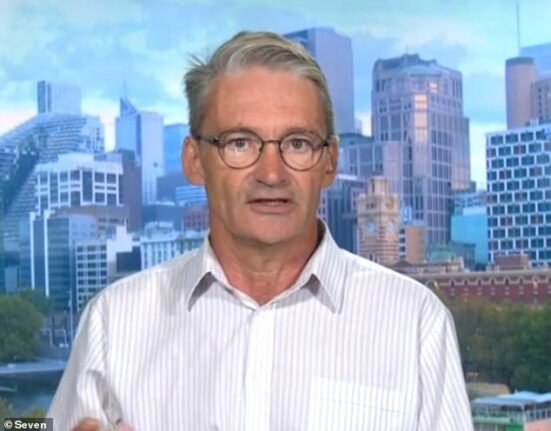

Making these points was Stuart Rumble, head of investment directing for the Asia-Pacific at Fidelity, in an interview with The Business Times.

He was speaking to reporters in Hong Kong on Jul 4, the day after the asset management firm’s Asia-Pacific Media Investment Conference.

On a historical basis, Chinese equities are trading at valuations that are well below long-term averages, and investors are heavily underweight on their allocations there, he noted.

Part of this reticence could stem from the “really important caveat” that there has been “a lot of dispersion” in earnings.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

He said: “You’ve seen earnings revisions – up for the tech companies, e-commerce companies; (and) you’ve seen it go down for areas like property, energy and, to an extent, utilities.”

Sectoral picks

Some of Rumble’s investment picks on a sectoral basis include beer producers, some of which are trading at “really cheap” valuations.

China’s top beer producers include Tsingtao Brewery, maker of the eponymous lager, and China Resources Beer, which produces the Snow brand.

“Some of these consumer staple products are (those) with pricing power – they have been around for a long time, (and) people will continue to buy them,” he explained.

Chinese sportswear is another “interesting” investment category “for the long term”, as it is a business that is benefiting from different consumption patterns and there are counters at “reasonable” valuations.

“Companies like Anta and Li-Ning have had a period of strong growth, and then a little bit of a pullback in this period of weaker consumer spending,” he noted.

“But they are getting a better control on their costs and optimising their store and product mix, and they’re benefiting from things like (Chinese consumers) buying local brands.”

The Chinese sportswear sector is also “hugely unpenetrated” compared to developed markets, noted Fidelity investment analyst Alex Dong in a separate briefing on Jul 3.

For instance, mainland Chinese spending on sportswear stands at less than US$50 per capita, compared with almost US$300 per capita in Hong Kong.

“Basically, you get six times upside for the consumption”, though this could take “a very, very long time to realise”, said Dong.

Chinese consumers are also pursuing a “much healthier” lifestyle post-pandemic, and the total number of sports shoes sold in China in 2024 totalled some 400 million pairs, less than a third of the country’s population of 1.4 billion people.

On the industrial front, there is still a lot of potential for automation within factories in China, noted Rumble – which means opportunities for machine toolers.

While a Western company is still the dominant market player in that space, some Chinese brands are already taking market share, he said, “because they can deliver products just as good; their manufacturing is now market-leading; they’re doing it for a cheaper cost; and they’re localised”.

On investment picks, Rumble and Dong did not name firms, in line with company policy.

Pop Mart’s outperformance

But one counter that was brought up during the interview was Labubu-maker Pop Mart, a company whose share price has shot up more than 180 per cent year to date.

The Hong Kong-listed toymaker has been a hot topic within the firm internally because of its outperformance, but it is fundamentally “a stock of a product that kind of divides opinion”.

Said Rumble: “At the moment, it’s popular with some segments of the consumer, but certainly not all.”

Toy characters also go in and out of favour, even for globally recognised icons such as Hello Kitty, which has had moments of lower popularity, he said.

“The tricky thing is, although (Pop Mart is growing its) business and its addressable market certainly can still grow, you’re paying a lot of money for that future growth,” he added.

“We’re watching it, and we’re waiting to see.”