Borders residents are calling for better access to cash as fears grow that older people are being left behind by modern technology.

Margaret Carey, 90, from Ayton, does not have access to a cash machine in her village. The 90-year-old has to travel by bus to the Post Office in Eyemouth.

Margaret said: “I can do bank transfers, I’ve done those. But there are still quite a few occasions when cash is needed, so you do have to go there. And then occasionally you might receive a cheque and that has to go to a Post Office to be paid in – it’s not easy.

“I’m going around some of the local community councils explaining the situation to them and asking them to join me in agitating.

“I’m calling myself a little border terrier, and I’m going to be nipping at the heels of these politicians.”

The company LINK works to create access to money through an ATM network.

Margaret has been campaigning for a banking hub, but LINK believes the current local provision is enough.

Scottish Borders Cllr James Anderson says the organisation needs to do more.

“I know they base it on older figures and statistics, but in a rural setting where the population is substantially higher for people in later life – it’s just not fair.”

Nick Quin, Chief Corporate Affairs Officer at LINK, admits there have been some “reliability issues” but believes cash access is “sufficient” in Eyemouth. The organisation say they have opened 30 banking hubs across Scotland.

He said: “[They] have the capacity to deal with access to cash needs. Yes, there have been reliability problems, but we do see that would make sense from time to time.

“But what generally happens is the engineers get out there pretty fast and get it working again because of that commercial incentive for them to do so.

“We will keep looking at Eyemouth and make sure that that is happening. But we’re confident based on the assessments we’ve done, that the access cash there is sufficient.

“And there is a key bit of context here, which is there’s still millions of people reliant on cash, but since Covid withdrawals in Scotland have gone down by 50%.”

Sellers from the farmers market in Selkirk say they also experience repeated issues with ATMs.

One woman said: “It’s down again, it’s so frustrating. We only have one cash machine in Selkirk and when it’s down, it really inconveniences cash-only businesses.”

Another seller said: “People that know us know that we only take cash, so they bring cash and other people some have cash, a lot don’t. And they’ll either go away and look for it or I’ll lose the sale.”

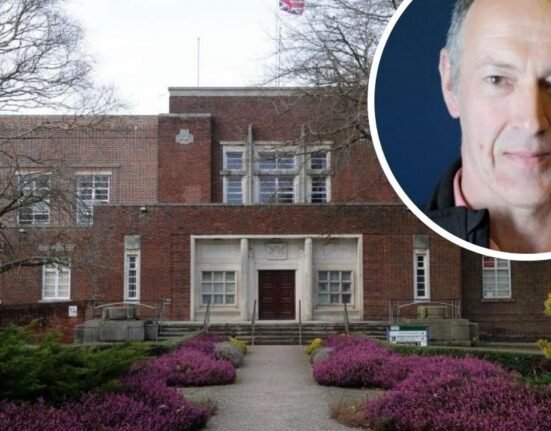

Cash Access UK, based in Jedburgh, opened in July 2024 to help meet the demand after previous bank branches closed down. Lesley Wilson, from Cash Access UK, said: “It provides a safe, welcoming space, not only for your older population, but also your vulnerable customers as well.

“It gives in the time to access cash at a time when it suits them between Monday and Friday, 9 to 5, and also if they need to – they don’t have to travel to the nearest branch. They can come here and speak to their community banker.”

Rachael Hamilton, Conservative MSP for Ettrick, Roxburgh and Berwickshire, says the criteria for banking hubs need to recognise rural towns.

She said: “It is very frustrating because it’s a criteria that is set around the banking hubs and access to cash. And I want to be able to try to change that criteria that recognises the rural rurality of some of the border towns, such as Eyemouth, Hawick, and Selkirk.”

Want a quick and expert briefing on the biggest news stories? Listen to our latest podcasts to find out What You Need To Know…