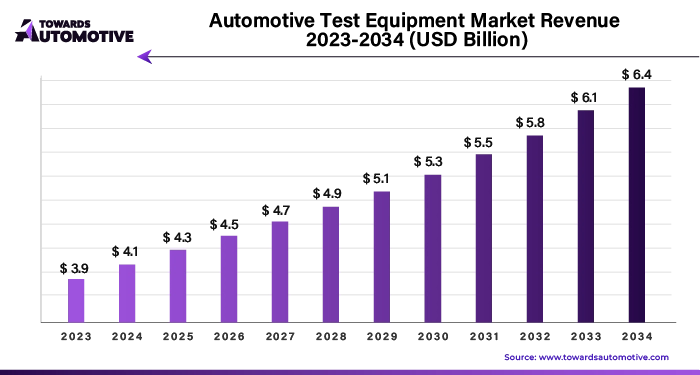

Ottawa, Aug. 29, 2024 (GLOBE NEWSWIRE) — The automotive test equipment market size is predicted to increase from USD 3.9 billion in 2023 to approximately USD 6.1 billion by 2033, according to a study published by Towards Automotive a sister firm of Precedence Research.

Key Takeaways:

- In 2023, North America led the automotive test equipment market, while Asia Pacific is anticipated to grow significantly during the forecast period.

- Engine dynamometers were the leading product type in the automotive test equipment market in 2023, and the passenger car segment is expected to experience significant growth.

- PC/Laptop-based equipment dominated the market in 2023, and the focus on electric vehicle testing includes battery, motor, and power electronics testing.

- Passenger car exports were 662,891 units in 2023, while commercial vehicle exports were 78,645 units.

- The engine dynamometer market is driven by advanced technologies, electric vehicle testing, and expansion into emerging markets.

Download a short version of this report @ https://www.towardsautomotive.com/insight-sample/1319

The Evolution of Automotive Testing Equipment: Adapting to the Future of Vehicles

As the automotive industry quickly advances with the growth of electric vehicles (EVs) and self-driving technology, there is a rising need for advanced testing tools. These tools are essential for checking the performance, efficiency, and safety of various vehicle components. Developing these sophisticated testing solutions is key to addressing the unique challenges posed by new technologies. The automotive market size valued at USD 4,070.19 billion in 2023, is growing and expected to exceed USD 6,678.28 billion by 2032, with a strong CAGR of over 5.66%.

Automotive Test Equipment Market Top Companies

- Delphi Technologies

- Robert Bosch GmbH

- Continental AG

- DENSO

- ABB Ltd.

- Honeywell

- Siemens

- Softing

- Horiba

- SGS

- Vector

Competitive Landscape and Market Updates

Key players in the market are making substantial investments in research and development to drive innovation and improve performance. Their focus is on developing advanced technologies with better tolerance and efficiency across various applications. This includes enhancing equipment materials, refining design techniques, and optimizing manufacturing processes.

To stay ahead of the competition, these companies are forming strategic partnerships with start-ups and technology providers. These collaborations enable them to explore new markets, share expertise, and co-develop innovative solutions. By prioritizing regulatory compliance and obtaining necessary certifications, they ensure their products meet industry standards for reliability and durability.

Additionally, companies are placing a strong emphasis on customer support. They offer tailored solutions, comprehensive training, and technical assistance to address specific customer needs effectively. By staying at the forefront of technological advancements and engaging in strategic partnerships with research institutions and technology providers, these companies foster knowledge sharing, access to new markets, and joint research initiatives. This approach helps them develop competitive products that cater to the evolving needs of various applications.

AVL’s New Hydrogen and Fuel Cell Testing Facility

- In September 2023, AVL, based in Austria, inaugurated a state-of-the-art hydrogen and fuel cell testing facility in Graz. This new facility is designed to support the development and testing of advanced hydrogen technologies, aiming to enhance the efficiency and performance of fuel cell systems.

Applus+ Acquires K2 Ingeniera

- In 2023, Applus+, a prominent Spanish company, expanded its portfolio by acquiring K2 Ingeniera, an environmental consulting firm based in Colombia. This acquisition is expected to strengthen Applus+’s position in the environmental sector and broaden its consulting capabilities.

Testing Equipment for Electric Vehicles

With the surge in electric vehicle (EV) adoption, there is an increasing demand for specialized testing tools. These tools are designed to evaluate critical EV components, including batteries, motors, and power electronics. Battery testing equipment measures performance aspects such as energy storage capacity, charging cycles, and temperature management. Motor testing solutions assess efficiency, torque, and power, often under various load conditions. Power electronics testing tools focus on inverters, converters, and other components to ensure they meet both performance and safety standards.

Advanced Testing for Autonomous Vehicles

Autonomous vehicles require highly sophisticated testing equipment to simulate diverse driving scenarios. Hardware-in-the-Loop (HIL) testing systems integrate actual vehicle components with simulations to evaluate control systems and algorithms in real time. Software-in-the-Loop (SIL) testing uses simulations to assess software algorithms without the need for physical hardware. Sensor simulation tools recreate real-world conditions to test crucial sensors, such as cameras, radar, and LiDAR, which are essential for autonomous driving.

Integrating IoT and AI in Automotive Testing

The integration of Internet of Things (IoT) and artificial intelligence (AI) is transforming automotive testing. IoT connectivity facilitates remote monitoring and control of testing tools, enabling real-time data collection and analysis. AI-driven predictive maintenance analytics can forecast potential equipment issues before they occur, minimizing downtime and enhancing efficiency. Additionally, AI algorithms optimize testing processes by analyzing data to refine testing procedures and improve accuracy.

Emphasis on Safety Testing

Safety remains a critical focus in automotive testing, with an emphasis on various safety aspects. Crash testing equipment is used to simulate and analyze vehicle collisions to ensure compliance with safety standards. Passive safety testing evaluates features such as airbags, seatbelts, and crumple zones. Advanced Driver Assistance Systems (ADAS) testing tools are employed to verify the functionality and effectiveness of these systems, aiming to enhance overall vehicle safety.

Modular and Flexible Testing Solutions

Automotive manufacturers are increasingly adopting modular and flexible testing solutions to accommodate evolving needs. These solutions offer scalability, allowing adjustments to testing equipment as vehicle development progresses and requirements change. Modular platforms can be customized to meet specific testing needs, supporting a wide range of scenarios and industry demands, thus ensuring adaptability and efficiency in the testing process.

Get the latest insights on automotive industry segmentation with our Annual Membership @ https://www.towardsautomotive.com/get-an-annual-membership

AI Integration: Driving Growth in the Automotive Test Equipment Market

The integration of Artificial Intelligence (AI) into the automotive test equipment market is poised to revolutionize the industry by enhancing efficiency, accuracy, and innovation. AI-driven systems can automate complex testing procedures, reducing the time and human error associated with manual processes. This leads to faster development cycles and improved product quality, which are crucial in a highly competitive automotive market.

AI can analyze vast amounts of data from test results to identify patterns and predict potential issues before they occur, enabling proactive maintenance and minimizing costly recalls. The use of AI also allows for more sophisticated simulations and modeling, providing insights that were previously unattainable. As automotive technology continues to evolve, particularly with the rise of electric and autonomous vehicles, the demand for advanced test equipment that can keep pace with these innovations is expected to grow.

AI integration will not only enhance the capabilities of test equipment but also drive market growth by meeting the increasing need for precision and speed in automotive testing processes.

Understanding the Supply Chain in the Automotive Test Equipment Market

In the automotive test equipment market, the supply chain is a crucial component that ensures the efficient delivery of high-quality products to end users. The supply chain begins with raw material suppliers, who provide essential components such as electronics, sensors, and mechanical parts. These materials are then passed to manufacturers who design and assemble automotive test equipment like dynamometers, emission testing systems, and diagnostic tools.

Once the equipment is produced, it is typically distributed to wholesalers or directly to end-users, which include automotive manufacturers, repair shops, and testing facilities. Distribution channels may also involve logistics providers who manage the transportation, storage, and timely delivery of these products.

To maintain a seamless supply chain, companies often rely on robust demand forecasting and inventory management practices to prevent bottlenecks or shortages. Additionally, collaboration with reliable suppliers and technology partners is essential for meeting industry standards and ensuring the timely rollout of advanced test equipment. As the market evolves with innovations in automotive technology, the supply chain must remain agile, adapting to new demands while minimizing costs and maintaining product quality.

Understanding the Key Components and Contributors in the Automotive Test Equipment Market Ecosystem

The automotive test equipment market is a critical segment of the automotive industry, comprising various specialized tools and systems designed to ensure vehicle performance, safety, and compliance with regulatory standards. Key components of this market include engine dynamometers, chassis dynamometers, vehicle emission test systems, and tire testing equipment, among others. These components are essential for assessing the mechanical and electronic functionality of vehicles, ensuring they meet required safety and environmental standards.

Various companies contribute to the ecosystem by offering innovative solutions that cater to different aspects of vehicle testing. Major automotive manufacturers often collaborate with specialized test equipment providers to develop custom solutions tailored to specific vehicle models. Companies like Bosch, ABB, and Horiba are prominent players, offering advanced testing systems that incorporate cutting-edge technologies such as AI and IoT for real-time data analysis and diagnostics.

Additionally, software providers enhance the functionality of testing equipment by integrating sophisticated data management and analysis tools, ensuring comprehensive evaluation and reporting. Together, these contributors create a dynamic ecosystem that supports the continuous advancement of automotive technology and ensures the production of safe, reliable vehicles.

The automotive test equipment market is experiencing several key trends:

- Growing Focus on Environmental Testing: As environmental concerns increase, there’s a rising demand for automotive test equipment that assesses the environmental impact of vehicles. This includes tools for emissions testing to meet regulatory standards and testing equipment to evaluate the sustainability of vehicle components. The push for greener technologies and stricter regulations is driving the need for more advanced testing solutions.

- Industry 4.0 Transforming Automotive Testing: The automotive industry is quickly adopting Industry 4.0 technologies, which involve automation, data exchange, and smart technologies. This includes digital twins—virtual models of physical systems that allow for real-time monitoring and analysis—predictive analytics to anticipate issues before they occur, and cloud-based testing platforms that offer greater flexibility and scalability. These innovations aim to make testing more efficient, productive, and effective.

- Focus on Cost-Effective and Efficient Testing: Automotive manufacturers are increasingly looking for testing solutions that save time and reduce costs. This has led to the development of new testing methods and technologies that streamline the process without compromising quality. Efficient and cost-effective testing solutions are in high demand as manufacturers aim to stay competitive in a fast-changing market.

- High Initial Costs Pose Challenges: One of the major challenges in the automotive test equipment market is the high upfront cost of acquiring advanced testing technologies, especially for specialized areas like electric vehicles (EVs) or autonomous systems. These high costs can be a barrier for smaller companies or those in emerging markets, making it difficult for them to invest in the latest equipment.

- Compliance with Strict Testing Standards: The automotive industry must adhere to strict testing standards and regulations, which can vary by region. Meeting these standards requires sophisticated equipment and expert knowledge. This adds complexity and cost to the testing process, as manufacturers need to ensure compliance while maintaining high levels of quality and safety.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

United States: A Hub for Automotive Innovation and Regulation

The United States remains a dominant force in the global automotive industry, characterized by its strong presence of major manufacturers, suppliers, and advanced testing facilities. This leadership is supported by several key factors.

Firstly, the U.S. boasts significant manufacturing prowess, with leading automotive manufacturers driving substantial market growth. This sector benefits from significant investments in research and development, aimed at meeting evolving industry standards and consumer preferences.

Secondly, regulatory compliance plays a crucial role, with the U.S. automotive industry subject to stringent standards enforced by agencies such as the National Highway Traffic Safety Administration (NHTSA) and the Environmental Protection Agency (EPA). These regulations cover vehicle safety, emissions, and performance, necessitating the use of advanced testing equipment to ensure compliance.

Lastly, the U.S. automotive sector is undergoing a transformative shift towards electric and autonomous vehicles. Companies are heavily investing in developing and testing components for electric vehicles (EVs), autonomous vehicle systems, and advanced driver assistance systems (ADAS). This trend is driving the demand for specialized testing equipment tailored to these cutting-edge technologies.

India: Tech Innovation and Rapid Urbanization

India is poised to experience the fastest growth in the automotive testing equipment market over the forecast period, driven by several key factors.

The country’s robust economic growth has led to increased disposable income and greater purchasing power among consumers. This growth is particularly evident in the expanding middle-class population, which represents a significant consumer base for automobiles and is contributing to the rise in vehicle ownership.

Moreover, India is witnessing rapid technological advancements, particularly in the development and launch of hybrid and electric vehicles. Improved manufacturing processes are further fueling the growth of the automotive testing equipment market in the country.

Key players in the Indian market are focusing on inorganic growth strategies, such as collaborations, to develop automotive software solutions for vehicle testing. For instance, in April 2024, Bayerische Motoren Werke AG (BMW) signed a collaboration agreement with Tata Technologies, an IT service management and digital services company, to form a joint venture. This venture aims to develop and introduce a software and IT development hub for automotive testing, with a focus on infotainment, automated driving, and digital services. The collaboration leverages the expertise of 100 skilled Tata Technologies employees to ensure a strong and prompt contribution to software projects.

China: Leading the Charge in EV Technology and Infrastructure

China is at the forefront of the global transition to electric and new energy vehicles (NEVs), driven by government policies and substantial investments in EV technology and infrastructure.

The Chinese government has introduced numerous initiatives and incentives to accelerate the adoption of electric vehicles. Programs such as the “Made in China 2025” strategy and subsidies for EV development have spurred significant investments in automotive technology, including testing equipment.

The market dynamics in China are diverse, with both domestic and international players contributing to the growth of the automotive testing equipment market. While international companies hold a strong position in certain segments due to their advanced technologies and established reputations, domestic manufacturers are rapidly expanding and offering competitive solutions tailored to local needs.

Additionally, government support for research and development (R&D) in the automotive sector is crucial. Investments in EV technology and testing capabilities are essential to maintaining China’s leadership in the global automotive market.

United Kingdom: Driving Innovation Through Government Support and Technological Advancement

The United Kingdom is at the forefront of technological innovation in the automotive industry, particularly in the development of advanced testing equipment.

UK companies are making significant strides in technological innovations by incorporating Internet of Things (IoT) connectivity, artificial intelligence, and Industry 4.0 principles into their testing solutions. These innovations are enhancing testing efficiency, accuracy, and automation, thereby fueling demand for advanced testing equipment.

The UK automotive sector also benefits from substantial investments in research and development to remain competitive. This includes exploring new testing methodologies and technologies. Collaboration between government initiatives, academic institutions, and the private sector plays a vital role in advancing automotive testing capabilities.

Furthermore, the UK’s automotive aftermarket sector contributes to the demand for testing equipment. Service centers, repair shops, and independent technicians require reliable and versatile testing solutions for vehicle diagnostics, maintenance, and repair.

Engine Dynamometers: Essential Tools Driving Automotive Innovation and Testing Through 2034

Engine dynamometers play a crucial role in the automotive industry, offering engineers a sophisticated means to measure and optimize engine performance. These devices are indispensable for various applications including performance tuning, durability testing, emissions testing, and the development of engine control systems.

The Role of Engine Dynamometers

Engine dynamometers are used to evaluate several key parameters of engine performance, such as power output, fuel efficiency, and reliability under different conditions. They enable engineers to optimize engine design by testing various configurations and settings, which helps in enhancing performance and efficiency. They also play a vital role in assessing durability through long-term testing, determining an engine’s lifespan and reliability under simulated stress conditions. Moreover, dynamometers are critical for ensuring emission compliance by conducting emissions testing to meet environmental regulations and emission standards. Additionally, they are used to develop and calibrate engine control systems, fuel injection systems, and other critical engine components.

Market Trends and Advancements

The engine dynamometer market is expected to grow significantly through 2034, driven by several trends and advancements. One major trend is the integration of advanced technologies, with modern dynamometers incorporating sophisticated data acquisition systems, real-time monitoring capabilities, and automation to enhance testing accuracy and efficiency. Another trend is the adoption of electric vehicle testing; as electric vehicles (EVs) become more prevalent, dynamometers are increasingly used to test electric drivetrains, battery systems, and regenerative braking systems. Additionally, the market is expanding into emerging regions such as Asia-Pacific and Latin America, where the demand for automotive testing equipment is rising, contributing to global market growth.

Global Sales Data for Electric Vehicles

In the passenger car segment, the demand for automotive test equipment is driven by the need for high performance and reliability. Automotive test equipment, including chassis and engine dynamometers, is crucial for vehicle performance optimization, which involves assessing the impact of various modifications on vehicle performance and emissions. The shift towards electrification and advanced technologies in the automotive industry also necessitates comprehensive testing, including the evaluation of electric drivetrains, battery performance, range, charging efficiency, and thermal management. This rising demand for passenger vehicles is expected to drive the growth of the automotive test equipment segment over the forecast period.

Recent Market Data

- In April 2023, data published by the Society of Indian Automobile Manufacturers (SIAM) reported that passenger vehicle exports increased from 577,875 to 662,891 units, while commercial vehicle exports decreased from 92,297 to 78,645 units.

Browse More Insights of Towards Automotive:

- The global permanent magnet motor market is valued at USD 49.26 billion in 2024 and is expected to grow to USD 130.52 billion by 2034, with an annual growth rate of 10.43% from 2023 to 2034.

- The small marine engine market, currently estimated at USD 8.84 billion in 2024, is projected to reach USD 17.09 billion by 2034, expanding at a CAGR of 6.93% from 2023 to 2034.

- The surface protection service market is valued at USD 14.01 billion in 2024 and is anticipated to grow to USD 22.40 billion by 2034, with a compound annual growth rate of 5.13% over the period from 2023 to 2034.

- The anti-aircraft warfare market, which is valued at USD 22.80 billion in 2024, is expected to increase to USD 46.92 billion by 2034, growing at a CAGR of 7.5% from 2023 to 2034.

- The automotive key blank market is estimated to be worth USD 6.00 billion in 2024 and is projected to reach USD 9.67 billion by 2034, with a CAGR of 4.70% from 2023 to 2034.

- The light electric vehicle market, currently valued at USD 98.24 billion in 2024, is expected to expand to USD 243.85 billion by 2034, growing at a CAGR of 10.63% from 2023 to 2034.

- The passenger car bearing and clutch component aftermarket, valued at USD 9.61 billion in 2024, is projected to grow to USD 16.08 billion by 2034, with a CAGR of 5.26% over the period from 2023 to 2034.

- The garage equipment market, which is currently worth USD 9.45 billion in 2024, is expected to increase to USD 21.43 billion by 2034, expanding at a CAGR of 8.45% from 2023 to 2034.

- The passenger car seat market is valued at USD 43.64 billion in 2024 and is projected to reach USD 50.41 billion by 2034, growing at a CAGR of 1.54% from 2023 to 2034.

- The global automotive rear seat reinforcement market size is calculated at USD 13.75 billion in 2024 and is expected to be worth USD 18.51 billion by 2034, expanding at a CAGR of 3.02% from 2023 to 2034.

Automotive Test Equipment Market TOC | Table of Content

Executive Summary

- Market Overview

- Key Market Insights

- Market Trends

- Market Opportunities

- Competitive Landscape

- Market Forecast (2024-2030)

Research Methodology

- Research Approach

- Data Collection Methods

- Market Size Estimation

- Market Breakdown and Data Triangulation

- Assumptions and Limitations

Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- Industry Trends

- Value Chain Analysis

- Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Industry Rivalry

Automotive Test Equipment Market – Market Insights

- Market Overview

- Market Size and Forecast (2018-2030)

- Market Share Analysis, 2023

- Automotive Test Equipment Adoption Rate

- Regulatory Landscape

- Technological Advancements

Market Segments

Market Analysis, by Product Type

- Chassis Dynamometer

- Market Size and Forecast

- Key Trends and Developments

- Engine Dynamometer

- Market Size and Forecast

- Key Trends and Developments

- Vehicle Emission Test System

- Market Size and Forecast

- Key Trends and Developments

- Wheel Alignment Tester

- Market Size and Forecast

- Key Trends and Developments

- Fuel Injection Pump Tester

- Market Size and Forecast

- Key Trends and Developments

- Transmission Dynamometer

- Market Size and Forecast

- Key Trends and Developments

Market Analysis, by Vehicle Type

- Passenger Cars

- Market Size and Forecast

- Market Trends

- Commercial Vehicles

- Market Size and Forecast

- Market Trends

Market Analysis, by Technology

- ADAS Testing

- Market Size and Forecast

- Market Trends and Developments

- ECU Testing

- Market Size and Forecast

- Market Trends and Developments

- Data Logger System

- Market Size and Forecast

- Market Trends and Developments

- Simulation Testing

- Market Size and Forecast

- Market Trends and Developments

Market Analysis, by Application

- Mobile Device-Based Equipment

- Market Size and Forecast

- Key Trends and Developments

- PC/Laptop-Based Equipment

- Market Size and Forecast

- Key Trends and Developments

- Others

- Market Size and Forecast

- Key Trends and Developments

Market Analysis, by Region

- North America

- Market Size and Forecast

- U.S.

- Canada

- Mexico

- Key Trends and Developments

- Europe

- Market Size and Forecast

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe

- Key Trends and Developments

- Asia Pacific

- Market Size and Forecast

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Key Trends and Developments

- Latin America

- Market Size and Forecast

- Brazil

- Argentina

- Rest of Latin America

- Key Trends and Developments

- Middle East and Africa

- Market Size and Forecast

- GCC Countries

- South Africa

- Rest of Middle East and Africa

- Key Trends and Developments

Cross-Segmentation Analysis

- Product Type vs. Vehicle Type

- Chassis Dynamometer

- Passenger Cars

- Usage: Performance and emission evaluations

- Commercial Vehicles

- Usage: Heavy-duty performance evaluations

- Passenger Cars

- Engine Dynamometer

- Passenger Cars

- Usage: Engine performance and efficiency

- Commercial Vehicles

- Usage: Testing larger and more powerful engines

- Passenger Cars

- Vehicle Emission Test System

- Passenger Cars

- Usage: Emission compliance and regulatory testing

- Commercial Vehicles

- Usage: Compliance with stricter emission standards

- Passenger Cars

- Wheel Alignment Tester

- Passenger Cars

- Usage: Regular maintenance and performance alignment

- Commercial Vehicles

- Usage: Alignment for trucks and buses to prevent tire wear

- Passenger Cars

- Fuel Injection Pump Tester

- Passenger Cars

- Usage: Testing fuel injection performance

- Commercial Vehicles

- Usage: Ensuring functionality of large engine fuel systems

- Passenger Cars

- Transmission Dynamometer

- Passenger Cars

- Usage: Performance and efficiency testing of transmissions

- Commercial Vehicles

- Usage: Testing durability and efficiency of heavy-duty transmissions

- Passenger Cars

- Chassis Dynamometer

- Technology vs. Vehicle Type

- ADAS Testing

- Passenger Cars

- Usage: Evaluates advanced driver assistance systems

- Commercial Vehicles

- Usage: Tests safety and automation systems

- Passenger Cars

- ECU Testing

- Passenger Cars

- Usage: Functionality of electronic control units

- Commercial Vehicles

- Usage: Validates ECU performance in commercial vehicles

- Passenger Cars

- Data Logger System

- Passenger Cars

- Usage: Collects data for diagnostics and research

- Commercial Vehicles

- Usage: Monitors data for fleet management

- Passenger Cars

- Simulation Testing

- Passenger Cars

- Usage: Simulates vehicle systems and performance

- Commercial Vehicles

- Usage: Simulates heavy-duty conditions and operational scenarios

- Passenger Cars

- ADAS Testing

- Application vs. Product Type

- Mobile Device-Based Equipment

- Chassis Dynamometer

- Usage: Limited application due to complexity

- Engine Dynamometer

- Usage: Limited, primarily dedicated setups

- Vehicle Emission Test System

- Usage: Mobile apps assist in data collection

- Wheel Alignment Tester

- Usage: Mobile applications for preliminary diagnostics

- Fuel Injection Pump Tester

- Usage: Not commonly used with mobile devices

- Transmission Dynamometer

- Usage: Not typically integrated with mobile devices

- Chassis Dynamometer

- PC/Laptop-Based Equipment

- Chassis Dynamometer

- Usage: Common for detailed performance analysis

- Engine Dynamometer

- Usage: Detailed engine performance evaluations

- Vehicle Emission Test System

- Usage: In-depth emission testing and reporting

- Wheel Alignment Tester

- Usage: Advanced alignment diagnostics

- Fuel Injection Pump Tester

- Usage: Detailed testing and diagnostics

- Transmission Dynamometer

- Usage: Comprehensive transmission performance analysis

- Chassis Dynamometer

- Others

- Chassis Dynamometer

- Usage: Specialized applications and integrations

- Engine Dynamometer

- Usage: Custom setups for specific needs

- Vehicle Emission Test System

- Usage: Specialized emission testing equipment

- Wheel Alignment Tester

- Usage: Custom alignment solutions

- Fuel Injection Pump Tester

- Usage: Custom diagnostic tools

- Transmission Dynamometer

- Usage: Specialized testing setups

- Chassis Dynamometer

- Mobile Device-Based Equipment

- Region vs. Product Type

- North America

- Chassis Dynamometer

- Market Presence: High demand in automotive testing facilities

- Engine Dynamometer

- Market Presence: Significant usage in performance testing

- Vehicle Emission Test System

- Market Presence: Regulatory compliance focus

- Wheel Alignment Tester

- Market Presence: Common in maintenance and repair shops

- Fuel Injection Pump Tester

- Market Presence: Used in specialized diagnostics

- Transmission Dynamometer

- Market Presence: Key in performance and durability testing

- Chassis Dynamometer

- Europe

- Chassis Dynamometer

- Market Presence: Focus on emission regulations

- Engine Dynamometer

- Market Presence: Extensive use in R&D

- Vehicle Emission Test System

- Market Presence: Strong regulatory requirements

- Wheel Alignment Tester

- Market Presence: Widely used in maintenance services

- Fuel Injection Pump Tester

- Market Presence: Common in high-performance testing

- Transmission Dynamometer

- Market Presence: Used in both passenger and commercial vehicle testing

- Chassis Dynamometer

- Asia Pacific

- Chassis Dynamometer

- Market Presence: Growing demand with automotive industry expansion

- Engine Dynamometer

- Market Presence: Increasing use in performance testing

- Vehicle Emission Test System

- Market Presence: Developing regulatory framework

- Wheel Alignment Tester

- Market Presence: Expanding with rising vehicle ownership

- Fuel Injection Pump Tester

- Market Presence: Emerging market demand

- Transmission Dynamometer

- Market Presence: Rising in both passenger and commercial vehicle sectors

- Chassis Dynamometer

- Latin America

- Chassis Dynamometer

- Market Presence: Developing market presence

- Engine Dynamometer

- Market Presence: Moderate usage in performance testing

- Vehicle Emission Test System

- Market Presence: Growing focus on emissions

- Wheel Alignment Tester

- Market Presence: Increasing in repair and maintenance services

- Fuel Injection Pump Tester

- Market Presence: Niche applications

- Transmission Dynamometer

- Market Presence: Limited but growing usage

- Chassis Dynamometer

- Middle East and Africa

- Chassis Dynamometer

- Market Presence: Emerging demand with automotive industry growth

- Engine Dynamometer

- Market Presence: Niche use in performance testing

- Vehicle Emission Test System

- Market Presence: Developing regulatory focus

- Wheel Alignment Tester

- Market Presence: Increasing in maintenance services

- Fuel Injection Pump Tester

- Market Presence: Specialized diagnostic tools

- Transmission Dynamometer

- Market Presence: Growing use in performance testing

- Chassis Dynamometer

- North America

Go-to-Market Strategies (Region Selection)

- Introduction to Go-to-Market Strategy

- Overview

- Importance of a Go-to-Market Strategy in the Automotive Test Equipment Market

- Market Entry Strategy

- Market Penetration

- Market Expansion

- Niche Market Targeting

- Competitive Positioning

- Product Launch Strategy

- Product Differentiation

- Value Proposition Development

- Product Pricing Strategy

- Distribution and Sales Channel Strategy

- Marketing and Sales Strategy

- Branding and Messaging

- Digital Marketing and Social Media Strategy

- Content Marketing and Thought Leadership

- Sales Enablement and Training

- Customer Acquisition and Retention Strategy

- Target Audience Identification

- Lead Generation and Nurturing

- Customer Relationship Management (CRM)

- Customer Feedback and Satisfaction

- Partnerships and Alliances

- Strategic Partnerships

- Joint Ventures and Collaborations

- Technology and Innovation Partnerships

- Geographic Expansion Strategy

- Entry into New Markets

- Localization of Products and Services

- Regulatory Compliance and Adaptation

- Channel Partner Strategy

- Selection of Channel Partners

- Channel Partner Management

- Incentives and Channel Partner Programs

- Sales Strategy

- Direct vs. Indirect Sales

- Sales Team Structure and Optimization

- Key Account Management

- Pricing and Revenue Model

- Pricing Strategy for Different Regions and Segments

- Dynamic Pricing and Discount Strategies

- Subscription and Usage-Based Models

- Customer Support and After-Sales Service

- Customer Support Strategy

- After-Sales Service Programs

- Warranty and Maintenance Plans

- Performance Measurement and KPIs

- Key Performance Indicators (KPIs) for Market Success

- Sales and Marketing Performance Metrics

- ROI Measurement and Analysis

- Risk Management and Contingency Planning

- Identifying Potential Risks

- Risk Mitigation Strategies

- Contingency Plans for Market Disruptions

- Future Growth and Scalability

- Scaling Operations and Resources

- Continuous Innovation and Product Development

- Long-term Market Growth Strategies

- Conclusion

- Summary of Go-to-Market Strategy

- Final Recommendations for Market Success

Integration of AI in the Automotive Test Equipment Market

- Introduction to AI Integration

- Overview of AI in Automotive Testing

- Importance of AI in Enhancing Testing Capabilities

- Evolution of AI in the Automotive Test Equipment Market

- AI-Driven Testing Solutions

- AI-Powered Data Analytics in Testing

- Predictive Maintenance and Diagnostics

- Autonomous Testing Systems

- AI in Emission and Compliance Testing

- Applications of AI in Automotive Test Equipment

- AI in ADAS and Autonomous Vehicle Testing

- Machine Learning Algorithms for ECU Testing

- AI-Enhanced Data Logger Systems

- AI-Based Simulation Testing

- Benefits of AI Integration

- Improved Accuracy and Efficiency in Testing

- Reduction in Testing Time and Costs

- Enhanced Predictive Capabilities

- Real-Time Data Processing and Decision Making

- Challenges in AI Integration

- Technical and Operational Challenges

- Data Security and Privacy Concerns

- Integration with Legacy Systems

- Regulatory and Compliance Issues

- AI in Test Automation

- Role of AI in Automating Routine Tests

- Adaptive Testing Algorithms

- AI-Driven Test Case Generation and Execution

- AI in Test Equipment Development

- AI in the Design and Development of Test Equipment

- Use of AI for Customization and Optimization of Testing Tools

- AI-Based Innovations in Hardware and Software

- AI in Enhancing User Experience

- AI-Powered User Interfaces

- Personalized Testing Solutions

- Voice and Gesture Control Integration

- AI and Big Data Analytics

- Leveraging AI for Big Data in Automotive Testing

- AI-Driven Insights for Test Optimization

- Role of AI in Handling Large Volumes of Test Data

- Collaborations and Partnerships in AI Integration

- Partnerships with AI Technology Providers

- Joint Ventures for AI-Driven Solutions

- Collaboration with Automotive OEMs for AI-Based Testing

- Future Trends in AI and Automotive Testing

- Evolution of AI in Autonomous Vehicle Testing

- AI and the Shift Towards Smart Testing Environments

- AI in Predictive and Prescriptive Testing

- Role of AI in the Future of Vehicle Safety Testing

- Case Studies of AI Integration

- Successful Implementation of AI in Automotive Test Equipment

- Real-World Examples of AI-Driven Testing Solutions

- Lessons Learned from AI Integration in the Industry

- Impact of AI on Market Dynamics

- How AI is Shaping Market Competition

- AI as a Differentiator for Market Leaders

- Influence of AI on Market Growth and Innovation

- Regulatory and Ethical Considerations

- Regulatory Landscape for AI in Automotive Testing

- Ethical Implications of AI in Testing

- Compliance with International Standards

- Conclusion

- Summary of AI Integration in Automotive Test Equipment

- Future Outlook for AI in the Industry

- Recommendations for Successful AI Integration

Production and Consumption Data in the Automotive Test Equipment Market

- Introduction

- Overview of Production and Consumption Trends

- Importance of Analyzing Production and Consumption Data

- Global Production Data

- Total Global Production of Automotive Test Equipment

- Production Trends by Year

- Key Producers and Manufacturers

- Regional Production Analysis

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Production by Product Type

- Chassis Dynamometer

- Production Volume

- Key Manufacturers

- Engine Dynamometer

- Production Volume

- Key Manufacturers

- Vehicle Emission Test System

- Production Volume

- Key Manufacturers

- Wheel Alignment Tester

- Production Volume

- Key Manufacturers

- Fuel Injection Pump Tester

- Production Volume

- Key Manufacturers

- Transmission Dynamometer

- Production Volume

- Key Manufacturers

- Chassis Dynamometer

- Global Consumption Data

- Total Global Consumption of Automotive Test Equipment

- Consumption Trends by Year

- Major Consumer Regions and Countries

- Consumption by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Consumption by Technology

- ADAS Testing

- Consumption Volume

- Key Applications

- ECU Testing

- Consumption Volume

- Key Applications

- Data Logger System

- Consumption Volume

- Key Applications

- Simulation Testing

- Consumption Volume

- Key Applications

- ADAS Testing

- Consumption by Application

- Mobile Device-Based Equipment

- Consumption Volume

- Key Applications

- PC/Laptop-Based Equipment

- Consumption Volume

- Key Applications

- Others

- Consumption Volume

- Key Applications

- Mobile Device-Based Equipment

- Regional Consumption Analysis

- North America

- Consumption Volume

- Key Trends and Drivers

- Europe

- Consumption Volume

- Key Trends and Drivers

- Asia Pacific

- Consumption Volume

- Key Trends and Drivers

- Latin America

- Consumption Volume

- Key Trends and Drivers

- Middle East and Africa

- Consumption Volume

- Key Trends and Drivers

- North America

- Market Balancing: Production vs. Consumption

- Analysis of Supply and Demand Balance

- Key Discrepancies and Imbalances

- Impact on Pricing and Market Dynamics

- Historical Data and Forecasts

- Historical Production and Consumption Data (Past 5 Years)

- Future Production and Consumption Forecasts (Next 5-10 Years)

- Influencing Factors and Trends

- Impact of External Factors

- Economic Factors Affecting Production and Consumption

- Technological Advancements Impacting Production

- Regulatory Changes and Their Effects

- Case Studies

- Examples of Key Players and Their Production/Consumption Strategies

- Successful Market Adaptations and Innovations

- Conclusion

- Summary of Production and Consumption Insights

- Implications for Market Stakeholders

- Recommendations for Balancing Production and Consumption

Opportunity Assessment

- Introduction to Opportunity Assessment

- Overview

- Importance of Identifying Opportunities

- Market Analysis

- Market Trends and Drivers

- Emerging Technologies

- Market Gaps and Unmet Needs

- Competitive Landscape

- Key Competitors and Their Strategies

- SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

- Competitive Advantage Assessment

- Customer Insights

- Customer Needs and Preferences

- Market Segmentation

- Customer Pain Points and Opportunities

- Regulatory and Economic Factors

- Impact of Regulations on Opportunities

- Economic Trends Influencing Opportunities

- Strategic Recommendations

- High-Potential Opportunities

- Strategic Initiatives for Exploiting Opportunities

New Product Development

- Introduction to New Product Development (NPD)

- Importance of NPD

- Overview of the NPD Process

- Idea Generation

- Sources of New Product Ideas

- Techniques for Idea Generation

- Assessment of Idea Viability

- Concept Development and Testing

- Developing Product Concepts

- Concept Testing with Target Audience

- Feedback Analysis and Iteration

- Business Analysis

- Market Potential Assessment

- Cost and Revenue Projections

- Profitability Analysis

- Product Design and Development

- Design Specifications

- Prototyping and Testing

- Product Development Lifecycle

- Commercialization Strategy

- Go-to-Market Strategy

- Launch Plan and Timing

- Marketing and Distribution Channels

- Post-Launch Evaluation

- Performance Tracking

- Customer Feedback and Product Iteration

- Long-Term Product Strategy

Plan Finances/ROI Analysis

- Introduction to Financial Planning and ROI Analysis

- Importance of Financial Planning

- Overview of ROI Analysis

- Cost Analysis

- Initial Investment Requirements

- Operational and Maintenance Costs

- Cost-Benefit Analysis

- Revenue Projections

- Revenue Streams and Pricing Strategy

- Sales Forecasting

- Revenue Models

- ROI Calculation

- ROI Metrics and Formulas

- Break-Even Analysis

- Payback Period Calculation

- Financial Risk Assessment

- Identifying Financial Risks

- Mitigation Strategies

- Financial Performance Monitoring

- Key Financial Metrics

- Performance Tracking and Reporting

- Adjustments and Optimization

Supply Chain Intelligence/Streamline Operations

- Introduction to Supply Chain Intelligence

- Importance of Supply Chain Management

- Overview of Supply Chain Intelligence

- Supply Chain Mapping and Analysis

- Mapping the Supply Chain

- Identifying Key Suppliers and Partners

- Analyzing Supply Chain Performance

- Operational Efficiency

- Streamlining Operations and Processes

- Reducing Operational Costs

- Implementing Lean and Agile Practices

- Technology Integration

- Role of Technology in Supply Chain Management

- Implementing Advanced Technologies (e.g., AI, IoT)

- Data Analytics for Supply Chain Optimization

- Risk Management

- Identifying Supply Chain Risks

- Developing Risk Mitigation Strategies

- Contingency Planning

- Performance Metrics

- Key Performance Indicators (KPIs)

- Monitoring and Reporting

- Continuous Improvement

Cross-Border Intelligence

- Introduction to Cross-Border Intelligence

- Importance of Cross-Border Intelligence

- Overview of Cross-Border Market Dynamics

- Market Entry Strategies

- Evaluating Foreign Markets

- Entry Modes (e.g., Direct Investment, Joint Ventures)

- Market Entry Planning

- Regulatory and Compliance Considerations

- Understanding International Regulations

- Compliance with Local Laws and Standards

- Trade Barriers and Tariffs

- Cultural and Economic Factors

- Cultural Differences and Market Adaptation

- Economic Conditions and Market Opportunities

- Risk Assessment

- Political and Economic Risks

- Currency Exchange Risks

- Risk Mitigation Strategies

- Cross-Border Partnerships

- Building Relationships with Local Partners

- Strategic Alliances and Joint Ventures

- Leveraging Local Expertise

Business Model Innovation

- Introduction to Business Model Innovation

- Importance of Innovation in Business Models

- Overview of Business Model Innovation

- Current Business Model Analysis

- Assessing Existing Business Models

- Identifying Strengths and Weaknesses

- Benchmarking Against Competitors

- Innovation Strategies

- Exploring New Business Models

- Leveraging Technology and Digital Transformation

- Customer-Centric Model Development

- Implementation Plan

- Developing an Innovation Roadmap

- Resource Allocation and Investment

- Change Management and Communication

- Performance Evaluation

- Measuring the Impact of Innovation

- Key Metrics and KPIs

- Continuous Improvement and Adaptation

Blue Ocean vs. Red Ocean Strategies

- Introduction to Blue Ocean and Red Ocean Strategies

- Definitions and Key Differences

- Importance of Choosing the Right Strategy

- Blue Ocean Strategy

- Overview of Blue Ocean Strategy

- Creating Uncontested Market Space

- Value Innovation and Differentiation

- Examples and Case Studies

- Red Ocean Strategy

- Overview of Red Ocean Strategy

- Competing in Existing Market Space

- Cost Leadership and Differentiation

- Examples and Case Studies

- Strategy Selection

- Assessing Market Conditions

- Evaluating Competitive Landscape

- Aligning Strategy with Business Goals

- Implementation and Execution

- Developing Strategic Plans

- Resource Allocation and Execution

- Monitoring and Adjusting Strategies

- Case Studies and Examples

- Successful Blue Ocean Strategies

- Examples of Red Ocean Strategies

- Lessons Learned and Best Practices

- Conclusion

- Summary of Key Insights

- Recommendations for Strategic Planning

- Future Trends and Considerations

Competitive Landscape

- Market Share Analysis, 2023

- Competitive Benchmarking

- Key Strategies Adopted by Leading Players

- Company Profiles

- Delphi Technologies

- Robert Bosch GmbH

- Continental AG

- DENSO

- ABB Ltd.

- Honeywell

- Siemens

- Softing

- Horiba

- SGS

- Vector

Future Outlook and Market Forecast

- Market Forecast by Product Type (2024-2030)

- Market Forecast by Vehicle Type (2024-2030)

- Market Forecast by Technology (2024-2030)

- Market Forecast by Application (2024-2030)

- Market Forecast by Region (2024-2030)

- Market Opportunities

- Investment Opportunities and Future Trends

Appendix

- List of Abbreviations

- Sources

- Research Methodology

- Disclaimer

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1319

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing automotive world.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

Web: https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive