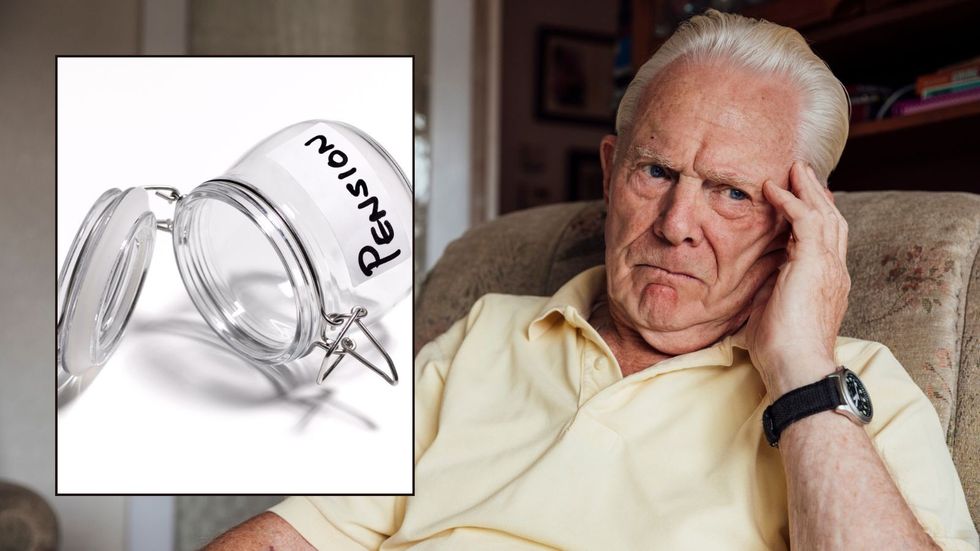

Retirees are facing “significant delays” in accessing their pension savings, according to experts.

Research conducted by My Pension Expert is sounding the alarm over the waiting times for pension transfers between providers.

Data from over 5,163 pension transfers in the 2023/24 financial year found Britons waited 28 days on average for ceding companies to move funds from one provider to another.

Furthermore, consumers with funds at certain pension firms are having to wait up to 96 days for their savings to be moved to their current provider.

The 28-day average was an improvement of only one day when put up against My Pension Expert’s 2023 Retirement Fairness Index

It should be noted that certain parts of the pension transfer process can result in delays, such as fraud checks.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are waiting months for their pension savings to be transferred

GETTY

Despite this, there are certain situations when a transfer from a pension scheme members’ existing provider to a new provider is delayed for no good reason.

According to My Pension Expert, often the reason for the delay is not communicated to the customer.

Due to this, pension savers are forced to contend with stress and uncertainty when it comes to their finances.

This comes amid wider financial anxiety among pensioners during the cost of living crisis.

My Pension Expert broke down the waiting time retirees have to put up with when it comes to pension transfers for different providers.

According to the financial advisors, Sanlam, Sun Life Financial, Fidelity, Standard Life and Legal & General take 18, 22, 22, 22 and 23 days each, respectively.

Some pension providers reportedly take significantly longer to complete transfers.

Mercer (96 days), NOW: Pensions (69 days), and TPT Retirement Solutions (67 days) were the firm that took the longest average time to transfer funds, based on My Pension Expert’s data.

Experts are warning pensioners could have ‘less money’ in retirementGETTY

Experts are warning pensioners could have ‘less money’ in retirementGETTY

Lily Megson, the policy director at My Pension Expert, broke down the impact of consumers who have retirement savings kept at certain firms.

She explained: “The tiny improvement in pension transfer times is disappointing. It highlights the ongoing challenges faced by UK retirement planners, who regularly face significant delays when moving their savings between providers.

“The process remains slow and lacks transparency. Customers regularly face significant delays when moving their savings.

“Clear visibility into the status of a pension transfer is essential in financial planning – improving the speed and communication of the process is vital not only to eliminate undue stress, but also allow people to manage their retirement savings as effectively as possible.”